The Dow Jones Industrial Average shook off COVID-19, supply-chain snafus, inflationary pressures and myriad other worries to deliver an outstanding year in absolute terms. Indeed, the blue-chip bastion of Dow stocks generated a price gain of 19% through Dec. 30.

To get a sense of what an outlier 2021 was for the blue-chip average, the Dow’s 30-year annualized price return comes to 8.7%.

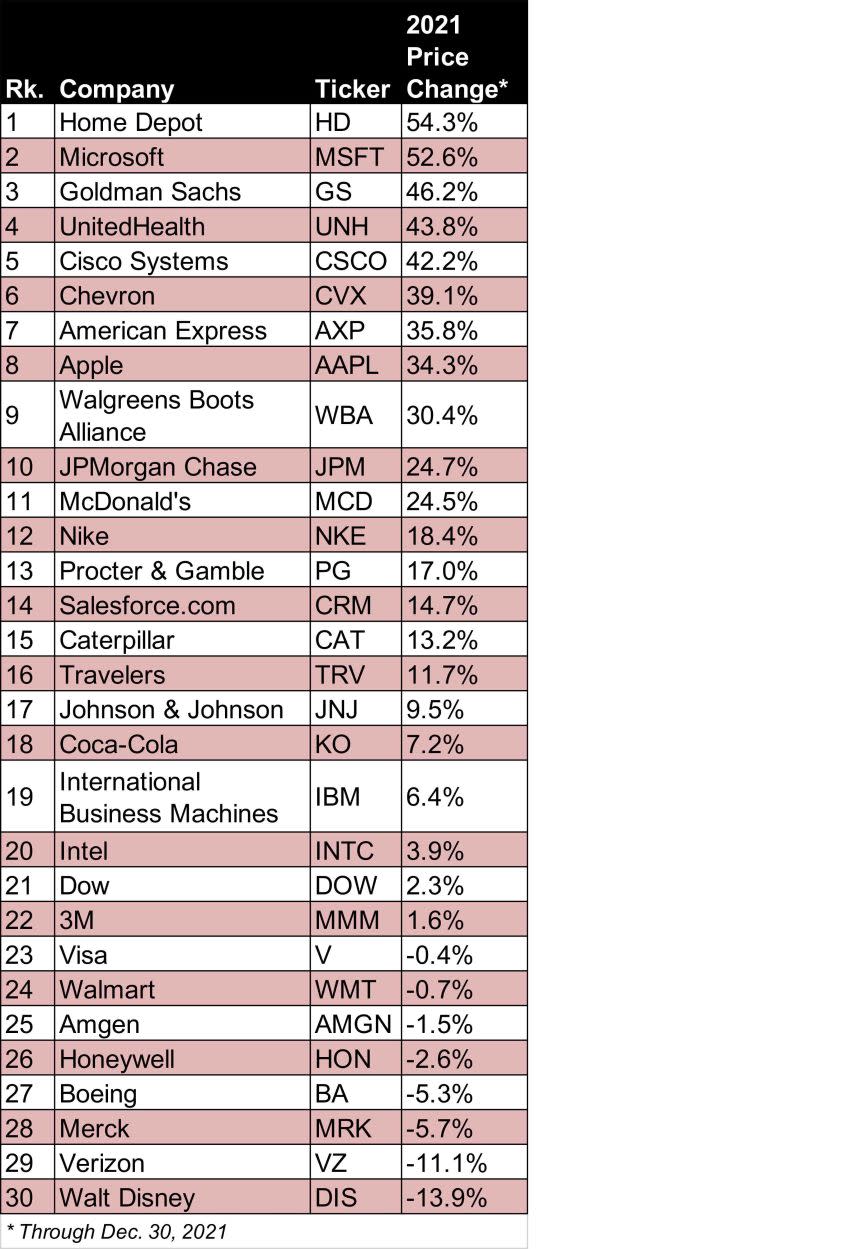

Although the Dow as a whole powered through the pandemic, there’s no question COVID-19 factored heavily in deciding the average’s winners and losers in 2021, which we list in full down below. Naturally, the pandemic remains a key variable in the minds of Wall Street analysts as they rate the 30 Dow Jones stocks’ prospects for 2022.

Either way, many of this year’s best Dow stocks are expected to continue their market-beating ways in the new year.

Take Home Depot (HD, $409.94) and Microsoft (MSFT, $339.32), for example. The Dow’s top stocks of 2021 – each up by more than half – are forecast to put up more big gains in the year ahead thanks to a continuation of current trends.

In HD’s case, the pandemic led to changes in consumer consumption patterns. Folks stuck at home decided to feather their nests, embrace do-it-yourself (DIY) projects and invest newfound discretionary income into their dwellings. The red-hot housing market also remains a tailwind at HD’s back.

MSFT, meanwhile, has become a king of cloud-based services. The rise of remote work accelerated companies’ embrace of Microsoft products such as Azure and Office 365. Looking ahead, analysts say enterprise customers are still in the early innings of their digital transformations.

On the other side of the ledger, analysts say some of this year’s losers are set to become 2022’s winners. Look no farther than Walt Disney (DIS, $155.93) for an example.

Disney was the Dow’s worst stock in 2021, losing almost 14%. The media and entertainment conglomerate was essentially undone by the emergence of the Delta and Omicron variants of COVID-19. Anything that creates uncertainty around the health of Disney’s all-important theme parks and resorts – not to mention its filmed entertainment business – is bad for DIS shareholders.

As much of a bummer as 2021 was for DIS, the Street gives shares a consensus recommendation of Buy, with fairly high conviction to boot. The pandemic can’t last forever, the thinking goes, and shares look cheap.

Here’s hoping, anyway.

Without further ado, have a look at how all 30 Dow stocks fared in 2021 in the table below:

S&P Global Market Intelligence

You may also like

Your Guide to Roth Conversions

Will You Have to Pay Back Your Child Tax Credit Payments?

15 Best Things to Buy at Dollar Stores (Including Dollar Tree) for the Holidays

Add Comment