“The Batman” is expected to cast a large shadow over the North American box office this weekend.

Estimates forecast the Warner Bros (T) film to cross $100 million in its domestic debut (which would only be the second $100 million opener of the pandemic-era, in addition to ‘Spider-Man: No Way Home.’)

Shawn Robbins, Box Office Pro chief analyst, predicted a range between $130 million to $170 million. He told Yahoo Finance that the film’s success will heavily “rely on an adult audience to turn out because it is a very adult movie.”

At the same time, the film “could really appeal to a lot of younger audiences, too,” who weren’t around for Christopher Nolan’s “Dark Knight” trilogy starring Christian Bale. That group “might see this as their Batman, so this seems like the beginning of a new generation’s Batman,” the analyst added.

Robert Pattison and Zoë Kravitz lead the new iteration of the famed superhero franchise, which has consistently performed well at the global box office.

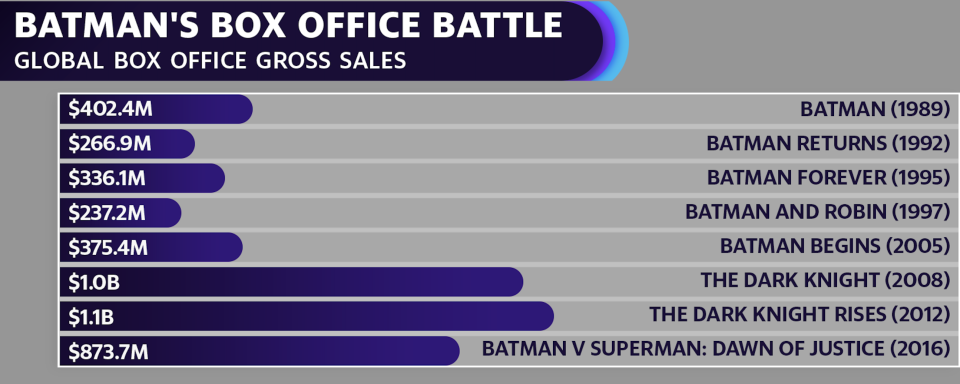

According to Comscore data, “Batman” movies averaged between $250 million to $400 million in global box office ticket sales between 1989 and 2005.

In 2008, “The Dark Knight” blew every other “Batman” film out of the water, garnering more than $1 billion in worldwide ticket sales.

AMC’s premium experiment

“The Batman” will also serve as an experiment for movie chains that are struggling to define their identity post-pandemic.

Earlier this week, AMC (AMC) revealed that it plans to charge more for a ticket to see “The Batman” compared to other theatrical releases, although it is unclear just how much that additional price point will be.

In an earnings call with investors, AMC CEO Adam Aron defended the decision, saying, “This is all quite novel in the United States, but actually, AMC has been doing it for years in our European theaters.”

“In Europe, we charge a premium for the best seats in the house, as do just about all other sellers of tickets in other industries — think sports events, concerts, and live theater, for example,” the executive continued.

Box Office Pro’s Robbins agreed that this trend, expedited by the pandemic, represents a potential shift to higher costs for a more superior, moviegoing experience moving forward.

“I see theatrical gravitating more and more toward the premium experience — that’s where these higher prices come into play,” the analyst noted. He added that theaters could hike prices for consumers seeing films on premium screens, or at premium, high traffic show times.

“It’s going to test a lot of elements of experience,” Robbins continued.

Streaming vs. Theaters

As theaters slowly recover, streaming platforms are also moving to preserve their momentum. On Friday, Disney (DIS) confirmed that it will be releasing a new, ad-supported subscription tier for its flagship streaming platform, Disney+.

The company did not disclose what the pricing will be, although competitors like Paramount+ (PARA) and Discovery+ (DISCA) have set their ad-supported tiers at $5 per month (Disney+ currently costs $8/month.)

The new offering, which will be available in the U.S. beginning in late 2022 with plans to expand internationally in 2023, comes as the streaming giant looks to attract more subscribers amid a crowded media landscape.

Since its inception in November 2019, Disney+ has notched an impressive 130 million-plus subscribers, with the expectation to attract between 230 million and 260 million by 2024.

The streamer has become an increasingly important asset to Disney, which pledged to spend at least $8 billion per year on the platform by 2024.

The dedication to the streaming side of the business has led to further questions when it comes to whether or not streamers will win out against the box office. In 2021, the movie industry deployed multiple experiments to combat the pandemic, primarily through hybrid streaming releases.

But 2022 is already shaping up to be a year of back to basics for studios as the theatrical-first strategy makes its comeback.

As for potential box office risks amid the streaming boom, Robbins believes the two modes of entertainment “can coexist,” citing the success of Disney’s Marvel properties both on Disney+ and in the theater.

“We generally see that the audiences who are consuming the most content, consume from each side of the equation…but ultimately, they are two different forms of consumption, two different forms of entertainment, and I think they’ll separate their identities over time,” the analyst surmised.

Alexandra is a Producer & Entertainment Correspondent at Yahoo Finance. Follow her on Twitter @alliecanal8193

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit