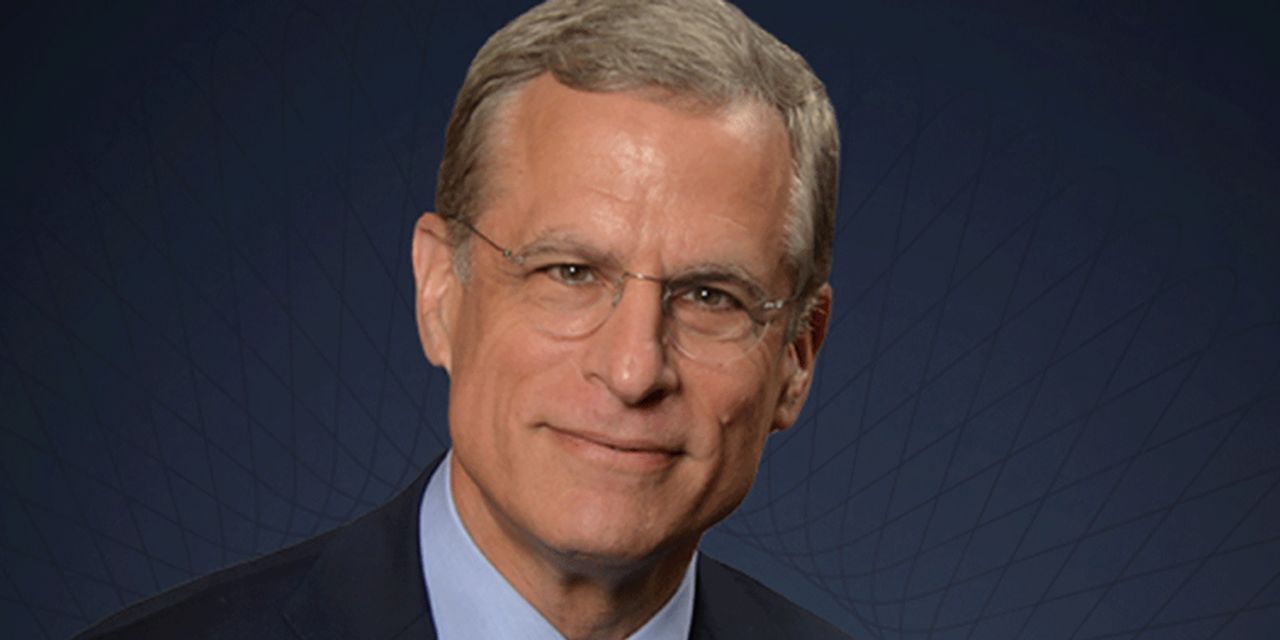

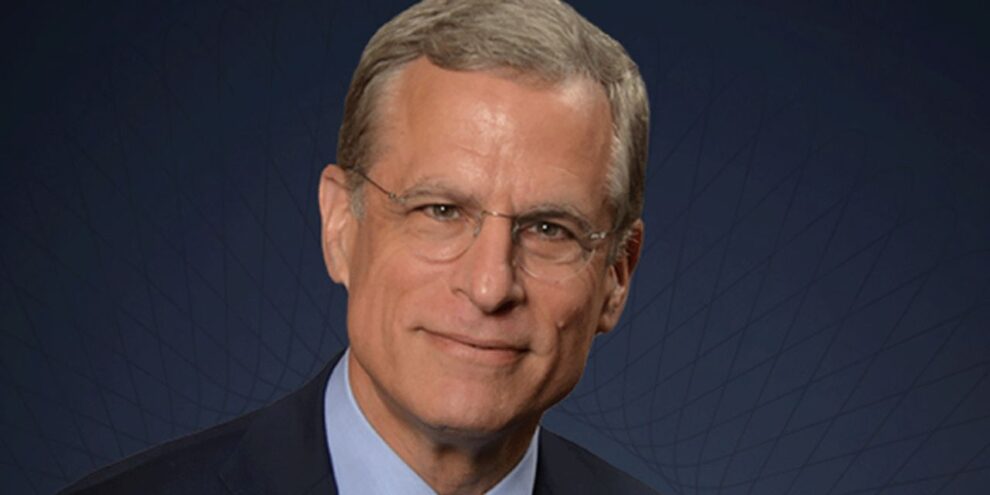

The U.S. economy is likely to grow by an approximate 5% rate this year and this forecast has “firmed over the last several weeks,” said Dallas Fed President Rob Kaplan on Friday.

The unemployment rate should decline to 4.5% by the end of the year, Kaplan said, in a discussion with the Forecast Club of New York.

Inflation will firm but stay below the Fed’s 2% target this year, he said.

The first few months of this year will be “sluggish” by gross domestic product probably won’t contract, Kaplan said.

New strains of the coronavirus add to some downside uncertainty about the outlook, Kaplan said. On the upside, there may be more of an increase in mobility than expected. At the moment, Kaplan said he thought consumers would return to stores only very gradually until June.

Since the pandemic hit the economy, the Fed has cut its policy rate to zero and is buying $120 billion in Treasurys and mortgage-backed assets each month.

On Wednesday, Fed Chairman Jerome Powell was peppered with questions on whether the Fed’s easy policy as a cause of the bubble-like behavior in the stock market this week, caused in large part by social media chat rooms that urged people to buy stocks like GameStop GME, +67.87%.

Kaplan said the Fed rate policy and asset purchases were one of several factors with what was going on in markets.

Speaking for himself, Kaplan said he fully supports using Fed policy “aggressively” while the economy is in the “teeth” of the pandemic even though he is aware there “are side effects” that can lead to financial imbalances.

“These tools we are using are not free,” he said. Regulators must scrutinize banks and non-bank practices, he said.

Once it is clear the economy has moved beyond the crisis, Kaplan said it will be “healthy to wean the economy off these extraordinary measures.”

Kaplan wouldn’t put a time frame on when this exit might occur. The Fed has said it would start to consider tapering the purchases once the economy has made “substantial progress” on getting unemployment down and inflation up.

“We’re not there by any stretch,” he said.

Kaplan is not a voting member of the Fed’s interest-rate committee this year.

“At the appropriate time, the FOMC would have a discussion” about exit, he said.

“It won’t come out of the blue. It will be well-telegraphed. The public will get plenty of notice. But we’re not anywhere close to that,” he said.

Many Fed watchers think the central bank will be buying assets all year.

Add Comment