San Francisco accountant Scott Hoppe had a client who was planning to stretch the sale of founder shares in a tech-sector company over a three-year period.

Instead, the client compressed the installment sale into a one-shot transaction this month.

What accelerated the deal?

The 2020 presidential race. “Assuming all else was equal, that was the driver of the choice,” said Hoppe, principal of the accounting firm Why Blu.

Right now, Hoppe’s client, worth between $10 million and $20 million, will be taxed on capital gains at a rate of 23.8%.

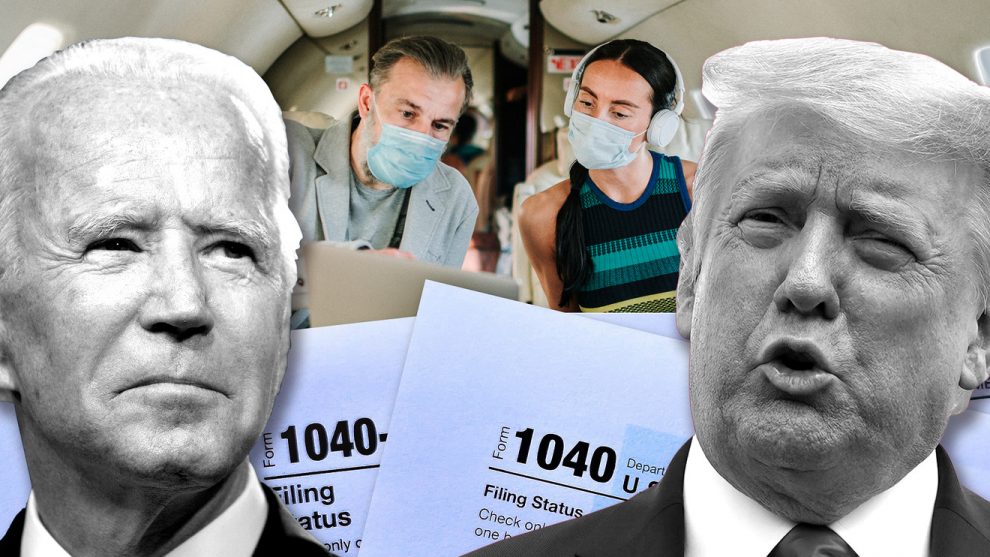

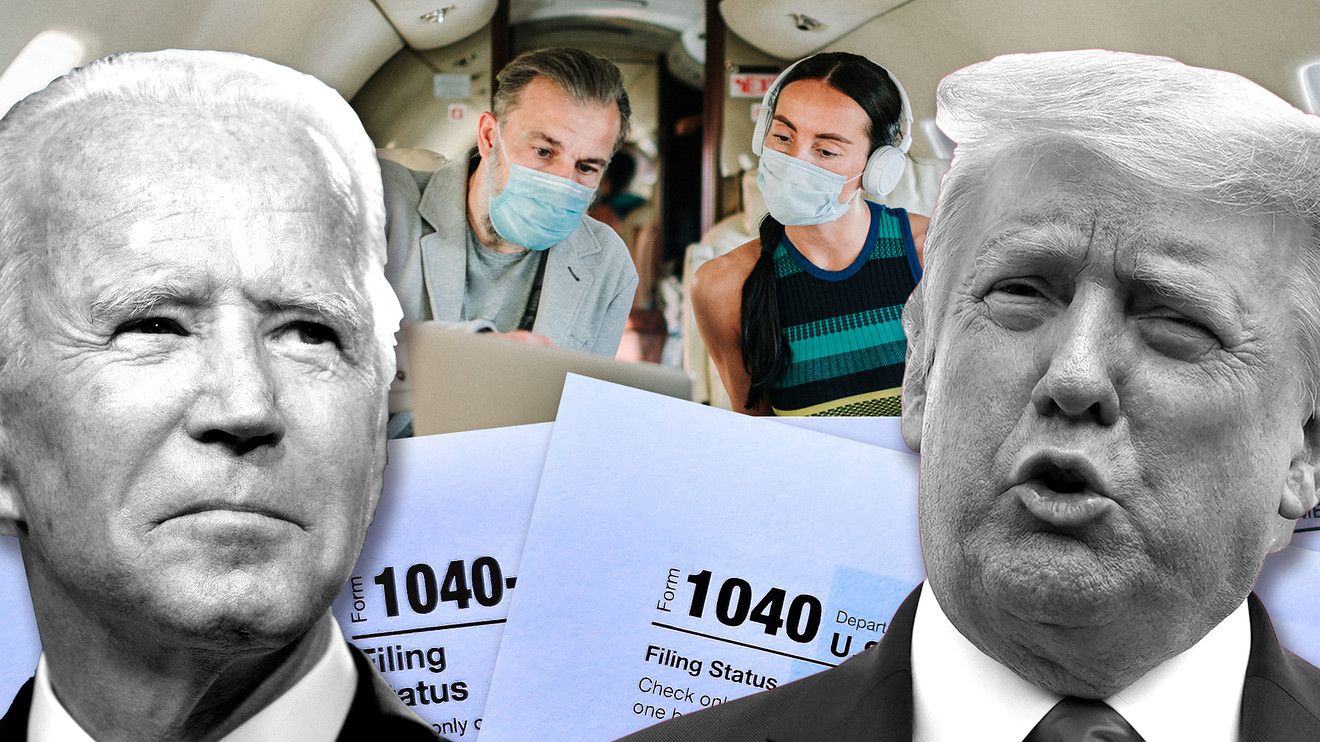

If Democratic candidate Joe Biden beats President Donald Trump — and Democrats retain the House of Representatives and flip the Senate — that client could have potentially been staring at a 39.6% tax rate on two out of the installment sale’s three years.

The compressed transaction saved the client approximately $320,000 in taxes on the $6 million sale. “The seller, for sure, was motivated and the buyer had the wherewithal” to pay the full price upfront, said Hoppe.

Biden’s tax proposal would put the marginal rate for top earners back to the Obama-era 39.6% rate, from the current 37% rate. That 39.6% rate would apply to the capital gains of people who earn more than $1 million. It’s one aspect of a tax proposal where the top 1% of earners would pay for almost 80% of the increase in taxes, according to a budget model from the University of Pennsylvania’s Wharton School of Business.

Election Day is eight weeks away, and the mass of expected mail-in ballots could prolong a final result. Though polling averages in swing states currently give Biden an edge over President Donald Trump, there was a time when polls indicated Hillary Clinton would beat Trump in 2016. Either way, America’s affluent households, and the experts who advise them, aren’t waiting.

Hoppe finishes every client conversation with a discussion about what a Biden administration could mean for portfolios. One Illinois financial planning firm has carried out approximately 50 Roth IRA conversions this year with an eye on the election.

“ One adviser’s left-leaning clients don’t think a Biden win will upend their finances but the adviser’s right-leaning ones think a Biden win could send their portfolio to ‘hell in a hand basket.’ ”

In Houston, Scott Bishop, executive vice president at STA Wealth Management, has fielded election-related calls and emails from half his clients in the past two months.

Bishop’s liberal-leaning clients want to hear about potential opportunities and tend to downplay the idea of new tax rules upending their finances. As for Bishop’s conservative-leaning clients, “they think this is going to hell in a hand basket” and want to get ready to quickly lock in rates and tax exposure if Biden wins.

Bishop — someone who talked down a client who wanted to “sell everything” after Trump won in 2016 — counsels everyone to think things through. “I try to get them to not to act on their biases,” he told MarketWatch.

The flurry in planning comes at a time when income inequality is at its starkest point in 50 years — and a coronavirus pandemic that could further deepen the divide between the rich and poor. Biden says his tax plan would make sure corporations and wealthy Americans pay their “fair share.”

“ ‘We are working in the boundaries that are given to us.’ ”

And what about the fairness of rich Americans using the tax rules to their full advantage? “We are working in the boundaries that are given to us,” Hoppe said, echoing a point others made to MarketWatch. Tax rules are written to discourage or encourage all sorts of activity, he said — like a lower capital gains rate to promote financial investments. If lawmakers “want to change our behavior, the code evolves.”

A Biden campaign spokesman couldn’t be reached for comment.

Here are three ways affluent Americans aren’t waiting for election results when it comes to tax planning.

Estate planning

Americans will inherit $765 billion this year in gifts and bequests and the sum will generate $16 billion in taxes, according to a New York University Law School professor who says that’s a 2%t effective tax rate.

Trump’s 2017 Tax Cuts and Jobs Act elevated the threshold when the 40% federal gift and estate tax exemption stops working. Starting in 2018, the exemption level went from $5.45 million to $11.4 million for individuals ($22.8 million for married couples) and is indexed for inflation.

The provision ends in 2025, but observers say Biden wants to end it a lot sooner and bring the estate tax back to its “historical norm.”

Biden wants to end the so-called “step up in basis.” This is the tax rule stating that if an heir sells an inherited asset, (like 7,000 shares of Apple AAPL, -1.12% ) capital gains taxation on any future sale is pegged to an asset’s value at the time of inheritance, not the original purchase. If an asset appreciates greatly over time, the step-up in basis saves an heir plenty in capital gains.

Michael Whitty, a partner specializing in estate law at Freeborn & Peters in Chicago, is telling his clients to schedule one-hour calls with him now to game out potential contingency plans if Democrats prevail.

How much to give away and what to give away are some of the topics, he said. Whitty wants to have the talks sooner rather than later — especially seeing that lawmakers in the past have been known to make estate tax rates retroactive when passing new laws.

“ ‘The client who waits until after Election Day, and some will wait until towards Thanksgiving, well, we’re going to be really behind the eight ball to put together a well-prepared, well-documented transfer.’ ”

“The client who waits until after Election Day, and some will wait until towards Thanksgiving, well, we’re going to be really behind the eight ball to put together a well-prepared, well-documented transfer,” Whitty said.

At Playfair Planning in Brooklyn, CEO Kim Bourne is advising clients more than ever to file estate tax returns even when they don’t have to. This gets asset valuations on paper — a move that will ease cost basis determinations later on, she said.

Bourne’s clients aren’t speeding up gifts right now, but Bourne is recommending they think about loans between family members. A loan doesn’t eat into the gift and estate exemption and it can always be converted to a “gift” later on, once planners know the legal landscape, Bourne said. “Intra-family loans are a simple way to navigate the uncertainty and take advantage of the low interest environment,” she said.

The election is influencing other long-term financial planning.

Don’t miss: Opinion: Will Biden’s 401(k) plan help you or hurt you?

The upcoming election “was a very critical component, but it wasn’t everything that was discussed,” when Randy Bruns’ Naperville, Ill.-based financial advisory firm, Model Wealth, carried out approximately 50 conversions this year from IRAs to Roth IRAs.

Investors pay tax on IRA distributions once they start tapping it. In a Roth IRA, they pay taxes during the contribution and the money comes out tax-free at distribution — so the reasoning for a Roth account is to avoid a higher tax rate in the future.

“ ‘This is all going up and you may never see it as good as it is now.’ ”

When Bruns explains the election implications to clients, he’s not taking a political stance on the merits of potential tax hikes, he notes. Focusing on rates, he tells his clients, “This is all going up and you may never see it as good as it is now.”

Capital Gains and Ordinary Income

Unlike his onetime rivals Sen. Bernie Sanders and Sen. Elizabeth Warren, Biden is not proposing a “wealth tax” on the highest earners. But the Democratic nominee does want to reset the top income bracket at 39.6%.

He also wants the rich to pay more into Social Security. Employers and employees currently pay a combined 12.4% in payroll taxes on the first $137,700 an employee earns. Biden’s proposal would re-start the 12.4% payroll taxation at the next $400,000 a person makes.

Under the circumstances, Stacy Francis, president and CEO of Francis Financial in Manhattan, says she’s telling clients expecting a bonus or other end-of-year compensation to see if they can arrange for the money to arrive by the end of this year and not at the start of next year.

Capital gains rates are another consideration. Biden would raise the capital gains tax rate to 39.6% for people making at least $1 million. That would go up from 23.8% (which is the 20% rate, plus the 3.8% net investment income tax).

That’s “nearly doubling the tax bite for higher earners,” Francis pointed out — and it could have repercussions for people with large transactions coming up. For example, if a family needs to sell off a brokerage account because of an upcoming college tuition bill or a house purchase, Francis said “it makes sense to do that sooner than later.”

“ ‘It’s only if you know that you’re going to have to sell investments in the next year or so that we recommend you do that now versus later.’ ”

Francis is not advising investors with long-term positions and goals to contemplate sell-offs now.

Election Day 2020 is uncertain, but it’s even more so beyond that. “10 years from now, the tax landscape is so uncharted,” Francis said. “It’s only if you know that you’re going to have to sell investments in the next year or so that we recommend you do that now versus later.”

‘We can only protect what we know about’ Are more audits coming?

Broader tax rules are one way to generate more revenue. Another way is making sure taxpayers are paying all their taxes to begin with.

The 2020 presidential campaign comes while the increasingly short-staffed Internal Revenue Service is auditing fewer returns. The agency data shows the IRS audited 1.73 million returns (almost 1% of all returns) in fiscal year 2010. The IRS audited just over 770,000 returns in fiscal year 2019, which is less than .5%.

Figures like former Treasury Secretary Lawrence Summers — a Biden campaign advisor — say the IRS could reap an extra $535 billion if it brought audit rates back to their point 10 years ago and trained its focus on the super-rich.

This summer, the IRS announced it would be launching hundreds of new audits on high-net worth individuals. Around the same time, Biden unveiled a plan for universal preschool and higher caregiver pay; the campaign says it’s a $775 billion plan underwritten, in part, by increased “tax compliance for high-income earners.”

Tax attorney Cameron Hess expects both parties to support more high-net worth audits.

Political attitudes about the IRS’s audit rates swing like a pendulum, said Hess, a partner at the California-based law firm Wagner Kirkman Blaine Klomparens & Youmans. At one point, starting around the 1990s, the IRS was seen as too aggressive.

“ ‘Perhaps there’s more support by Democrats than Republicans, but there is a push to swing the pendulum back the other way.’ ”

Now it’s a question whether the IRS is doing enough. “Perhaps there’s more support by Democrats than Republicans,” said Hess, “but there is a push to swing the pendulum back the other way.”

Looking ahead to Election Day and beyond, Hess has been telling clients, and tax industry colleagues, how important it is for them to have access to permanent records related to the costs of their capital assets That’s something the IRS has become increasingly curious about, Hess said.

When Hoppe talks to clients about the election, one thing he’s doing is flagging the potential for an audit. Specifically, Hoppe is making sure he knows about all the offshore accounts a client may have, or if they have any cryptocurrency holdings he is unaware of. Hoppe says he’s already meticulous in his documentation, but still, “We can only protect what we know about.”