(Bloomberg Opinion) — Even with major stock indexes either at or near all-time highs, markets are in the midst of simultaneously pricing in both a speculative tech boom and a deepening U.S. recession as new coronavirus cases surge. New data and headlines suggests both sides of that narrative have merit, even if that doesn’t last for more than a few more quarters.

America’s biggest banks started reporting quarterly earnings this week and are setting expectations for a much more prolonged slump than when they last reported their results. George Pearkes of Bespoke Investment Group notes that JPMorgan’s loan loss provisions are growing faster than they did in the 2008 financial crisis that kicked off the Great Recession, in part due to new accounting rules. Optimists may point out that banks are better-capitalized than they were in 2008 and that the scale of federal relief given to households and businesses will prevent bank losses from being larger than they otherwise would be. Yet it’s easy to see why investors would be concerned about the potential for further loan losses without any clarity on when the public-health crisis will end.

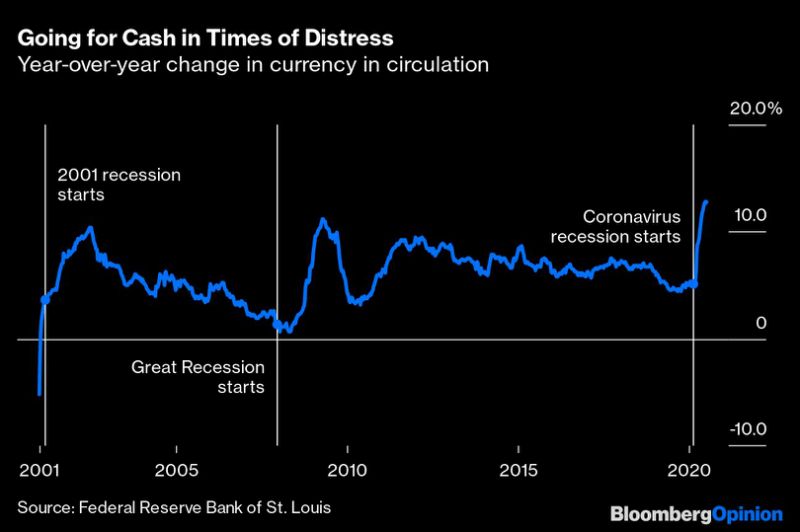

Households are also hoarding cash in a manner that suggests we’re in a severe recession, with the growth rate of hard cash in circulation at similar levels to those seen during the the 2001 and 2007-09 recessions. Bank failures might not be the concern this time around, but there are plenty of reasons to be wary. A contributing factor to currency hoarding could be that the $1,200 relief checks and enhanced unemployment benefits may have been given to the types of households more likely to hold cash.

The monthly Bank of America fund manager survey shows that most investors believe we’re either in the middle of a recession or the early cycle of an expansion, similar to what they believed in the first half of 2009 (that recession officially ended that June). Both views seem reasonable — unemployment is high, banks are reporting high levels of loan losses, bankruptcies of retailers and small businesses are elevated, and companies are suspending stock-buyback programs, cutting dividends and raising liquidity with debt and equity sales. To the extent financial assets have direct exposure to economic problems because of the pandemic — think of airlines, cruise lines, shopping malls and banks — their depressed valuations generally reflect the recession scenario.

At the same time, there’s parallel exuberance in companies and industries that benefit from the stay-at-home economy and have strong long-term growth potential. Companies that were already growing faster than most, such as Amazon, Shopify and Zoom, have seen their growth accelerate as households rely on e-commerce and videoconferencing amid government-mandated or self-imposed quarantines. With that faster growth has come higher valuations. Some of the increase might reflect their improved financial condition. It also may be a sign that investors who sold their industrials and financials stocks have piled into equities that are seen as having both lower risk and the ability to take advantage of shifting consumption patterns during the pandemic.

There’s also a growing boom in future-oriented technology stocks with little exposure to the pandemic, as investors discount the harm being done to the economy today while they focus on growth potential in the coming decade. Electric-vehicle makers that are publicly traded have surged, and private companies are raising money to fund their growth. This could reflect anticipation of a change in policy should Joe Biden win the presidency, reinforced by Biden’s recently announced plans to accelerate the federal government’s investment in clean-energy technologies. Something similar happened in 2008, as solar-energy companies saw their stocks soar before the election of Barack Obama. First Solar’s valuation peaked at about $25 billion when its trailing 12-month revenues were less than $1 billion. Its market value now is about $6 billion.

But this fire-and-ice market is unlikely to last beyond early next year. If the public-health crisis subsides because of medical breakthroughs or vaccines that convey at least partial protection against the coronavirus, this should reduce the pressure on banks, small businesses and household finances, allowing stocks tied to those sectors to participate in broad market rallies. If, on the other hand, the pandemic extends well into 2021, further pressure on banks, businesses and households will likely drag down the growth of software companies that until now have remained relatively insulated from the pandemic-driven downturn. And for electric-vehicle companies, the solar-energy stock boom of 2008 wouldn’t be a welcome parallel. Even as solar panel installations soared during the Obama administration, profits remained elusive and eventually valuations crashed back to earth.This pre-election pandemic period has many investors worrying about the present while others dream about the future. That’s fine, as long as we all remember that it won’t last forever.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Conor Sen is a Bloomberg Opinion columnist. He has been a contributor to the Atlantic and Business Insider.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”28″>For more articles like this, please visit us at bloomberg.com/opinion

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”29″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.