Tesla Inc. on Monday unveiled its in-house driverless-car hardware and highlighted the strides it has made toward fully autonomous vehicles that could morph into a fleet of “robo-taxis” as early as next year in some locations, in one of the day’s many bold promises by Chief Executive Elon Musk.

Tesla TSLA, -3.85% owners would choose to add their vehicles to a future, app-managed Tesla robo-taxi fleet to defray car-ownership costs, with Tesla taking a cut.

The Silicon Valley car maker would also sit on a trove of “real-world” data from its driverless cars, which would enable the company to accelerate its machine-learning plans and get to the top of a heap of companies vying for dominance in driverless-car technology.

Tesla would be cash-flow neutral as it builds the fleet, and “extremely cash-flow positive” after that, Musk said.

Wall Street proved to be skeptical, at least initially, about Monday’s claims: Tesla shares ended 3.9% lower on Monday, slightly worse off than before the investor-day presentation started. The stock was recently up 0.1% in the extended session.

The investor event came two days ahead of Tesla’s first-quarter results, expected for Wednesday after the bell.

Tesla is seen as reporting an adjusted quarterly loss of 94 cents a share on sales of $5.5 billion, according to estimates gathered by FactSet. That would compare with a loss of $3.35 a share on sales of $3.4 billion in the year-ago quarter.

Musk said he expects Tesla to gather regulatory approval for a fully autonomous robo-taxi fleet in some locations by the end of next year.

The future of self-driving cars is hardware and visual recognition, but also poses a “massive software problem,” Musk said.

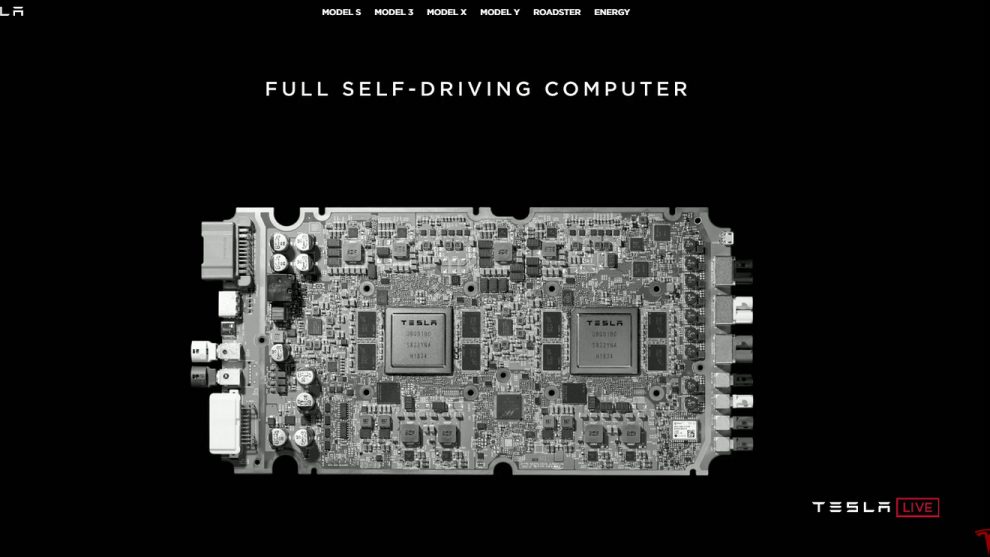

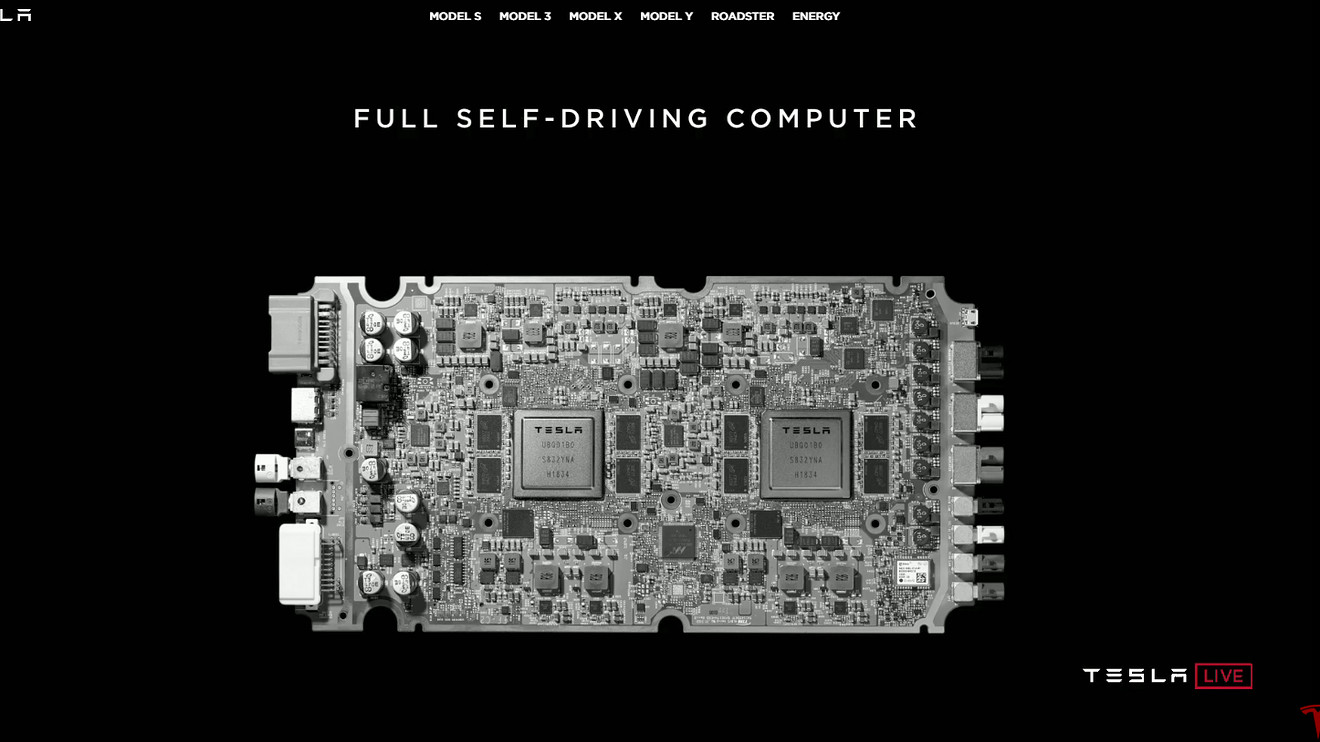

To that end, Tesla’s Peter Bannon, vice president of hardware engineering and former Apple Inc. AAPL, +0.33% executive, introduced Tesla’s Full Self-Driving computer, saying that the company set off to work on it three years ago after it realized there was nothing specifically designed for autonomous driving.

The computer will fit behind a Tesla vehicle’s glove box and hold two independent chips that will run only Tesla-encrypted software.

Musk said that “any part of this could fail and the car (would keep on) driving.”

Musk later called the hardware the “best in the world” and said that all Tesla cars currently being built have everything necessary for self-driving, minus the software.

The chips started being installed in new Model S and Model X vehicles in March and are being installed in Model 3s now. Samsung Electronics Co. Ltd. 005930, +0.11% will make the Tesla chip in Texas.

Musk took a small dig at Nvidia Corp. NVDA, +1.16% which has made hardware for Tesla, saying it was a “great company” that had too many customers and therefore had to do a “generalized solution.”

A spokesperson for Nvidia said Tesla had been “inaccurate” in describing its self-driving computer as more powerful than Nvidia’s.

Musk also criticized the car industry’s reliance on lidar, a common technology in self-driving test cars such as those by Alphabet Inc.’s GOOGL, +0.99% driverless-car unit, Waymo.

“Lidar is a fool’s errand and anyone relying on lidar is doomed. Doomed,” he said, likening lidar to an “expensive appendix.”

Tesla has placed its bets on visual recognition, which Tesla executives said offers a richer picture than lidar points. Musk predicted all the companies investing in lidar sensors would “dump” the technology.

Teslas will be “feature complete” for self-driving this year, and Tesla drivers will be ready to get their hands off the wheels by the second quarter of next year, Musk said.

The CEO kept mum on Tesla’s well-publicized promise to have a fully driverless-car coast-to-coast road trip, first envisioned to take place in 2017.

The shares are down 9% in the past 12 months, versus gains of 9% for the S&P 500 index SPX, +0.10% .