Nvidia is still slightly off its last all-time high, which it set this year.

While there are many measures of what “the market” is, the most common reference is to the S&P 500, which is made up of the 500 largest U.S.-listed companies. This gives investors a fairly diversified representation across all market sectors, which is why it’s typically used as a baseline. The S&P 500 has notched new all-time highs for a couple of days in a row, but that doesn’t mean every stock is also hitting new all-time highs.

Although Nvidia (NVDA -3.66%) has been an excellent investment in 2024, it is not one of the stocks that has hit a new all-time high recently, although it’s not far from achieving that. It’s about 10% off its all-time high, but that stock has rallied aggressively in the last few days.

Will Nvidia notch a new all-time high in the coming days?

GPUs have never been in higher demand

Nvidia’s graphics processing units (GPUs) have been at the top of their industry for a long time. However, only recently has that best-in-class accolade paid off. Because GPUs can process multiple calculations in parallel, they are ideal for arduous computing tasks. Originally, GPUs were intended for processing gaming graphics, thus the name. Eventually, they found their way to other use cases, like engineering simulations, cryptocurrency mining, and artificial intelligence (AI) model training.

The latter has caused Nvidia’s demand to explode, as many of the largest tech companies raced to build the most powerful AI-training servers possible. This means filling them with thousands of Nvidia GPUs, which caused Nvidia’s business to boom.

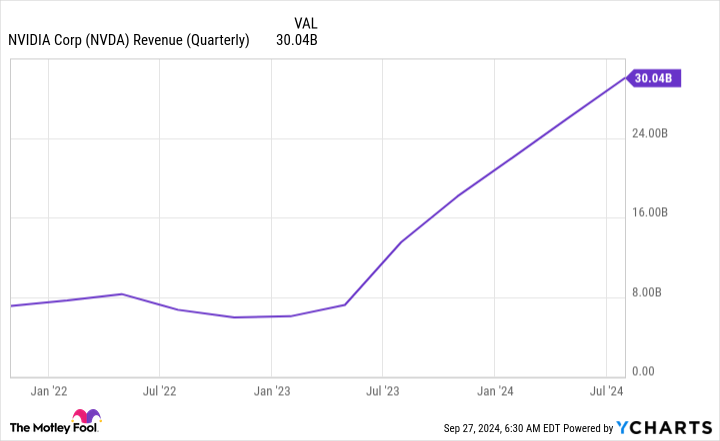

Since 2023, this has led Nvidia’s revenue to skyrocket.

NVDA Revenue (Quarterly) data by YCharts.

But the growth isn’t over, and it will likely push Nvidia’s stock higher to notch a new all-time high.

Nvidia’s impressive growth is slated to continue

While the second quarter saw impressive 122% year-over-year revenue growth to $30 billion, Nvidia isn’t done yet. Management expects $32.5 billion in revenue for third-quarter fiscal year 2025 (ending around Oct. 31). This would indicate revenue growth of 80%. Nvidia’s revenue growth is slowing, as it’s starting to come up against quarters where revenue was higher. But, with revenue projected to grow at a quarter-over-quarter pace of 8%, it’s still seeing strong demand.

Q3 isn’t the end for Nvidia, either. For FY 2025, Wall Street analysts project an average of $125.5 billion in revenue. If Nvidia hits Q3 expectations on the nose, that would indicate fourth-quarter revenue should be around $37 billion — a further healthy increase from previous quarters’ levels. That growth will extend into FY 2026 as well, according to analysts. They think Nvidia will produce revenue of $178 billion, which would be massive 42% growth.

Should Nvidia hit that target and maintain its current 55% profit margin, it would produce a net income of $97.9 billion. If all those projections are hit and the stock price doesn’t move, Nvidia’s stock would trade for 31 times trailing earnings at the end of FY 2026.

Although 31 times earnings may sound expensive, it’s unlikely that Nvidia would trade at that low a level, considering that the company would likely still be growing at a strong pace at that time.

So, whether it is in one week, one month, or a year from now, Nvidia is likely heading for a new all-time high. With strong future prospects, Nvidia looks like it could be a buy again, but with high expectations already built into the stock, don’t expect it to double anytime soon. Instead, Nvidia should be looked at as a stock that can consistently beat the market by outperforming it by a few percentage points each year.

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.