(Bloomberg Opinion) — Huawei Technologies Co. has become very much the U.S.’s whipping boy in the battle to nip China’s technological ascendancy in the bud. President Donald Trump’s administration has slapped sanctions and curbs on the Shenzhen-based company and lobbied allies to do the same. Last month growing resistance against Huawei among lawmakers in Germany’s governing coalition sparked threats of retaliation from the Chinese ambassador.

But what’s happening next door in the Netherlands has higher stakes for China.

There, Beijing’s envoy this week said there will be negative consequences if the Dutch continue to block the export of a single piece of high-tech manufacturing equipment made by ASML Holding NV. According to Reuters, the U.S. has exerted pressure to prevent the sale to a Chinese firm. But it’s not just any machine. It’s a $150 million state-of-the-art apparatus that could ensure Moore’s Law — which says that processing power doubles every 18 months — continues apace, and the microchips powering our smartphones, computers and networks get ever smaller.

Like with Huawei, U.S. Secretary of State Mike Pompeo cited intelligence concerns, though Reuters didn’t specify what they are. The Hague subsequently rescinded an export license it had previously granted for the machine.

Any individual nation state cutting Huawei, the world’s largest networking business, out of the supply chain for its 5G networks will of course be a blow to the Chinese firm. But the impact on China as a whole will be limited. Beijing will still be able to build its own next-generation telecommunication networks, and losing a few exports will have a minor effect on the economy as a whole. Huawei’s sales in Europe, the Middle East and Africa totaled $31 billion in 2018.

A ban on buying machines from ASML is potentially far more significant, because it will hinder China’s ambitious goals to strengthen its super high-tech manufacturing industry.

As far as tech giants go, ASML doesn’t have the global brand cachet of an Apple Inc., Samsung Electronics Co. or Amazon.com Inc. That’s partly because its products are two steps removed from the electronic devices that reside in consumers’ pockets, on their desktops or in their living rooms: ASML builds the machines that make the semiconductors that go into their devices. But it’s one of Europe’s biggest three technology companies, and its top customers include chipmakers Intel Corp., Samsung and Taiwan Semiconductor Manufacturing Co., which is known as TSMC and makes chips for Apple and Huawei alike.

The Dutch firm stands out from rivals Nikon Corp. and Canon Inc. because it’s alone in having mastered an approach known as extreme ultraviolet lithography, which is needed for the manufacture of the next generation of chips. Lithography is the process by which circuit patterns are etched onto silicon wafers, and the EUV process will allow the printing of circuits that are more than 10 times smaller than the current standard.

QuicktakeHow Chinese Technology Grew to Rival Silicon Valley

So you can see why China would be particularly interested in using ASML’s equipment. Although the country is a hub of electronics manufacturing, much of that is simply assembling iPhones, laptops, smart speakers and the like. The underlying tech is often imported, including some $200 billion-worth of semiconductors each year.

Beijing wants to reduce that dependence on imports by investing $150 billion over a decade in an effort to take the lead in technology design and manufacturing. Access to machines made by ASML will be essential to achieving that. By the end of next year, as much as half of TSMC’s revenue will depend at least partly on some EUV processes, according to Bloomberg Intelligence analyst Masahiro Wakasugi. That could be $18 billion worth of chips. While it could take a decade and more than one EUV machine for Chinese firms such as Semiconductor Manufacturing International Corp. to rival that, that is clearly the long-term goal. (SMIC is reportedly the company that placed the order at the heart of the current spat.)

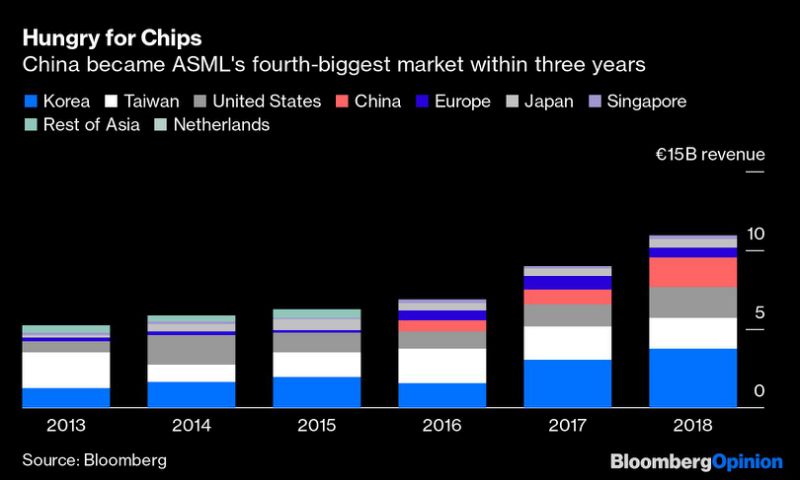

Dutch newspaper Het Financieele Dagblad reported last year that ASML was the target of theft by a rival with ties to the Chinese state, though the company later said that any “suggestion that we were somehow victim of a national conspiracy is wrong.” Chief Executive Officer Peter Wennink surely doesn’t want to lose China’s business: It’s ASML’s fastest-growing market.

What makes the Dutch move so remarkable is that the U.S. can only unilaterally block sales abroad if components or R&D contributions originating domestically exceed 25% for the relevant product. Here, it seems to have succeeded in leaning on the Dutch government to prevent the sale even though, according to press reports, ASML’s extreme ultraviolet lithography machine doesn’t meet that test. An even greater risk would be that other important suppliers of underlying technology follow suit, whether under U.S. duress or not.

To contact the author of this story: Alex Webb at [email protected]

To contact the editor responsible for this story: Melissa Pozsgay at [email protected]

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Alex Webb is a Bloomberg Opinion columnist covering Europe’s technology, media and communications industries. He previously covered Apple and other technology companies for Bloomberg News in San Francisco.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”39″>For more articles like this, please visit us at bloomberg.com/opinion

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”40″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.