After months of speculation and reports, the U.S. government openly announced Tuesday afternoon that it is investigating the largest U.S. tech companies for anticompetitive practices, an inquiry that could lead to antitrust charges.

Previous reports had suggested that the Justice Department and Federal Trade Commission had worked together to split up individual investigations against Google parent company Alphabet Inc. GOOGL, +0.78% GOOG, +0.72% Amazon.com Inc. AMZN, +0.45% Apple Inc. AAPL, +0.78% and Facebook Inc. FB, +0.02% , but those reports were never officially confirmed by the government nor the companies. The Wall Street Journal reported Tuesday afternoon that a larger investigation had begun in the Justice Department looking at all of Big Tech, and the department officially confirmed that inquiry just minutes later.

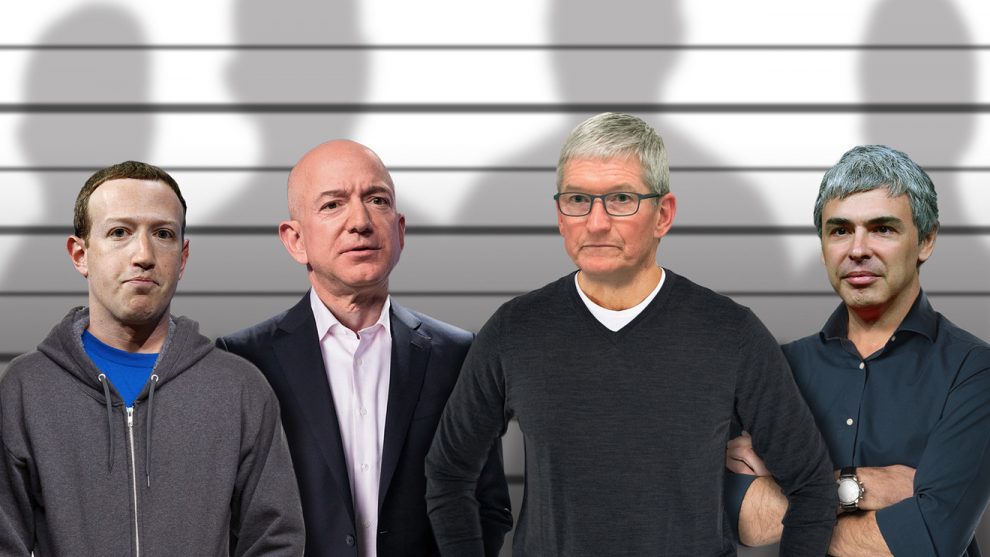

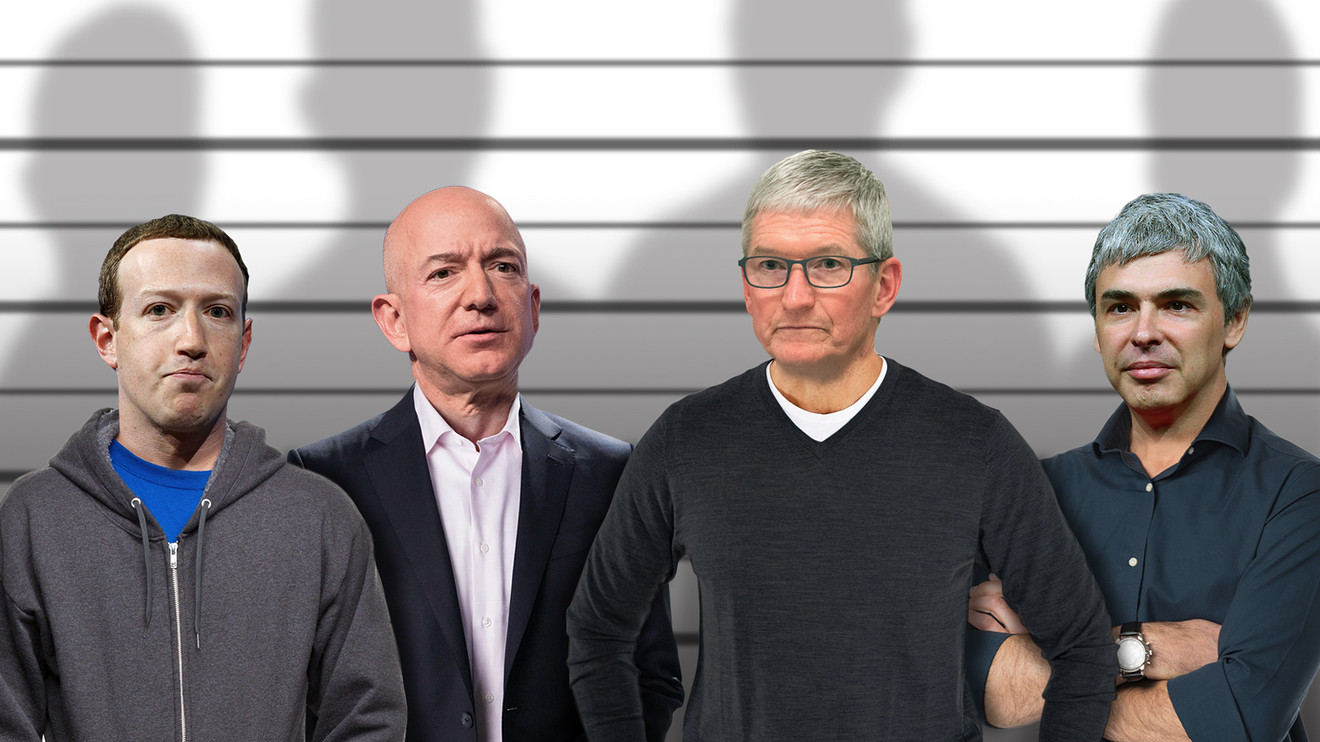

The antitrust suspects: Facebook and Apple appear to be most at risk

“The Department’s antitrust division is reviewing whether and how market-leading online platforms have achieved market power and are engaging in practices that have reduced competition, stifled innovation, or otherwise harmed consumers,” the Justice Department announced.

“The goal of the Department’s review is to assess the competitive conditions in the online marketplace in an objective and fair-minded manner and to ensure Americans have access to free markets in which companies compete on the merits to provide services that users want,” the announcement concluded. “If violations of law are identified, the Department will proceed appropriately to seek redress.”

See also: Four reasons why antitrust actions will likely fail to break up Big Tech

Shares in the largest U.S. tech companies took a hit in after-hours trading. Stock in Amazon, Alphabet and Facebook fell more than 1%, while shares in Apple and Microsoft Corp. MSFT, +0.62% — the largest tech company by market value, which already faced antitrust charges in the U.S. nearly two decades ago — declined by less than 1%.

Facebook declined comment. An Apple spokesman referred to a CBS interview in which CEO Tim Cook said, “We are not a monopoly.” A Google spokeswoman pointed to testimony given by Adam Cohn, its director of economic policy, before Congress last week, where he defended the search giant’s business practices. Amazon did not immediately respond to an email message seeking comment.

Reaction to the DoJ announcement ran from vindication from smaller competitors to concern among investors. One former Justice lawyer called the investigation inevitable.

“It’s heartening to see the Department of Justice examine how companies like Google are harming consumers and stifling competition,” Luther Lowe, senior vice president of policy for Yelp Inc. YELP, +1.80% tweeted.

The scope of the now-formal investigation constitutes a “major shot across the bow” for FAANG stocks and is cause for “near-term uncertainty” among investors, Wedbush Securities analyst Daniel Ives said in a note late Tuesday.

Former Justice Department attorney Avery Gardiner, who is now senior fellow for competition, data, and power at the Center for Democracy & Technology, told MarketWatch she would be “flabbergasted if DOJ hadn’t been investigating conduct by Big Tech for years.”

“I personally recall an investigation of one of these companies dating back to 2008, and I know of another (which stayed confidential) involving another of the tech giants from five years ago, and I think there have been many, many more over the years,” Gardiner said without identifying the companies. She wondered if the phrase “market-leading online platforms” might include Twitter Inc. TWTR, +0.85% .

The animus toward tech in the Beltway was on full display last week during four heated hearings on the vast influence of its biggest players. A frustrated Rep. David Cicilline, D-R.I., chairman of the House Antitrust Subcommittee, fired off letters to Google, Facebook, and Amazon on Tuesday asking for more information on their market power and business practices.

“I was deeply troubled by the evasive, incomplete, or misleading answers received to basic questions directed to these companies by Members of the Subcommittee,” Cicilline said in a statement.

For the most part, big tech stocks continue to march toward record highs despite antitrust chatter. A litmus test may come later this week when Facebook, Alphabet and Amazon report quarterly results. Apple reports next week.