These stocks are up big, but that doesn’t mean that they can’t go up even more.

Way back in 2016, before most investors were even aware of artificial intelligence (AI), Nvidia (NVDA 1.63%) co-founder Jensen Huang delivered an AI supercomputer to leadership at OpenAI. In 2022, OpenAI released the popular ChatGPT chatbot, sparking a generative AI revolution. And now the tailwinds couldn’t be blowing any harder in Nvidia’s sails.

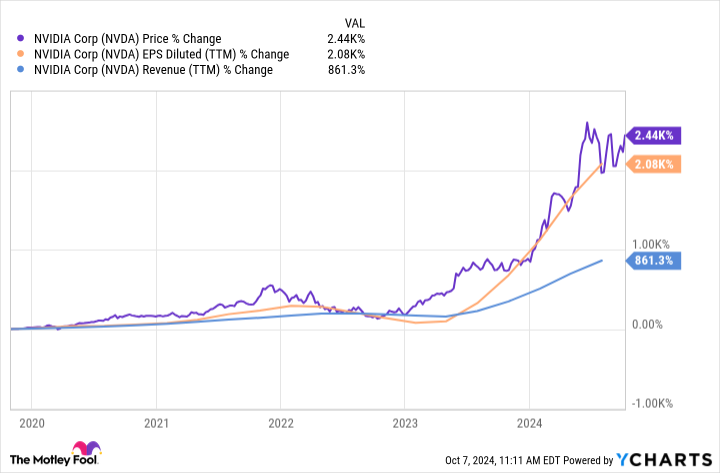

Returns for Nvidia stock over the past five years have been sensational, with the stock up about 2,700%. But this isn’t a case of pure runaway investor enthusiasm. The company’s revenue is skyrocketing with AI demand, sending its earnings per share (EPS) up more than 2,000% during this time.

As of this writing, Nvidia stock is up more than 160% in 2024, which is sensational for any stock, let alone one already valued at more than $3 trillion. But as spectacular as those gains are, Nvidia stock isn’t the top-performing stock this year.

To the contrary, AppLovin (APP 1.00%), Carvana (CVNA 0.79%), and Cava (CAVA -1.23%) are three companies valued at $10 billion or more (making them large-cap stocks) and which are beating Nvidia stock in 2024. Let’s take a look.

1. AppLovin

As of this writing, AppLovin stock is up a whopping 255% in 2024. But the fundamentals of the business surprisingly support the surging stock price. In the company’s second quarter of 2024 (ended June 30), its revenue was up 44% year over year to over $1 billion, and its net income was up 286% to $310 million.

AppLovin is growing like this because its software business is both high-margin and high-growth — Q2 software revenue was up 75% year over year. But CEO Adam Foroughi isn’t worried about growth hitting a wall. To the contrary, he believes software revenue can grow at a better-than 20% annual clip long term.

Foroughi makes a compelling case. Today, AppLovin’s software is used primarily by mobile gaming businesses. And the company isn’t able to meet all the demand from its customers because its AI software is still learning how to find users for these apps. It believes its software will keep improving, allowing it to grow by meeting current demand. And improvements will even allow it to branch outside of gaming eventually.

Therefore, while AppLovin stock has been on a sensational ride, it could have even more long-term upside if it can grow as well as Foroughi hopes.

2. Carvana

For its part, Carvana stock is up a strong 243% in 2024. With skyrocketing debt and questionable profitability prospects, the stock was left for dead in 2022 before roaring back in 2023 and year to date in 2024. In short, the company finally turned a net profit, causing investors to reevaluate everything about this business.

According to Carvana co-founder and CEO Ernie Garcia, management identified 22 opportunities that could each increase gross profit by $100 per used car sold. It hasn’t reached its goal with all 22 yet, but this focus served as a catalyst to lift its overall profitability.

Granted, its profit margin of 1.4% in the second quarter of 2024 is nothing to write home about. But Garcia believes it’s just a starting point.

Garcia and his management team have identified more opportunities to grow profitability at Carvana. One of its opportunities is selling more cars with the infrastructure it has — management hopes to triple its sales from here. At first, that sounds audacious. But then again, Carvana only has 1% market share, so perhaps tripling its sales isn’t so audacious after all.

Carvana still has an enormous long-term debt load at more than $5.4 billion, which cost it $173 million in interest in Q2 alone. So the business still has a lot of work to do. But if it can triple sales and improve profitability, perhaps Carvana’s business can continue improving and defying the doubters.

3. Cava

Finally, Cava stock has been a strong performer since going public, and shares are up 198% in 2024. This is a high-growth restaurant chain with revenue in the first half of 2024 up 31% from the same period of 2023. Same-store sales are growing, showing its increasing popularity in existing markets. And with only 341 locations at the end of the second quarter, there are many more markets it could eventually enter.

Perhaps what has investors most interested in Cava is its average unit volumes (AUV), or the average annual sales per location. As of Q2, the company’s AUV are $2.7 million, which is quite high and demonstrates a growing appetite for its Mediterranean-themed cuisine.

High sales volume provides a good boost for Cava’s own profitability. The restaurant industry is known for thin margins. But Cava is showing above-average potential, with its own profit margin at 8% as of Q2.

However, Cava’s valuation is good reason for investors to pause and consider the risk before investing today. A restaurant stock often trades at 1 to 2 times sales. A great restaurant company could trade for 4 to 5 times sales. But Cava stock has skyrocketed in 2024 mostly as its price-to-sales (P/S) ratio balloons higher and higher — it trades at nearly 18 times sales now.

Which to buy?

When it comes to Cava stock, I’m on the sidelines due to this valuation risk. And when it comes to Carvana stock, I’m on the sidelines due to the risk from its high debt load.

That leaves AppLovin stock as the one of these three that I would buy today. While no company is risk-free, AppLovin has executed an impressive turnaround with its business over the last year or so, and it still has a large opportunity as it expands. For those who haven’t considered it before, AppLovin stock might be worth a closer look.