Andy Jassy, the incoming Amazon CEO, needs to improve labor relations, reduce packaging waste and further its climate goals if it wants to be a world-leading company from an environmental, social and governance perspective.

Indeed, Amazon’s AMZN, +0.63% role model could be Apple AAPL, -0.31%, which advocates say has become a sustainability leader among megacap stocks.

Amazon is starting to make strong operational strides such as investing in electric vehicles for its fleet and running data centers on renewable energy, but remains a laggard in other key ESG pillars such as workplace issues, racial and diversity inclusion and has more work to do on carbon reduction, say ESG advocates. Because of that, only a handle of ESG exchange-traded funds and mutual funds own the company.

Read: Amazon’s electric delivery vehicles hit the road in L.A.

Outgoing CEO Jeff Bezos, the founder of the e-commerce giant, has “actually done the hard stuff, the hardest stuff being operations,” says Andrew Behar, CEO of As You Sow, a nonprofit shareholder advocacy group. “On other issues, though, he’s completely not even thinking about them.”

Bezos will retain an influential position in the company as executive chairman and one of its largest shareholders. Jassy, the new CEO, is now the head of Amazon Web Services, the company’s cloud-computing business.

Read: 5 things to know about new Amazon CEO Andy Jassy

In his letter to Amazon’s workforce, Bezos tried to burnish his ESG credentials:

“As Amazon became large, we decided to use our scale and scope to lead on important social issues. Two high-impact examples: our $15 minimum wage and the Climate Pledge. In both cases, we staked out leadership positions and then asked others to come along with us. In both cases, it’s working. Other large companies are coming our way. I hope you’re proud of that as well.”

Natasha Lamb, managing partner at Arjuna Capital, a sustainable and impact investment firm focusing on workplace issues for women and people of color, disputes Bezos’ claim of being a leader in these two areas, saying that there was great pressure on the company to increase worker pay and to sign the climate pledge.

“He is not the poster child of the American dream, but of what is eating America alive, which is growing inequality,” she says.

Amazon increased the minimum wage to $15 in 2018 after years of criticism that it mistreated and underpaid workers, and the company caught flak for what workers said were poor health conditions in the pandemic. It is also fighting a unionization attempt at a warehouse in Alabama.

Emanuele Colonnelli, an assistant professor of finance at the University of Chicago’s Booth School of Business who has done ESG research, agrees with Lamb. “A lot of the most promising steps toward ESG seem reactionary, as they have been taken only recently, at a moment in which regulatory and public pressure reached sky-high levels that became impossible to ignore,” he says.

Jeff Bezos built Amazon into a monolith — but did it hurt American workers?

Although Amazon installed a higher minimum wage, MSCI considers the company a laggard when it comes to corporate behavior and labor management. Overall, MSCI gives Amazon a BBB rating, saying it is average for companies in the retail-consumer discretionary space.

Lamb says Amazon has become what Walmart WMT, +1.28% was in the 1990s, criticized for shuttering small businesses. During the coronavirus, “everybody has become so reliant on Amazon, and those patterns are sticky. It has grave implications for small business.”

Colonnelli says Amazon’s monopoly power can’t be denied and should be at the core of its ESG considerations. “It will be up to Jassy – and Bezos of course- to decide whether they want to be driving the change toward a business model that is less prone to anti-competitive practices, and therefore lead to a more equitable allocation of rents,” he says.

Opinion: Like Rockefeller and Gates, Bezos rides off into the sunset just as the lawyers take away the fun

A ‘real opportunity’ to be a leader

Behar says As You Sow has interviewed Amazon employees and says the company has a “real opportunity” to be a leader on human capital management, such as increasing hourly employee wages, improving health care benefits, especially during the pandemic, and paid leave, as well as improving efforts around diversity equity inclusion.

Lamb says with a new CEO coming on board, she wants greater clarity about defining gender and racial pay equity and to address diversity as a whole, noting that there are very few women and people of color in the company’s upper ranks. She says other shareholders are asking for a racial equity audit and for a worker representative on the board of directors, “which I think would be helpful.”

Climate inroads

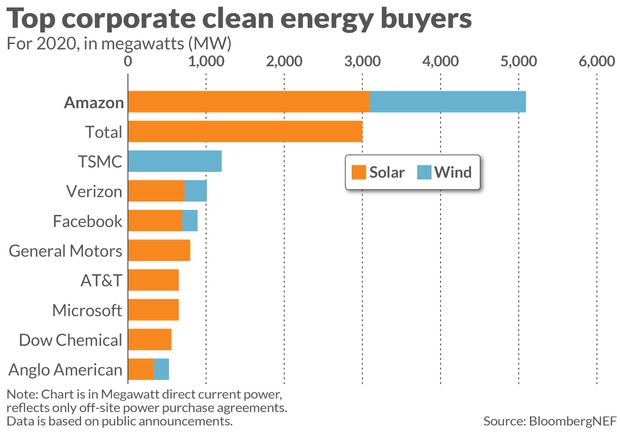

When it comes to its climate pledge, Amazon is making some inroads. BloombergNEF said Amazon was the leading corporate buyer of clean energy in 2020, signing 35 separate clean energy power-purchasing agreements, totaling 5.1 gigawatts of power. BNEF says Amazon has now purchased over 7.5GW of clean energy to date, pushing it ahead of Alphabet GOOGL at 6.6GW and Facebook FB at 5.9GW as the world’s largest clean-energy buyer.

Garvin Jabush, chief investment officer at Green Alpha Advisors, says Amazon’s investments in renewable energy and its $440 million investment in electric-truck start up Rivian are all impressive starts, but the company has a long way to go.

Green Alpha Advisors doesn’t own Amazon because Jabush says it is still a large contributor to climate risk; he noted the company saw a 15% increase in carbon dioxide emissions in 2019. It also supplies advanced computing data to the oil and gas industry to help fossil-fuel companies locate new deposits.

Opinion: The key lesson for Amazon investors as Andy Jassy takes over from Jeff Bezos

Both Jabush and Behar says Amazon faces material risk as it deals with electronic waste and plastic waste. Behar says it is trying to work with the e-commerce giant to reduce waste, noting the company could emulate Best Buy’s BBY, +0.61% take-back program to recycle electronic waste. This could become a sustainable money maker by recouping the copper, gold and silver in used electronic parts, he says.

Reducing plastic waste is also critical since Amazon is a big user of packaging. Amazon has reduced Styrofoam usage, but “they could commit to zero plastic in two to three years from now and it would make a big difference,” he says.

Jabush says it’s always a debate at his firm each year about whether to buy Amazon because it is “a phenomenal business,” but he says until it reduces its climate impact, he won’t buy it. But with a new CEO, there’s an opportunity for change, Jabush says, pointing to how Tim Cook changed Apple after taking over from Steve Jobs.

“Sustainability was low on their priority list, and Tim Cook has made Apple into by far the most sustainable megacap in the world right now,” he says.

Debbie Carlson is a MarketWatch columnist. Follow her on Twitter @DebbieCarlson1.

More on ESG investing:

BlackRock’s push on ESG and climate goals is coming at ‘a business-friendly pace’

If you support green energy, you should buy utilities and oil stocks — here’s why

Your ESG investment may be a ‘light-touch’ fund and not as green as you think

ESG investing now accounts for one-third of total U.S. assets under management