Teladoc (NYSE:TDOC) is a leader in budding telehealth industry, where patients can get health care online or through phone rather than going to a physical doctor’s office. In addition to teleheatlh services, Teladoc also deals in Artificial Intelligence (AI), analytics and telehealth devices. The global telehealth market is expected to expand at a compound annual growth rate (CAGR) of 29.2% between 2020 to 2028, reaching a market size of over $528 billion by the end of the period, according to Emergen Research.

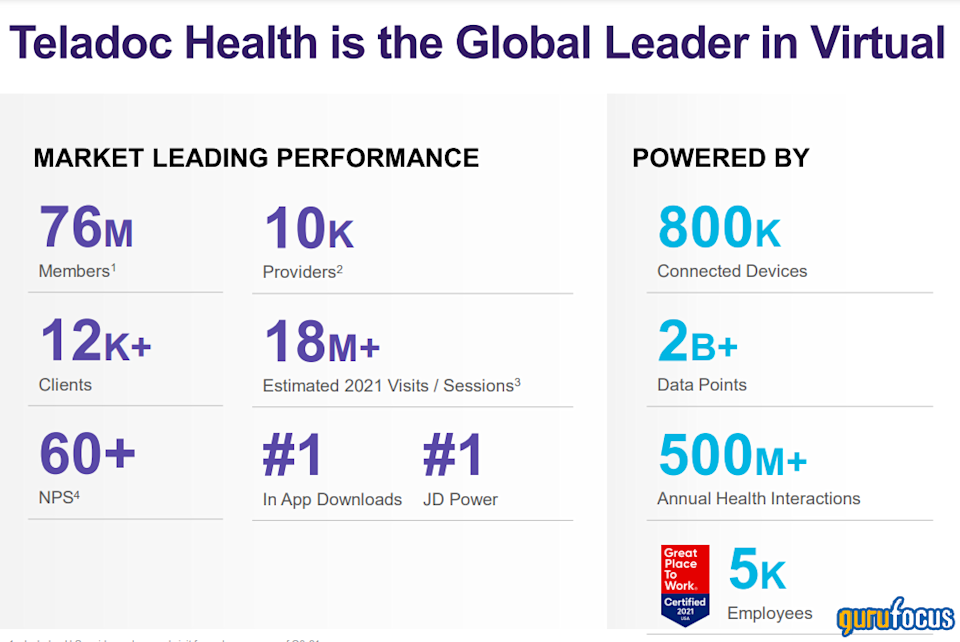

Teladoc is ranked as the number one telehealth provider by Forbes and is the largest market cap company in the space, despite a 77% share price decline from highs in February 2021. The company merged with Livongo in 2020 to expand its offerings into wearable health technology. There are around 800,000 health devices powered by the Lovongo acquisition.

Amazon partnership

In February 2022, Teladoc scored a major partnership with Amazon (NASDAQ:AMZN). This will make Teladoc a prescribed service provider of Amazon Echo. For example, if you say Alexa, I want to talk to a doctor,” a Teladoc doctor will call you back. As Amazon Echo has over 40 million users, this offers huge potential for Teladoc.

Source: Teladoc investor presentation

Revenues and users growing

Teladoc grew both its top and bottom lines in full-year 2021, with 86% revenue growth to reach over $2 billion. The loss per share narrowed from $5.36 in 2020 to $2.73 in 2021. Total visits also increased 38% to 15.4 million.

Cash flow from operations for the full year of 2021 grew to $194 million and has been positive for three consecutive quarters.

Despite this good news, Teladocs (NYSE:TDOC) share price is down 77% from its highs in February 2021, mainly due to the popping of the “Covid stock” bubble, high inflation and a suspected rise in interest rates.

Is the stock undervalued?

According to the GF Value chart, a unique intrinsic value calculation from GuruFocus which takes into account historical multiples, past gains and analyst estimates of future business performance, the stoc is significantly undervalued.

The stock’s price-sales ratio dropped to less than 4 in March 2022, which was the lowest since way back in 2016. Today it is trading at a price-sales ratio of 5.33, with a price-book ratio of 0.69. The mean five-year price-sales ratio is approximately 10, thus the stock is 50% cheaper than average relative to past multiples.

Final thoughts

Teladoc is the number one leader in the budding telehealth industry. It is growing fast and has some incredible financial growth thanks to successful fundraising efforts. The partnership with Amazon underscored the company’s value proposition and provides a new avenue for huge growth. The main negative I can see is the macro economic environment of high inflation and rising interest rates. This has seriously compressed the valuation multiples of all growth stocks. Thus, I expect the stock price to remain suppressed in the short term, but in the long term I believe there is huge upside potential.

This article first appeared on GuruFocus.