After Tiger Woods completed one of the greatest comebacks in sports history with his fifth Masters victory on Sunday, sponsors that placed big bets on his revival joined him in basking in the glory.

Nike NKE, +1.14% was quick to post an ad that went viral, and its shares followed with a Monday nudge higher. Bridgestone, whose logo adorned the balls used by Woods, said website traffic soared and weekend sales surged 50% from a year ago.

Pretty much everything golf-related was feeling bubbly.

“Tiger Woods is synonymous with modern-day golf, and his success tends to have positive impacts across the broader golf industry, with the industry’s success in the early-2000s almost explicitly linked to his success and popularity,” KeyBanc analyst Brett Andress wrote in a note to clients.

The impact was felt beyond the golf industry, too.

Monster Beverage MNST, -0.13% paid for a valuable piece of real estate on Woods’s golf bag, and all that final round attention gave the company almost a million-dollar boost in brand exposure, according to Apex Marketing.

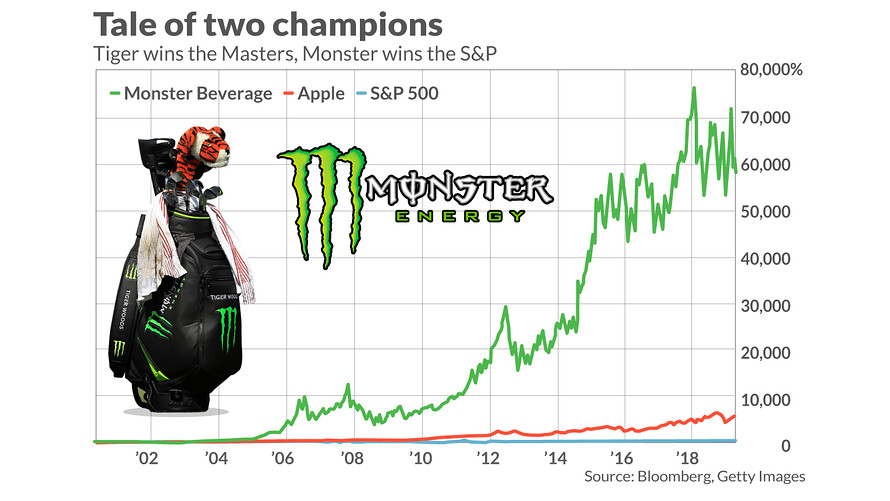

Shares of the energy-drink maker also got a nice push after the win, but the 2% pop barely registered in the bigger picture. After all, the stock has soared almost 60,000% since 2000, according to Bloomberg, making it the best-performing stock in the S&P 500 SPX, +0.10% this century.

Monster’s ferocious rally has been propelled by a steady diet of earnings growth every quarter dating back to 2008 along with annual revenue growth that hasn’t fallen short of 9% since the bursting of the dot-com bubble in 2001.

Still, the Tiger push, however short-lived, was timely for Monster shares, which have slid almost 20% in recent weeks. Wall Street has been struggling over whether Monster is in the process of getting disrupted by the competition from Bang and others or just dealing with temporary pains.

“While we believe Monster’s move into the performance energy segment will support an improved topline trend, it won’t be enough to sustain the top and bottom line growth of recent years,” UBS analyst Sean King, who has a sell rating on the stock wrote in a recent note. “Results and sentiment will continue to be pressured.”

Monster investors are hoping the company handles that pressure like the man they sponsored in Augusta over the weekend.