(Bloomberg Opinion) — A young labor force, a real estate boom, a politically stable Communist-led country that can reap riches through exports and a friendly relationship with the U.S. — many have compared Vietnam to what China was more than two decades ago. Add one more trait to this mix as we enter the 2020s: profitless prosperity.

With Vietnam quickly moving up the global supply chain, the Southeast Asian nation has been hailed as the biggest winner out of the current U.S.-China trade spat. High-profile relocations underscore the point. Alphabet Inc.’s Google is shifting production of Pixel smartphones, while Samsung Electronics Co. has closed its last smartphone plant in China. Even Chinese companies, such as Goertek Inc., supplier of Apple’s popular AirPods earphones, are moving. It’s prime time for Vietnam in the tech world. The country also notched just under 7% growth in gross domestic product, among the fastest in the world.

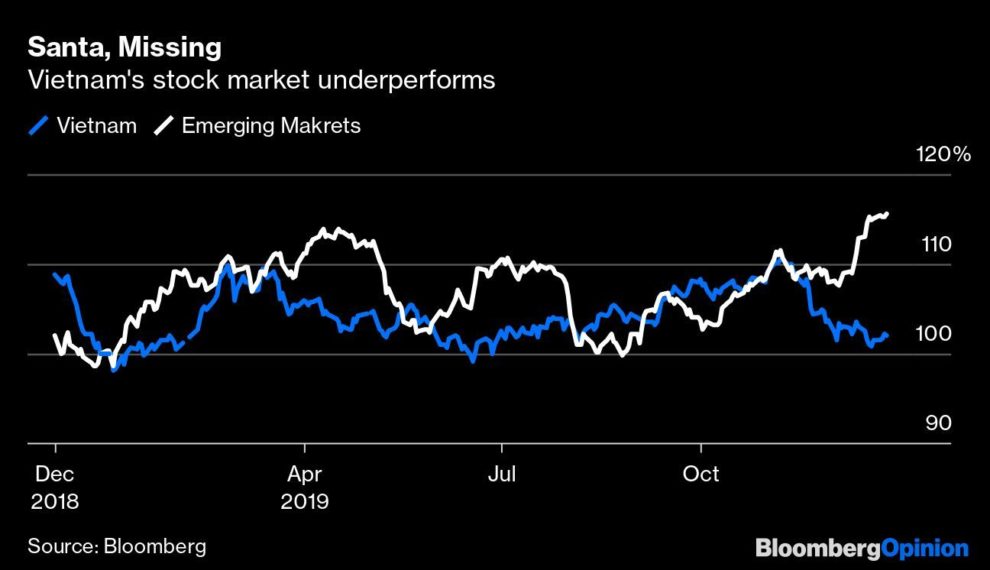

Yet such enthusiasm is not reflected in the stock market. The benchmark Ho Chi Minh Stock Index rose only 7.3% year-to-date, lagging well behind 32% gains in mainland China’s Shanghai Shenzhen CSI 300 Index. While emerging markets staged a Santa rally in December, Vietnamese stocks headed the other way.

So what’s sapping Vietnam’s bull spirit?

Exchange traded funds are becoming a major source of foreign capital, with funds tracking the benchmark index accounting for 44% of total market flow in 2019. However, take a look at what’s in the basket and one can’t help but frown. It’s a lot less shiny than the booming manufacturers. The market is dominated by banks, and just one real estate developer, Vingroup JSC. While Vingroup has edged into auto and smartphone manufacturing, its cash-cow business remains property.

With average return on equity at 15%, banks in Vietnam are an enviable bunch by any standard. But bank loans have already exceeded the country’s GDP level, high for a nation that earns only about $2,500 per capita. So the banks need to raise capital to buffer against bad debt in the future. Roughly half of local banks are unable to meet the minimum 8% capital adequacy ratio, Fitch Ratings has warned.Capital-raising is difficult even if outsiders are keen to buy, because the government imposes strict 30% foreign ownership limits on its banks. Without lifting the cap, there are only two outcomes for the sector: Either follow China’s lead into a debt crisis, or scale back corporate lending. Neither is good news for investors.

Vingroup and its subsidiaries, which account for almost 15% of the index, are also problematic. Land has become scarce — it’s difficult to find large parcels in the megacities of Hanoi and Ho Chi Minh City. As such, the government has slowed approving new projects, sapping growth potential for developers.

The shortage of land and the overlapping listings between Vingroup and its components make it difficult for a portfolio manager to argue for having so much of Vingroup in her basket. If she wants exposure to the real-estate scene, she can just buy into residential developer Vinhomes JSC, which in any case accounts for two-thirds of the parent’s revenue. Or, for Vingroup’s retail mall operations, the Vincom Retail JSC unit is up for grabs. Why should anyone own Vingroup twice? The ultimate culprit is the onerous foreign-ownership regime. High-quality stocks have already hit their quota, and foreigners are paying significant premiums trading with each other. Because of the liquidity issues, these stocks are given tiny weights by index providers. What’s left on the benchmarks are leftovers that no one wants.

In this sense, Vietnam is indeed becoming the next China, sowing the seeds of an unhealthy stock market dominated by debt-ridden banks and devoid of New Economy technology stocks. While the country doesn’t lack admirers, its economy will inevitably slow. When that time comes, banks will need more capital and start-ups will want to go public.

By then, no one will be interested in a broken system, as China well knows. So before outsiders lose appetite, it’s time Vietnam removes protectionist policies and opens its economy for real.

To contact the author of this story: Shuli Ren at [email protected]

To contact the editor responsible for this story: Patrick McDowell at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Shuli Ren is a Bloomberg Opinion columnist covering Asian markets. She previously wrote on markets for Barron’s, following a career as an investment banker, and is a CFA charterholder.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”62″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.