April is National Financial Literacy Month. To mark the occasion, MarketWatch will publish a series of “Financial Fitness” articles to help readers improve their fiscal health, and offer advice on how to save, invest and spend their money wisely. Read more here.

If you’re feeling underwhelmed by the size of your income-tax refund this year, you’re probably not alone.

Before the start of the 2023 filing season, tax professionals and the Internal Revenue Service were cautioning U.S. taxpayers that many refunds would likely be smaller this year due to the expiration of a number of pandemic-related boosts to tax credits and deductions.

The filing deadline is Tuesday, April 18 — except for those who file for an extension — and the predictions about smaller refunds are coming into focus. The drop in refund amounts comes as particularly bad news at a time when historically high inflation is cooling only slowly.

Also read: Yes, inflation does affect your tax return. Here are 5 things to watch out for.

On Friday, the latest filing statistics from the IRS confirmed the trend on refund amounts. But while last-minute filers should be prepared to join the crowd of disappointed people, it’s not a hard and fast guarantee that they will.

While many taxpayers are getting smaller refunds than they did last year, some wealthier taxpayers are seeing larger refunds this year, according to a new analysis from Bank of America. That might be explained by the capital losses investors can apply against their capital gains and income, researchers said. And investors sure did sustain losses last year, as stocks had their worst performance since 2008.

For many people, an income-tax refund is a significant annual event in their financial lives. But like the tax code itself, lives are complicated. Here’s how refunds are playing out this tax season.

Refunds are smaller

When people filed their 2021 returns last year, millions of households got the second half of enhanced child tax-credit payouts in their refund. The credit for parents with childcare costs was as much as $8,000, instead of the previous $2,100 maximum for two or more dependents. The earned-income tax credit also applied to a larger swath of workers in 2021 and paid more to those without children. And even people who took the widely used standard deduction could deduct some charitable contributions.

That all went away this year.

The effects may already be showing up in the larger economy, with debit- and credit-card spending softening by 1.5% from February to March, according to Bank of America. Lower tax refunds are one part of the explanation for that, researchers said.

Meanwhile, retail sales dropped 1% in March, according to Friday’s data. It was the biggest drop in four months.

Many will use their refund to pay off debt

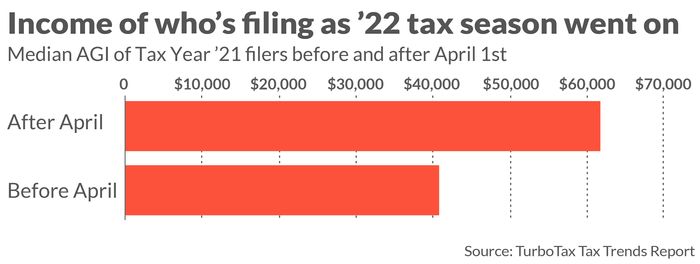

There was a clear divide between the incomes of taxpayers who filed before April 1 last year and those who filed after that date, according to research from TurboTax.

The data is from 2022, but it’s likely that the trend continued this year, said Lisa Greene-Lewis, a certified public accountant and tax expert at TurboTax.

And even if the average refund is lower than it was last year, it’s still a large sum of money that means a lot to people who may have little in the way of savings. “The refund, for a lot of people, it’s the biggest paycheck that they get all year and they rely on it for bills or to get ahead,” Greene-Lewis said.

Nearly one-third of people (28%) said they would use their refund money to pay down debts, while 26% said they would put the money in savings, according to a Bankrate survey last month.

Opinion: We all know an emergency fund is important. Here’s how to get started.

Not all refunds are lower

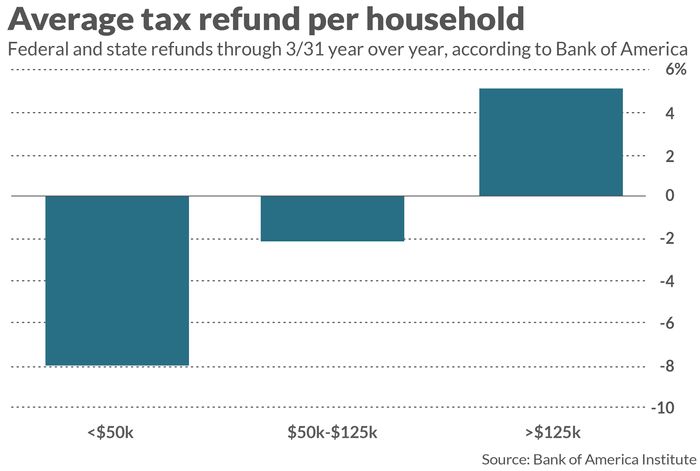

In an analysis released Thursday, Bank of America reviewed internal data to see if lower refunds were consistent across income groups. They weren’t.

The largest drops came for households with income under $50,000. Households earning between $50,000 and $125,000 also saw lower refunds year over year. But it was a different story for households earning more than $125,000.

What explains the refund disparity that is giving a boost to wealthier taxpayers? The researchers have one theory. “In our view, this could be due to realized losses in capital markets for higher-income households,” they wrote.

Investors can sell capital assets, like stocks, at a loss and apply those losses to offset capital gains. If losses exceed gains, losses up to $3,000 can be deducted and the remainder can get carried forward. (The $3,000 capital-loss limitation has been in place since 1978.)

Tax-loss harvesting is a strategy to gather up multiple capital losses, and last year’s market conditions likely made it a tempting strategy. Stocks and bonds were socked by recession worries, rising interest rates and the heavy toll of inflation.

Another theory about why higher-income households are seeing higher refunds this year has to do with estimated tax payments, according to Jason Stein, founder of Bluepoint Wealth in Orange County, Calif.

Stein doesn’t prepare tax returns, but he does help clients with their tax planning and strategies. While salaried wage earners have taxes taken out of every paycheck, people who rely on investment income pay their taxes for the coming year quarterly, Stein noted.

Equities had a high-flying performance in 2021. If investors based their 2022 estimated tax payments on what they owed for 2021, Stein said, they might have been overpaying.

“If your income is largely attributed to investment earnings, your investment earnings can vary substantially between those two years,” he said.

On Friday, the Dow Jones Industrial Average DJIA, -0.42%, S&P 500 SPX, -0.21% and Nasdaq Composite COMP, -0.35% all closed lower despite big first-quarter earnings beats from the country’s largest banks.

Year to date, the Dow is up more than 2%, while the S&P is up 7.7% and the Nasdaq is up 15.8%.