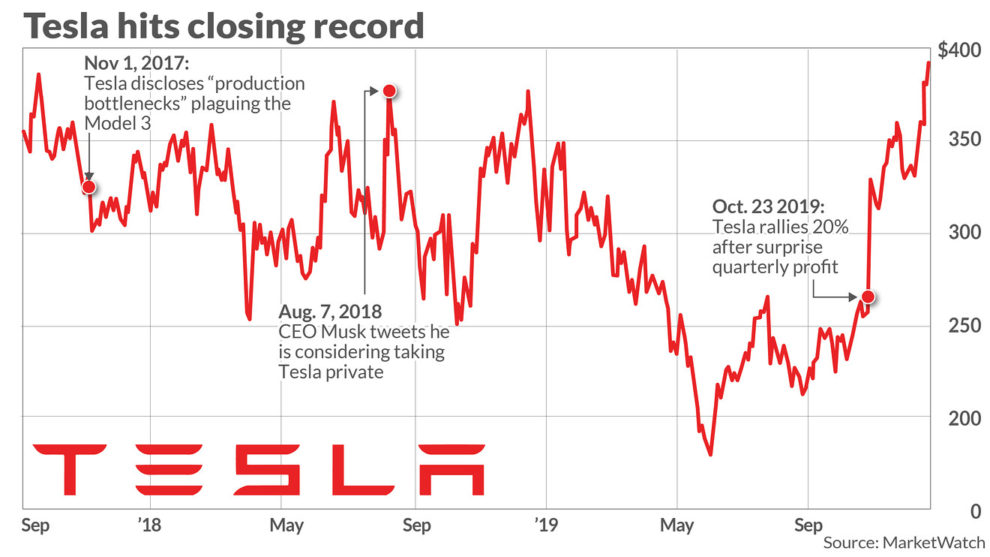

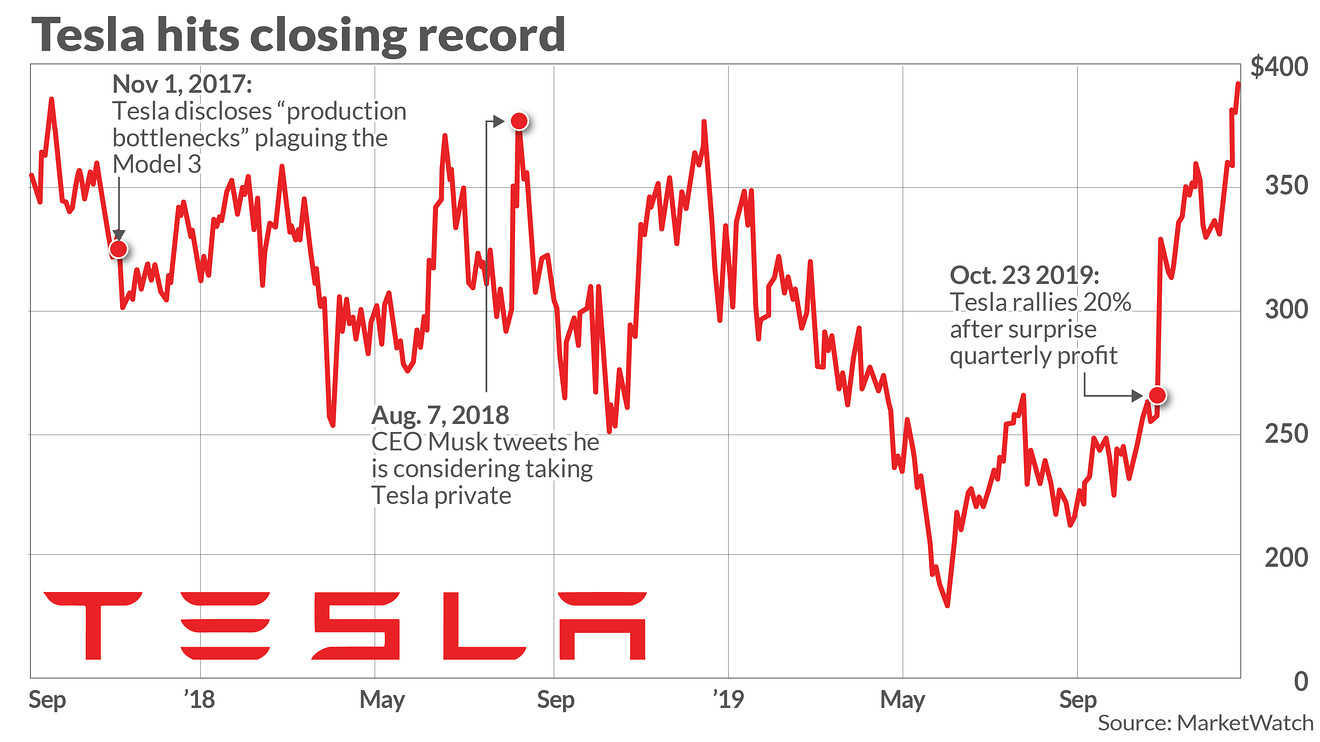

Tesla Inc. stock soared to a closing record Wednesday, the culmination of a late-year rally that started in October when the Silicon Valley car maker surprised investors by showing a profit for its third quarter.

Tesla TSLA, +3.74% shares gained 3.7% to close at $393.15, surpassing a previous record close of $385 set in September 2017.

That brought Tesla’s 2019 gains to 18%, compared with advances of 27% and 21% for the S&P 500 SPX, -0.04% and the Dow Jones Industrial Average DJIA, -0.10% in the same period. The stock traded as high as $393.22 on Wednesday, a new intraday record.

Tesla’s market valuation is north of $70 billion, ahead of General Motors Co.’s GM, +2.75% $53 billion and Ford Motor Co.’s F, +1.60% $38 billion.

Some investors see potential for margins in China to be above the company average around 25%, said Bill Selesky, an analyst with Argus Research. A positive report this week from Credit Suisse, known bears on the stock, also likely helped, he said.

Earlier this week, analysts at Oppenheimer said that the production ramp in China was likely to be “smooth.” And, after a visit to the Tesla “gigafactory” in Nevada, Dan Levy of Credit Suisse said Tesla’s batteries offer it a clear advantage over other auto makers.

The company in October reported a surprise GAAP and adjusted profit for the third quarter, kicking off the late-year gains for the shares, which include a 31% advance for October.

Related: Jim Chanos on Tesla: ‘We are still bears’

Tesla is also fresh from showing off its “Cybertruck,” and Chief Executive Elon Musk has said the pickup truck already has received about 250,000 preorders, which each including a $100 refundable deposit.

Tesla is expected to report fourth-quarter deliveries in early January and fourth-quarter results likely in February. Analysts polled by FactSet expect the company to report an adjusted profit of $1.30 a share on sales of $6.7 billion. That would compare with an adjusted profit of $1.93 a share on sales of $7.2 billion in the year-ago period.