Alphabet and Nvidia are worth picking up after their recent slides.

A sell-off has taken hold of the stock market in July, mainly aimed at the tech industry. The Nasdaq-100 Technology Sector index is down by 9% since July 10, when the bulk of the declines began.

The downturn started amid increasing tensions between the U.S. and China. Earlier this month, a Bloomberg article revealed that the U.S. was considering further tightening restrictions on China’s access to advanced technology. Implementing the proposed measure, the Foreign Direct Product Rule, would allow the U.S. to restrict foreign companies from exporting products to China that use even small amounts of American technology. Such a policy could negatively affect the sales of large numbers of tech companies.

The earnings season that kicked off in late July only exacerbated matters as Wall Street was unimpressed by some of the first reports. However, tech remains an excellent place to find reliable long-term investments. Budding technologies like artificial intelligence (AI) and cloud computing have plenty of growth ahead.

So, run, don’t walk to take advantage after tech market sell-offs. Here are two stocks to buy before it’s too late.

1. Nvidia is at its lowest valuation in months

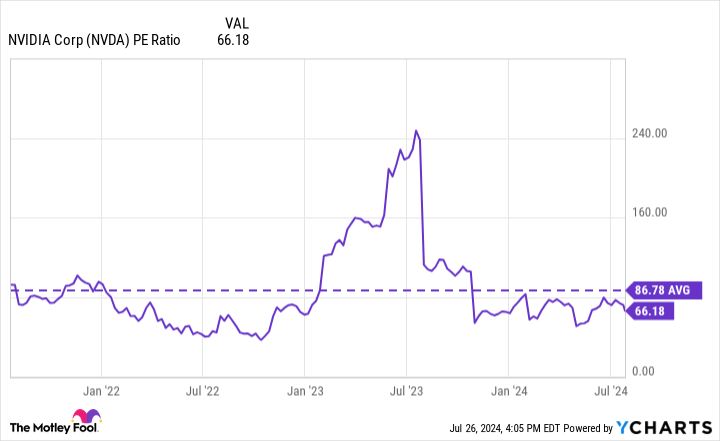

Nvidia (NVDA 12.81%) has fallen by 17% since early July. While that hasn’t felt great for established shareholders, it has made the stock a bit more attractive for those considering opening new positions. Nvidia’s price-to-earnings ratio is now well below its three-year average and significantly lower than it was a year ago.

Data by YCharts.

The stock has risen by 478% in the last three years while maintaining an average P/E of about 87. So while a P/E of 66 would generally be viewed as high rather than a bargain, Nvidia’s significant growth potential and its dominant position in a key tech arena make that a compelling level at which to invest.

Nvidia has delivered massive revenue and earnings growth in recent years by cornering the market on AI graphics processing units (GPUs) — chips capable of handling the heavy workloads involved in training AI models. As many of its rivals scrambled to launch new chips that could take advantage of rising demand, Nvidia was perfectly positioned to supply developers and cloud infrastructure providers worldwide, achieving an estimated 85% market share in the AI chip industry.

Rivals like AMD and Intel have released competing products. However, Nvidia has retained its majority share thanks in part to its Compute Unified Device Architecture, the software platform that accompanies its GPUs. Large numbers of developers have acclimated to this platform, making them less likely to switch to a competing product that would come with a learning curve.

Meanwhile, Nvidia is staying ahead of the competition with regular updates to its chip lineup. The company introduced its Blackwell GPU architecture earlier this year, and its Rubin architecture is due out in 2025.

Nvidia is crushing it in AI, and also holds solid positions in gaming, consumer products, self-driving technology, and more. After its recent sell-off, the company’s stock is just too good to pass up.

2. Alphabet’s booming cloud business is key

Alphabet‘s (GOOG 0.75%) (GOOGL 0.73%) shares have declined by 13% since July 10. Beyond the headwind of a sectorwide downturn, that pull-back was driven by its earnings release on July 23 and a new announcement from OpenAI just two days later.

On July 25, OpenAI unveiled SearchGPT, a prototype search engine that will eventually be integrated into the ChatGPT chatbot. That tool could cut into Google’s market share in search. However, Google controls more than 90% of the search engine market, and has dominated it for at least the last decade. With market dominance and vast financial resources, it won’t be easy to dethrone Google.

Moreover, Alphabet’s second-quarter results last week beat estimates on multiple fronts. Revenue jumped by 14% year over year, exceeding the consensus estimate by $450 million. Meanwhile, earnings per share came in at $1.89 when analysts had expected $1.85. Yet Alphabet’s stock slid, which market watchers attributed to the slower-than-expected growth of YouTube ad sales, which increased by 13%.

However, there was plenty to be bullish about in the Q2 report. Operating income soared by 26%, powered by significant growth in its AI-focused Google Cloud segment. Google Cloud revenue increased by 29%, with operating income nearly tripling to top $1 billion for the first time.

Alphabet’s bread-and-butter business has long been ad sales. However, recent trends suggest cloud computing is likely its future. The company has ramped up its AI expansion, making Google Cloud its fastest-growing business.

Trading at an attractive price-to-earnings ratio of 24, Alphabet is a no-brainer tech stock to buy in 2024.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.