Americans, have no fear — the future of retirement may not be as bleak as you fear.

It also may not be quite as cheerful as you’d hope.

The gender gap in Social Security benefits will narrow, women’s increased lifetime earnings will bolster how much money they get in retirement and retirement incomes in general will continue to rise, according to the Urban Institute, a Washington, D.C.-based think tank for economic and social policy research. “What struck me most was the realization that the sky is not falling for retirement security,” said Richard Johnson, an economist at the Urban Institute.

But at the same time, there are plenty of challenges, particularly in preretirement income replacement, the potential cuts in Social Security benefits (if Congress doesn’t address the program’s shortfalls) and racial and ethnic disparities in retirement income. “Those challenges are increasingly pressing for younger people — those decades away from retirement,” Johnson said.

The Urban Institute measured numerous factors in retirement income, including Social Security, earnings, pensions, government benefits, and retirement account withdrawals.

See: What kind of retirement saver are you?

Here’s what the research shows:

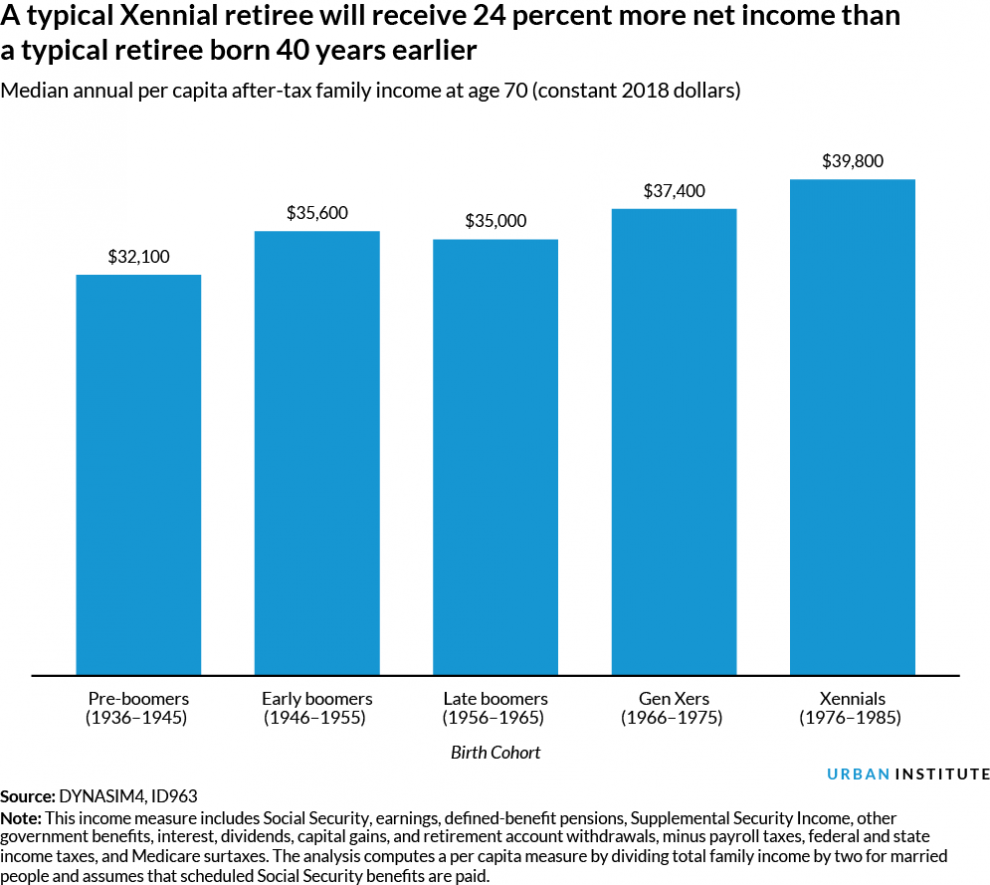

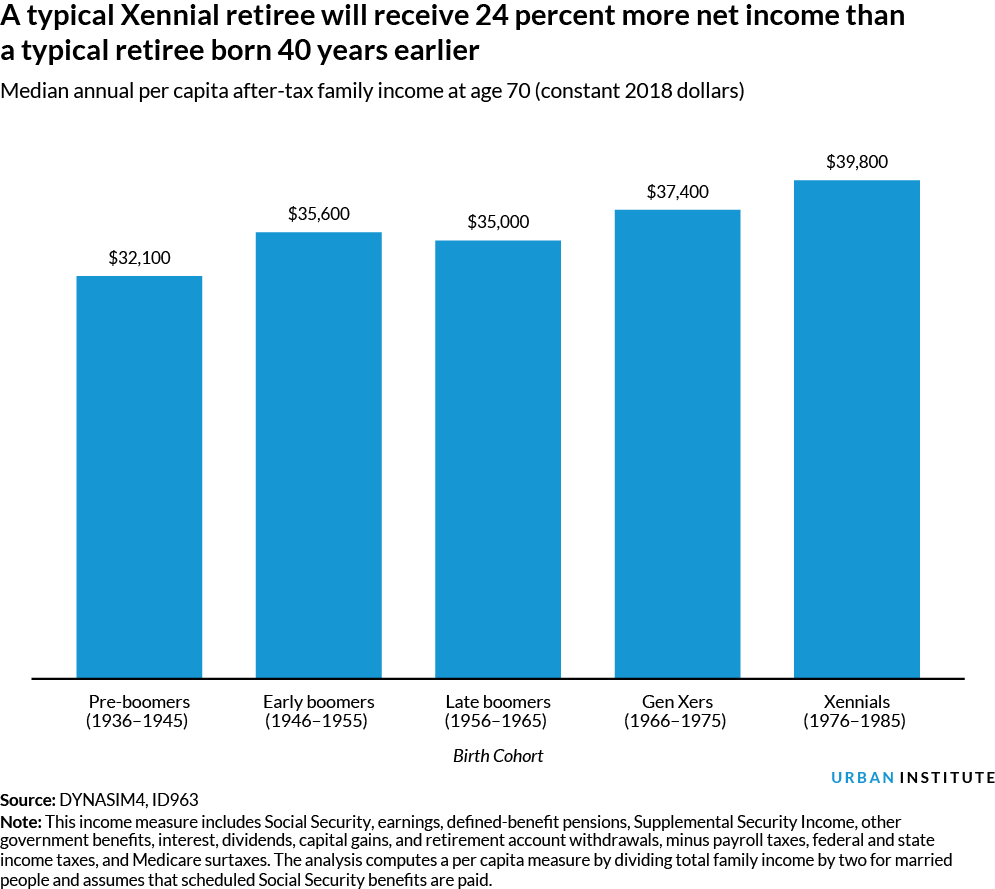

Retirement incomes will continue going up

Future retirees will save more than their predecessors, according to Urban Institute. Researchers broke down the generations into 10-year birth cohorts, and found the younger the generation, the more they’d have come retirement. The youngest cohort, dubbed the Xennials (born between 1976 and 1985), are projected to have a median retirement income that’s 24% more than pre-boomers (those born between 1936 and 1945).

The caveat: Social Security must remain completely intact. Right now the trust funds supporting the program are facing depletion by 2035, and if that occurs, retirees will see only 80% of the benefits their owed, according to the Social Security Administration’s trustees report released earlier this year. Should Social Security see this shortfall, 38% of Generation X and 40% of Xennials won’t be able to replace at least 75% of their preretirement income.

Still, even if Social Security benefits remain the same, 30% and 32% of Gen X and Xennials, respectively, will fall short of a 75% replacement ratio, compared with 26% of late, early and pre-boomers who could not make up the same amount of income. About one-third of Xennials will see their standard of living decline in retirement.

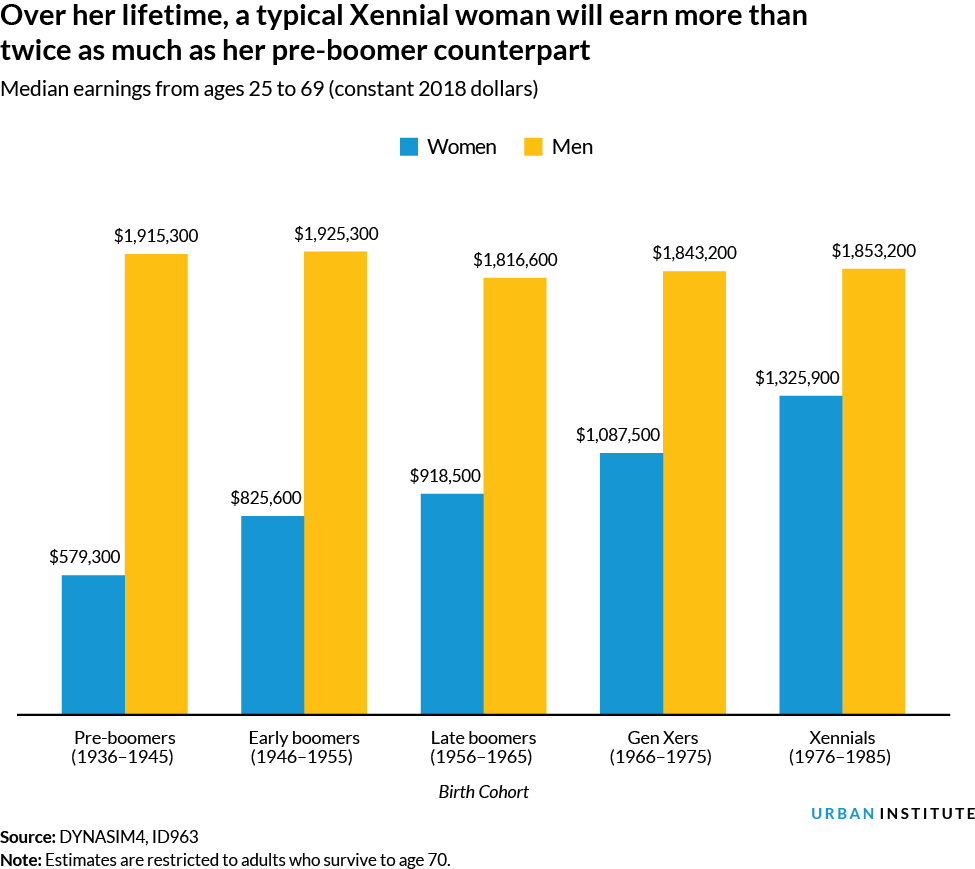

Women are earning more, and that benefits them in retirement

As more women work (or take on longer hours) and earn more, they’ll strengthen their retirement security. Median lifetime earnings will be 88% higher for Gen X women and 129% higher for Xennial women (adjusted for inflation) than pre-boomer women. Xennial women have a projected median lifetime earning of $1.33 million dollars, compared with their male counterparts in the same cohort who will earn $1.85 million. Pre-boomer women’s lifetime earnings amounted to $579,300, pale in comparison to their male counterparts who made $1.92 million over the span of their lifetime.

The gender gap in earnings has yet to close — or come close — but the gap in Social Security benefits is lessening. This gap is expected to fall from 37% for pre-boomers to 15% for Xennials. Xennial women may see a median of $22,000 in annual Social Security income at age 70 (versus the men’s $26,000), compared with pre-boomer women, who had an annual Social Security benefit of $13,100 (compared with pre-boomer men’s median of $20,800).

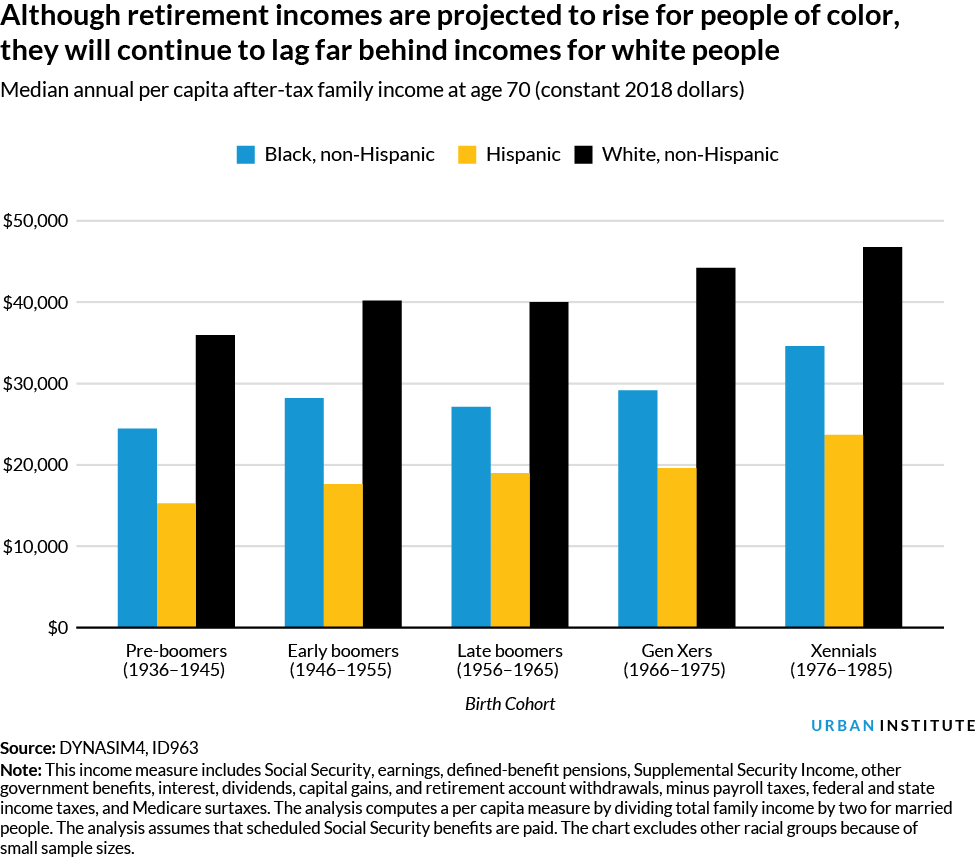

There are still many disparities among races in retirement

Retirement security is more of a challenge for some races than others. While retirement incomes are expected to rise for all individuals, people of color will see less because they earn less than their white counterparts. The median after-tax income for pre-boomer black retirees at age 70 was 32% less than non-Hispanic white people; pre-boomer Hispanic people had 58% less.

The gaps are expected to narrow slightly, but not nearly enough. White Xennials may receive almost $50,000 in median after-tax family income at age 70, while their black counterparts will receive about $35,000 and their Hispanic counterparts will be less than $25,000.

All races have a risk of falling below their standard of living in retirement, but it is worse for blacks and Hispanics. A little less than half (48%) of white people are not on track to maintain their standard of living in retirement, compared with 54% of black people and 61% of Hispanics, according to Alicia Munnell and a recent study from the Center for Retirement Research at Boston College. Still, even accounting for Social Security’s progressive benefit formula, which redistributes benefits to help people with low lifetime earnings, people of color have less of an ability to save for retirement — or even access a workplace plan — and need to make up a higher replacement rate despite their lower annual income.