Reuters

Reuters

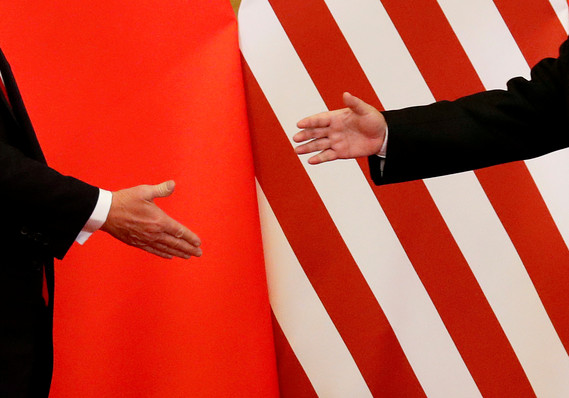

Markets were taken by surprise when trade talks between the U.S. and China broke down in early May, and since then, pundits have opined that the relationship between the two countries is on thin ice.

The S&P 500 SPX, -1.10% was trading around its 200-day moving average, as of Wednesday afternoon trade, nursing losses since Trump’s May 5 tweet indicating talks had soured.

Related: Here’s the damage done to the stock market since Trump’s May 5 trade tweet

But one long-time China watcher wasn’t surprised by the events of the spring, and says talks are still in early innings. There’s still a long way to go before the two sides sit back down, and some hurdles in the interim that most U.S. media isn’t even taking note of, but Leland Miller, a co-founder of the China Beige Book, is more bullish than most observers.

“This thing is still very much in play,” Miller told MarketWatch.

Leland Miller

Leland Miller

The China Beige Book is a unique research service that uses real-world survey data to compile a more accurate picture of economic conditions than the notoriously opaque government reporting provides. Miller was fretting about the likelihood of a trade spat in 2017 when few analysts saw it coming.

Related: A China skeptic takes a victory lap as unwanted steel floods the market

Miller is looking ahead to the upcoming Group of 20 summit in Osaka, which will take place June 28 and 29, just before the next round of tariffs is due to go into effect: a 25% charge on all $500 billion of Chinese imports.

But there’s a long road before then, with an enormous speed bump in the middle: the 30th anniversary of the Tiananmen Square massacre. “The Chinese are more worried of Tiananmen than Trump,” Miller said. “Nothing can get done until after that.”

Miller stresses that he doesn’t expect much to happen on or around June 4 because the Chinese are clamping down hard on domestic unrest. “The likelihood is that it comes and goes with some memorials and some arrests and there’s no story,” he said. But the legacy of 1989 looms large enough that it’s still a wildcard, and it will consume the Chinese government’s attention completely.

It’s also a microcosm of the big-picture questions facing China. President Xi Jinping, as the singular leader of China, technically can make big decisions quickly and single-handedly – but he still has political considerations, Miller said.

The same goes for China writ large. Negotiators and the state-run media claimed that Trump administration demands were an infringement on the country’s “sovereignty and dignity.” It’s going to be tough to walk back such strong rhetoric, Miller said.

Even if it doesn’t happen in Osaka, there are two big forces working in favor of a deal at some point, Miller thinks.

First, the popular idea that the Chinese are girding for – and can withstand – a “long march” – is wrong. “The Chinese want a deal and need a deal,” he said. “Their economy is not going to implode if they don’t get one, but it will be under severe stress starting soon” after tariffs rise to 25%.

And “the most important factor,” in Miller’s view? “Trump still wants a deal. Trump wants to be the person who pulls it together.”

Related: Does America need to be made great again?