AMC Entertainment Holdings Inc.’s first-quarter results given analysts reason for optimism regarding the movie theater industry’s recovery, but most analysts believe the stock price is still way too high to recommend buying.

The stock AMC, -5.43% dropped 5.4% to close at a one-year low of $11.84 on Tuesday, reversing an intraday gain of as much as 11.9%. The stock has plunged 24.7% amid a four-day losing streak.

AMC reported late-Monday a first-quarter loss that was wider than expected but revenue that rose more than fivefold to exceed forecasts, as growth in admissions revenue outpaced the rise in food and beverage revenue.

Don’t miss: After 80% plunge from peak, AMC stock bounces back slightly as revenue beats expectations.

And Chief Executive Adam Aron was upbeat about the coming slate of blockbuster movies, including “Top Gun: Maverick,” “Jurassic World Dominion,” “Black Panther: Wakanda Forever” and “Avatar 2.”

MKM Partners analyst Eric Handler said the box office should improve this year and AMC’s new initiatives, such as the rollout of the delivery and off-premise popcorn offering, are progressing. However, even with the stock trading about 81% below the June 2, 2021 record close of $62.55, he said valuation remains “irrational.”

Handler reiterated the sell rating and $1 stock price target he’s had on the stock since February 2021.

“[W]e remain concerned about the slower-than-anticipated pace of the theatrical industry’s overall recovery, most notable a 30% decrease in content volume attributed to the lack of mid-level movies,” Handler wrote in a note to clients. “In addition, specific to AMC, it could take many years for the company to grow into its capital structure, which has seen a 400% increase in shares outstanding since the start of the pandemic along with its sizable $5.57 [billion] of debt.”

The increase in shares outstanding resulted from the company taking advantage of the “meme-stock” surge in prices to issues shares to raise money. Part of that kitty was used in the surprise investment in silver and gold miner Hycroft Mining Holding Corp. HYMC, -2.34% announced in March.

And Aron indicated on the late-Monday post-earnings conference call with analysts that “there will be more Hycrofts ahead, not gold or silver mining per se.”

Wedbush’s Alicia Reese reiterated the underperform rating she’s had on the stock since November 2021, but trimmed her stock price target to $4 from $5.

Reese expects theater attendance to “meaningfully improve” through the rest of the year, but said the AMC will have to contend with a road to recovery that is riddled with higher marketing spend, higher concession and utility costs and higher wages.

Reese believes the stock will continue to be volatile, with an “uncertain long-term multiple,” given its ownership and the possibility that at some point, AMC will launch its own cryptocurrency.

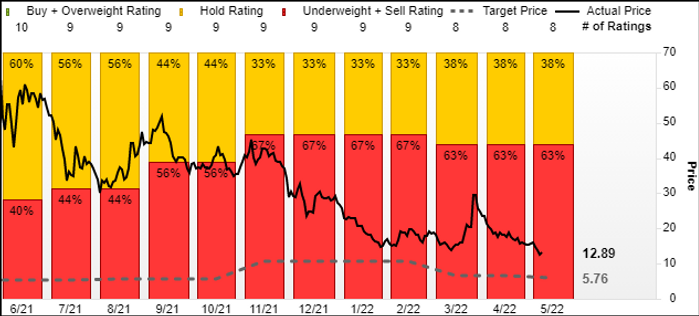

MKM’s Handler and Wedbush’s Reese are just two of five analysts, of the eight total analysts surveyed by FactSet, who are bearish on AMC. There are no bulls, as the other three analysts are neutral.

The average price target of the analysts surveyed is $5.76, or about 51% below current levels.

B. Riley analyst Eric Wold is one of the neutral analysts, and has the Street’s highest price target at $16. While that price target now implies about 35% upside from current levels, and despite a “solid” first-quarter report, an uncertain outlook keeps him from turning bullish.

“Although we are increasingly positive after the upside 1Q22 results, we are not making any meaning changes to our 2022 or 2023…estimates after taking a slightly more cautious approach to the remainder of the year as trends continue to develop and inflationary/labor headwinds persist,” Wold wrote in a research note.

Despite the stock’s plunge from its record close, it was still up 17.8% over the past 12 months, while shares of fellow meme stock GameStop Corp. GME, -5.35% have tumbled 36.4% and the S&P 500 index SPX, +0.25% has lost 3.6%.