Federal Reserve officials from Chair Jerome Powell on down have been pretty consistent in their scorn toward negative interest rates, even as the market briefly priced in the expectation that U.S. rates would fall below zero.

That criticism takes two forms — one, Fed officials say evidence doesn’t show much effectiveness where they have been tried, and two, negative interest rates might throw markets, such as those for money markets, into turmoil.

So it’s notable, if not a signal of future intention, that a publication from the St. Louis Fed argues in favor of negative interest rates.

Yi Wen, assistant vice president, and Brian Reinbold, a research associate, say aggressive fiscal and monetary policy will be needed to get the U.S. economy back to trend after the hit from the coronavirus pandemic. The fiscal response of over $2 trillion in spending and the Fed’s asset-purchase program that has brought its balance sheet to over $7 trillion may not be enough, they say.

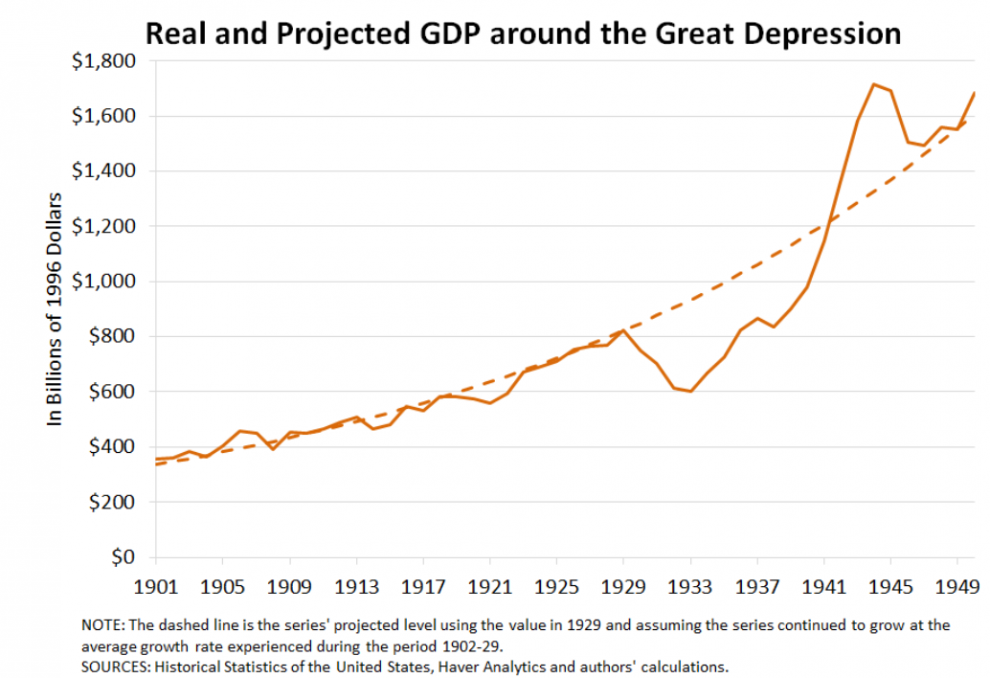

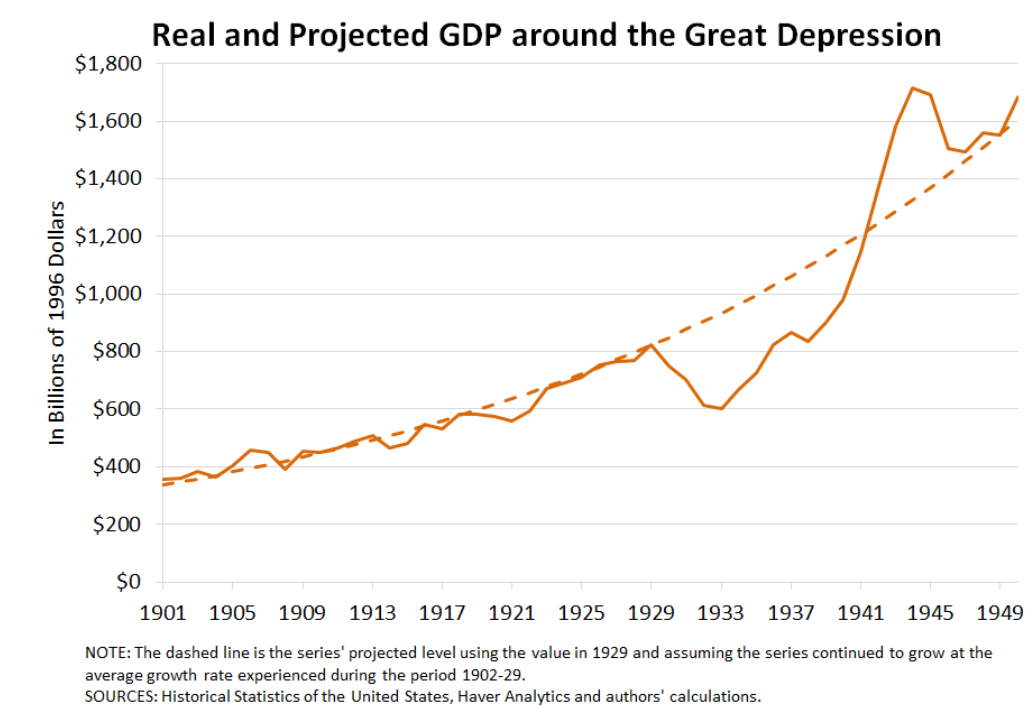

They said the V-shaped recovery from the Great Depression was due to President Franklin D. Roosevelt’s aggressive fiscal stimulus package during the 1930s and the surge in government spending once World War II started.

By contrast, despite aggressive quantitative easing programs designed by the Fed and the government’s stimulus package during the Great Recession, the U.S. economy only managed to achieve an L-shaped recovery, the researchers said.

A model Yi created found that more policy actions will be needed now.

“Aggressive policy means that the U.S. will need to consider negative interest rates and aggressive government spending, such as spending on infrastructure,” the researchers said.