New research argues the ultra-rich paid a lower overall tax rate for the first time ever last year than the other income groups. “There are a lot of advantages to being rich, and this is one of them,” said Mark Mazur, director of the Urban-Brookings Tax Policy Center. The more money you make, he said, the more money you have to pay someone to find ways to legally avoid paying tax.

University of California, Berkeley economists said the 400 richest Americans paid a combined state, local and federal tax rate this year of 23%, lower than the combined 24% tax rate for the bottom half of households. The claim has its skeptics, but some economists say the Trump administration’s revamp of the tax code helped wealthy Americans. They also have other theories.

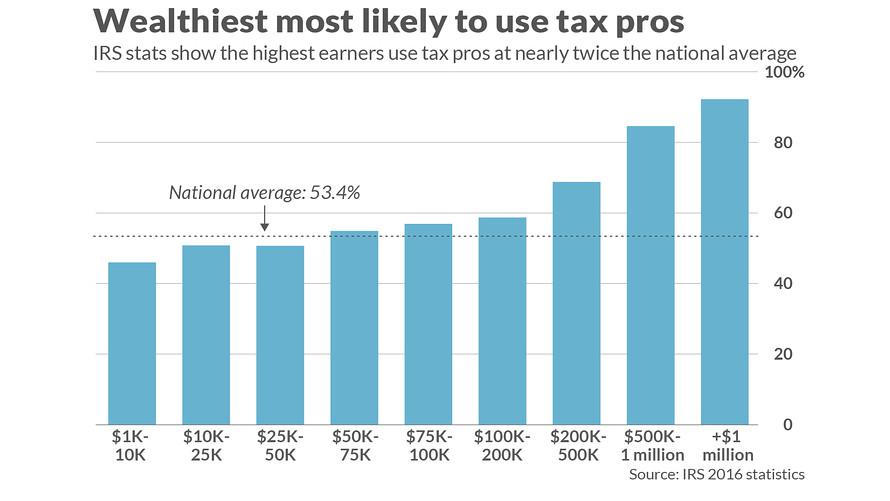

The wealthy also have a slew of savvy professionals to help them navigate a complicated tax system, according to Internal Revenue Service statistics. Nearly 69% of taxpayers earning between $200,000 and $500,000 a year used a professional tax preparer versus 85% of those earnings between $500,000 and $1 million, and 92% of people earning at least $1 million.

That compares to a national average of 53.4%. While many less wealthy Americans may not have such complicated accounts, they also miss out on the myriad ways of legally avoiding paying taxes, experts say. Paid preparers — like accountants and tax attorneys — submitted 80 million of the almost 150 million tax returns in 2016, the most recent data on the matter.

Why the rich don’t file their taxes like everyone else

The wealthy obviously have more complicated returns, and that can cause problems. IRS data for this tax season, as of July, showed a $1.13 trillion tax liability for all individual returns. Tax liability for taxpayers worth at least $1 million accounted for 14% of that total bill. Including liabilities incurred by those who earn between $500,000 and $1 million, that percentage rises to 25%.

Yet some observers — like Berkeley University economists Gabriel Zucman and Emmanuel Saez — contend the nation’s richest haven’t being taxed enough, and part of that is because the rich know how to minimize their tax exposure. The pair have advised Democratic presidential hopeful Elizabeth Warren on her proposals to tax the wealthy.

Kyle Pomerleau, chief economist at the right-leaning Tax Foundation, said there’s a big difference between illegal tax evasion and tax avoidance “which is totally normal and legal.” Tax avoidance is finding the ways within the law to keep taxation at its smallest amount. That, after all, is what the paid professionals are there to do.

One shrewd money move: donating stocks to an heir upon death. If the heir sells the stock, he or she could sidestep the capital gains tax, he said. “Is it tax evasion?” he said. “No. Is it tax avoidance? Of course.” That advice doesn’t come cheap. Tax attorneys can charge an hourly rate between $200 and $400, though that rate can go much higher in large law firms, according to one estimate.

What’s more, low-income taxpayers claiming the earned income tax credit (EITC) face a disproportionate amount of scrutiny. In fiscal year 2018, 37% of all the audited individual returns were picked because they had an EITC claim, according to the Taxpayer Advocate Service, a watchdog within the IRS. EITC returns comprised 18% of all individual returns filed in 2017.