Article first published on Simply Wall St News

Netflix, Inc. (NASDAQ:NFLX) is trading around pre-pandemic levels and investors are wondering if this is related to a depressed market or justified based on the fundamentals. In this article, we will touch on both topics and attempt to assess why markets have changed their mind on Netflix.

First off, we begin by summing up the market situation.

Market Shifts

2020 and the first half of 2021 were a boon to stay at home, tech and growth stocks. This was partly because of the excess liquidity poured into financial markets, and they were also a good bet in a physically disconnected economy. As a result, most of the big stocks got bigger, and this includes Netflix as it gained around a 100% from the beginning of 2020 to the highs of 2021 in November.

Initially, the stock outperformed the NASDAQ100 up until November, but is now down some 33% from the last 12 months.

View our latest analysis for Netflix

Investors speculate that there are a few reasons for the change in price – However, these are not independent of the company’s fundamentals, and we will factor them-in later.

Some key developments that changed how markets value sectors include:

-

Pricing-in the reality of inflation. This prompted both the market and lenders to change their valuations. For lenders, this is reflected in the rise of interest rates, while the market reacts with demanding a higher return from their investment in the near(er) future.

-

Rotation from growth to value – closely tied to the previous point, investors started rotating their funds from high risk-return stocks, to lower return but established companies with reliable cash flows.

-

Rise in high pricing power stocks – as inflation erodes the value of money, investors seek out stocks that can pass on these costs to their clients. This included a rotation into financial institutions, energy/commodity companies, consumer essentials, utilities. There is an argument to be made that this will continue to unfold as we keep tracking inflation developments.

-

Increase in the competitive landscape. When Netflix started to gain popularity, it was a near monopoly on the streaming market, and customers were intrigued by the trendiness of the service. As time passed, more and more companies joined the streaming entertainment business. Now, consumers are faced with picking from closed ecosystems of competitors that all offer a discretionary product.

Markets are future oriented, so they are also pricing-in uncertainty, economic slowdown and stability. In that regard, it is quite hard to estimate where to move next, that is why we will pair our analysis with the fundamentals of the stock and see how investors might see the future of Netflix.

The takeaway from what we observe in markets, is that the fundamentals will matter more, not less. Investors will want tangible cash returns and stocks that trade with justifiable multiples/valuations. Hence, why we see stocks being more sensitive to earnings calls.

The Fundamentals

As far as Netflix is concerned, the company still trades like a growth stock, with a 32x price to earnings ratio, which has decreased from the 63x P/E from Q1 2021. It seems that investors are anticipating a slowdown of the high growth phase and are adjusting the price to the value closer to the present.

Netflix has also shifted the development of their service into 2 fronts: Content creation and International Expansion. As far as investors are concerned, international expansion is a great move that will give the company exposure to more people with relatively low investment.

It is the content creation part that is debatable, as Netflix must spend a lot more in order to produce engaging content that has a relatively short life-cycle. The mix of original content on the international stage is arguably a smart move, but the company will need to invest more than ever to develop the business. We can see this in the statement of cash flows, the company has spent US$1.339b in investing activities, while cash from operations has fallen to US$392m in the last 12 months. Some investors view this as a future oriented strategy, while others might be more concerned with the current performance.

Moving over to the income statement, Netflix reported US$30b in revenue, roughly in line with analyst forecasts, although statutory earnings per share (EPS) of US$11.24 beat expectations, being 5.0% higher than expected.

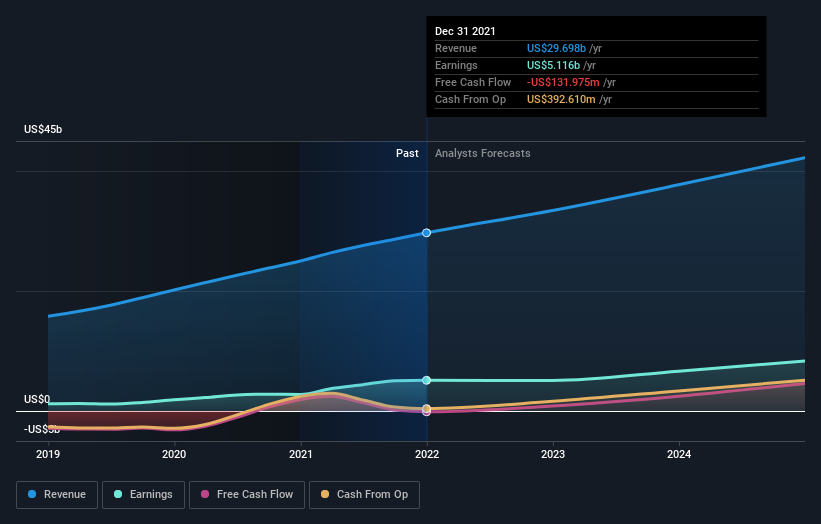

We can see what analysts expect from the company in the chart below.

The most recent consensus for Netflix from 42 analysts is for revenues of US$33.4b in 2022 which, if met, would be a decent 13% increase on its sales over the past 12 months.

Statutory earnings per share are expected to shrink 3.2% to US$11.15 in the same period, which could be part of the reason why some investors are holding back. The consensus price target is largely unchanged at US$513. Which means that analysts are still expecting the stock to revert to 2021 levels.

Conclusion

It seems that the fundamentals paint a divergent picture. While Netflix is still expected to grow around mid-teens, it is apparent that investors are factoring-in the deceleration of growth rates, since the company historically grew revenues around 23%. It also seems concerning that EPS is expected to drop slightly, and in a volatile market, this may make investors weary about pouring additional capital.

You still need to take note of risks, for example – Netflix has 3 warning signs (and 2 which don’t sit too well with us) we think you should know about.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.