Apple is beefing up the software services on its phones in hopes of getting more buyers.

It’s that time of year again. The leaves are beginning to change, and just like every September of the last decade, Apple (AAPL -0.12%) has hosted an event to announce its new iPhone. The iPhone 16 will have four different pricing tiers and is loaded with new artificial intelligence (AI) features.

We are entering the age of AI-powered iPhones. What does that mean for Apple’s business? Should you buy the stock on an AI phone upgrade cycle? Let’s take a closer look.

The AI iPhone and a pricing power test

We all know what the iPhone is. The leading premium smartphone maker revolutionized personal computing when it launched the product over 15 years ago.

But it is not hard to argue that the iPhones of the last five years have lacked innovation. Yes, they come in different colors (rose gold, anyone?), but the basic functionality of the smartphone has been solved. There simply isn’t anything left for Apple to do in hardware design.

Now, the company still wants to differentiate itself from other smartphone sellers. This is why in recent years it has pushed aggressively on the software side of things. It offers customers Apple Health, iCloud, and other software products as reasons to buy the iPhone over competitors. They are useful tools that lock customers in from switching to competitors, and they make Apple more money. A win for both Apple’s customers and the company.

The next step in Apple’s evolution to improve its customer value proposition might be AI. The iPhone 16 (as well as a few older models) will come with increasing AI updates to its software kit.

These include an image search product, ChatGPT integrations, and a (hopefully) reinvigorated Siri. This will allow users to have conversational search with AI, search images, and give voice commands. If these products are actually useful like the company claims, it will be a big increase in the value proposition for a new iPhone.

Which brings us to the important topic: upgrade cycles and pricing power. The cheapest new iPhone costs $800, with the highest at $1,200. Apple has embraced higher prices for its phones as fewer and fewer people upgrade every year. If customers are clamoring to get their hands on these new software tools, it could lead to increased upgrades and higher sales for Apple.

The fundamentals need a momentum builder

Apple is looking to get a boost from AI tools — and, boy, does it need it right now. With a slowing upgrade cycle and slowing consumer spending in markets like China, the company’s revenue has stagnated in recent years. Trailing-12-month revenue is actually down from 2022.

The financial fundamentals for Apple could use some momentum. But will AI be the catalyst? I have some doubts and think Apple might be behind in AI software.

First, it is turning to OpenAI and ChatGPT to power its conversational language model. Second, a lot of these announced tools are not coming right away to these new iPhones but are slated to come within the next 12 months. That means the developers are behind.

Lastly, it doesn’t seem like hardware is an advantage when it comes to AI — everything is run in the cloud. Anyone with a strong internet connection can run the latest products from OpenAI or Alphabet‘s Google. All of the products Apple has planned to launch are already offered by Google.

People might still buy the iPhone because they love the Apple brand and want to upgrade their phones. But I don’t think it will be because of some commoditized AI tools.

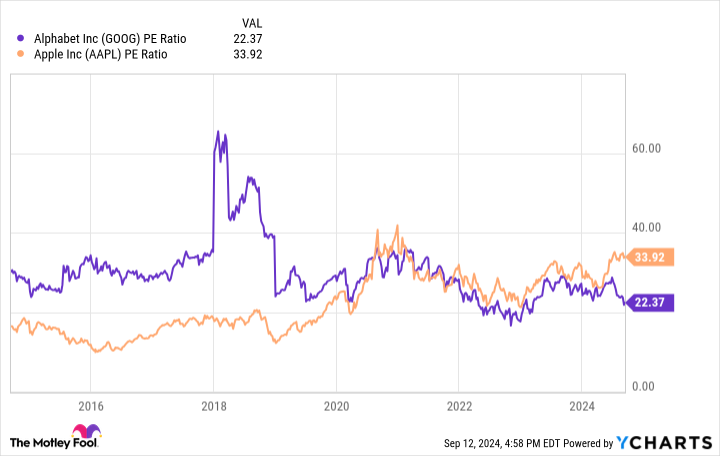

GOOG PE ratio data by YCharts.

Time to buy Apple stock?

At today’s price, Apple trades at a price-to-earnings ratio (P/E) of 34. This is higher than the S&P 500 index average of 29 right now.

Clearly, investors are betting that Apple’s new AI iPhone will reinvigorate sales and lead to earnings growth. If you believe in this thesis, now could be a time to buy the stock. Because if sales keep stagnating, the stock will not do well starting at a P/E of 34. Perhaps this is why Warren Buffett is unloading his Apple position right now.

I’m in the camp that thinks AI is not material for Apple. It is not a leader in this field, and never has been. Just because you launch products that a user can find through an internet search (and access mostly for free) on Google and OpenAI does not mean more people will suddenly want to spend $1,000 on a phone.

At a much cheaper P/E and with faster revenue growth, I would bet on Alphabet stock right now over Apple. The valuation looks much more attractive.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Brett Schafer has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet and Apple. The Motley Fool has a disclosure policy.