(Bloomberg) — Investors had hoped earnings from five of the world’s biggest companies would shake the stocks out of a malaise and provide a fresh jolt for the S&P 500.

Most Read from Bloomberg

Instead, in many cases they were left wanting.

While Microsoft Corp., Apple Inc., Alphabet Inc., Amazon.com Inc. and Meta Platforms Inc. all topped analyst expectations for sales and profits last week, the results weren’t strong enough to justify their lofty multiples relative to the broader market.

With few reasons to bid up the group, technology investors hit the sell button, resulting in a 1.8% drop in the Bloomberg Magnificent 7 Index, with only Alphabet and Amazon ending the week in the green. The S&P 500 fell 1.4%, weighed down by the big-tech group.

“Investors had higher numbers in mind,” said Michael Casper, equity strategist at Bloomberg Intelligence. “They’re expecting more from AI and these AI projects than what they’ve gotten so far.”

The issue isn’t the current quarter per se: the group of seven companies is on track to deliver profit growth of 30% in three-month period through September, which would beat the estimate of 18% at the start of earnings season, according to data compiled by Bloomberg Intelligence.

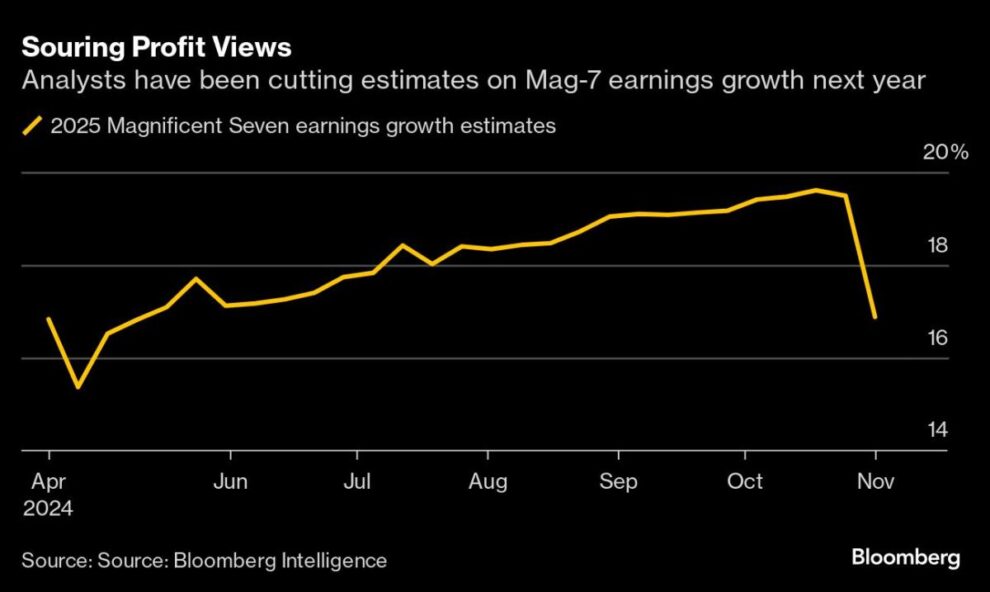

The trouble is next year’s profit outlook remains murky with the tech giants continuing to spend heavily on infrastructure to support more AI computing power. Analysts have been cutting their 2025 profit-growth projections for the Magnificent Seven cohort since earnings season began more than two weeks ago.

Higher spending on artificial intelligence dominated Magnificent Seven earnings this season. Amazon, Microsoft, Alphabet and Meta pumped a record $59 billion into capital expenditures in the third quarter while pledging to spend significantly more next year.

“Right now you have a little bit of Silicon Valley arrogance that says, we just are going to spend, because we know better than you do,” said Ted Mortonson, managing director at Robert W Baird & Co.

While there were signs that revenue from AI-related demand is picking up steam, the message from management teams was that investors will need to wait longer for the big payoffs to show up.

Microsoft’s AI business is on track to exceed an annual revenue run rate of $10 billion next quarter, which would make it the fastest business in the company’s history to reach that milestone, Chief Executive Officer Satya Nadella said on the earnings call.

Significant Costs

However, those sales come with significant costs. Microsoft’s commercial cloud margin will narrow in the current quarter as capital expenditures continue to ramp up, Chief Financial Officer Amy Hood said.

That didn’t sit well with many investors when coupled with a forecast for slower quarterly cloud revenue growth. Microsoft shares tumbled 6.1% the day after its earnings, the biggest drop in two years. Combined with a disappointing revenue forecast from Meta Platforms, traders headed for the exits.

All told, technology, media and telecom stocks collectively saw the largest net selling in five weeks, according to Goldman Sachs prime brokerage report.

Read: Big Tech Stocks Lose Some of Their Aura as Earnings Growth Slows

“As long as these companies are going to keep spending like this, they have to back it up on the revenue side and the revenue bar is very high,” BI’s Casper said. “It’s a concern for the next few quarters.”

There were bright spots, of course. Amazon, which has been dogged by concerns about pressure on margins from big spending, soothed nerves when its forecast for operating profit for the current quarter exceeded expectations.

Sean Sun, a portfolio manager at Thornburg Investment Management, came away from this week encouraged that AI-related sales growth is sufficient to justify the higher spending.

“For many of these companies, growth is accelerating and margins are improving and that’s what you want to see,” he said in an interview. “The AI winners will continue to perform.”

However, other questions hanging over the tech giants heading into earnings went unanswered.

Apple, whose shares have soared on optimism that new AI features will reinvigorate sluggish revenue growth, gave a sales forecast for the current quarter that fell short of the average analyst estimate.

To BI’s Casper, this week’s earnings did little to tarnish the relative attraction of cheaper S&P 500 sectors that have outperformed big-tech stocks since July.

“The story is still that the rest of the S&P 500’s growth rates are starting to catch up,” he said. “It’s not a bad story for tech by any stretch, but maybe some other groups get to have some fun now.”

–With assistance from Carmen Reinicke.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.