Yahoo Finance’s Jared Blikre breaks down the notable stock dips as markets prepare to react to the Fed’s course of action following their December 15 meeting.

Video Transcript

[MUSIC PLAYING]

– Welcome back to “Yahoo Finance Live.” We’ve been watching the losses stack up in today’s session. Of course, the NASDAQ the biggest loser today, off by about 2%. Only three sectors in the green when you look at the S&P 500– consumer staples, energy, and financials. And for more on all the moves we’re watching, want to get to Yahoo Finance’s chart master, Jared Blikre, who has the latest for us. Jared.

JARED BLIKRE: Yeah, it’s no FOMC drift today that we’re seeing. And that refers to the fact that usually before a Fed meeting, starting on Tuesday, you do tend to see the market volatility lessen a little bit. And that’s not what we’re seeing today.

So let’s take a look at the Wi-Fi Interactive, where we have the NASDAQ 100 up. And we are seeing a lot of red here. Some of the standouts among the mega-caps, Apple. That stock is down 1.5%, reversing an earlier gain. This is the one-day price action. You can see started out in the green, but no more. Also, some news that they are going to be limiting people, the traffic in some of their stores. They are also going to be requiring masks at all their US stores for all entrants and employees.

So a little bit of negative news on the omicron front there may be weighing on stocks. But also, retail has been taking it on the chin. Just taking a look at Amazon, that stock is down about 1 and 3/4 of a percent. We take a look at what’s happened over the trailing month, you can see down 5%, a lot of the losses just in the last few sessions here.

And then Tesla, Tesla has been under pressure. It’s down about 25% from its recent record high. You put a candle chart– excuse me, I’m going to put a candlestick chart here going back two months. And we can see there we’ve broken through these lows. We have a series of lower highs and lower lows. That means we are in a downtrend right now, until further notice. And then Microsoft. We’re going to do a deeper dive into the software sector in a little bit, but that stock is off 4.5%.

I do want to take a look at the sector action. We’re seeing a little bit of love for the value sector. We see financials up about one third of a percent, energy up about 10 basis or 11 basis points. But everything else pretty much sinking into the red, guys.

– And Jared, you know, I’m looking at the sectors right now, energy and financials really the only ones that are bucking the trend. An ugly day for tech, particularly with the big tech names.

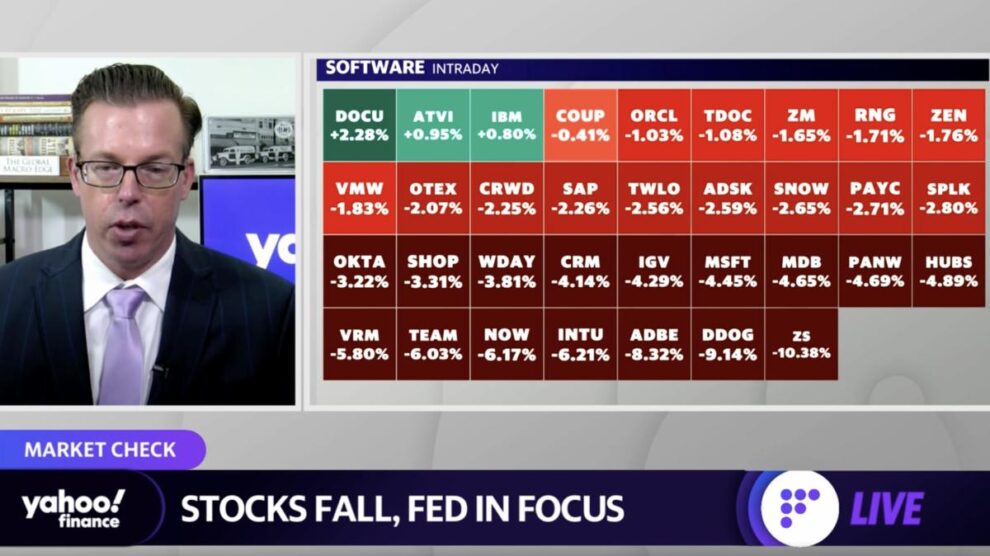

JARED BLIKRE: Yeah, and software, in particular. We were just talking about Microsoft, Microsoft having its worst day since October of last year. And you can see it’s down 4.5%. Adobe is down 8%.

And let me just do this. I’m going to sort by performance and show you what’s happened over the last month, because some of these names have taken some huge hits. DocuSign, that stock is down 46%. We have Splunk that’s down 35%, Teladoc, and a lot of these work from home trades not working that well anymore.

I want to go back to our sector action here, because I think this is pretty telling. This is over the last month. I want to do the last two days. And this covers this week. So you’re seeing staples, utilities, and health care. Those are the only sectors in the green. That is a defensive setup.

So I think what’s happening here is a lot of PMs, let’s call them portfolio managers, hoping for a Santa Claus rally, probably looking for a tradable low sometime tomorrow around the FOMC announcement or Jay Powell’s press engagement. And if that happens, then we could very well get the Santa Claus rally. But the key is going to be what stocks do they buy. Looking a little bit defensive here, so it’ll be interesting to see how this all unravels over the next 24 hours, guys.

– Yeah, I’m not sure what that says about the confidence in the Santa Claus rally or what it means in terms of which winners we’ll all be discussing at the Wednesday close, Jared. But we’ll of course be watching for every piece of, I guess, inclination that we’re going to get from Chair Powell on Wednesday. Appreciate the update.