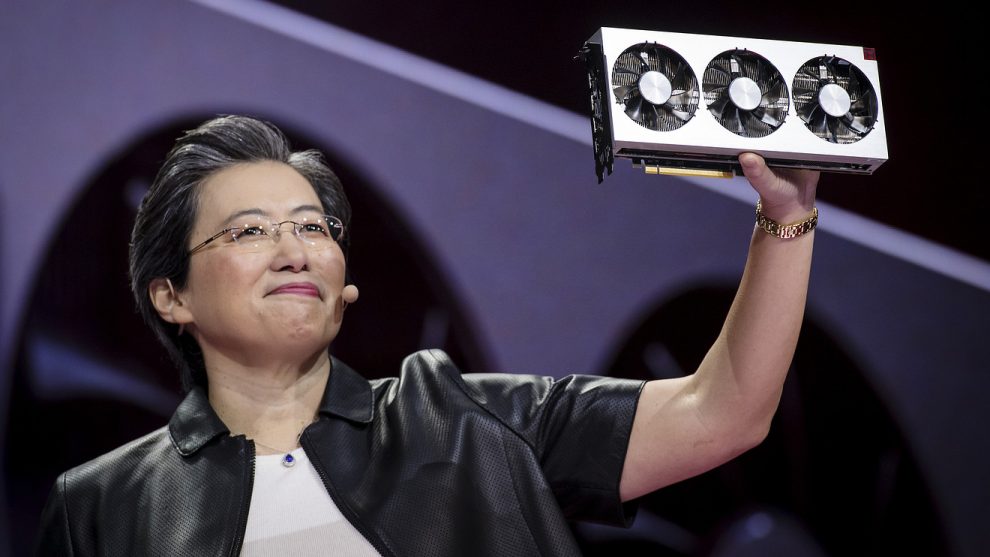

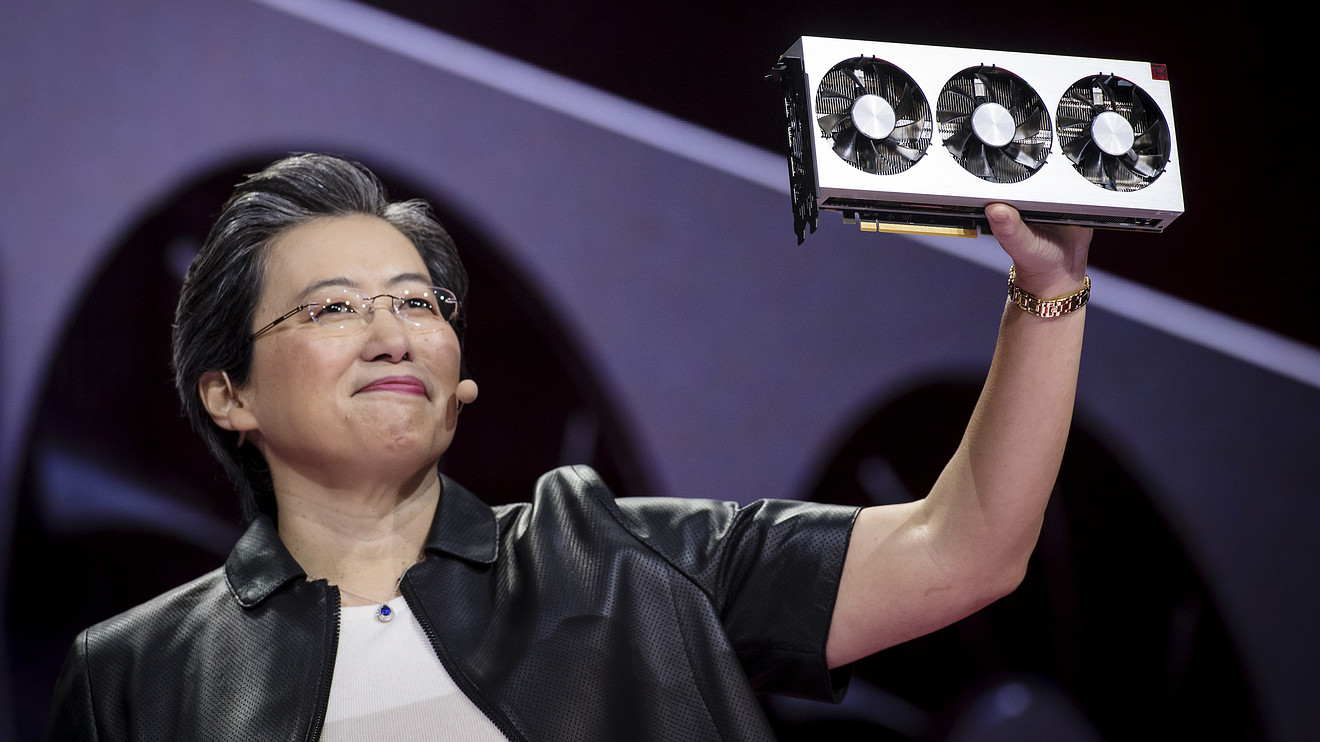

Advanced Micro Devices Inc. is causing a “major shift” in the chip landscape, and that’s one reason to own the chipmaker’s stock, according to an analyst.

Wedbush’s Matthew Bryson initiated coverage of both AMD AMD, +2.71% and rival Nvidia Corp. NVDA, +2.74% with outperform ratings on Thursday, and both stocks were heading higher during the session.

Bryson expects that AMD will be able to win market share in PC and server chips during the next few years, coming at the expense of Intel Corp. INTC, -1.39% which he rates a sell in part due to continued execution issues.

“Moreover, we expect AMD will also realize some more modest benefits on the GPU side from its transition to leading TSMC nodes, with AMD’s GPU (and custom ASIC) business also poised to benefit from a resumption of more normalized channel sales (2H19), sales into Google Stadia, console transitions (2020), and a recently signed agreement with Samsung to share and license intellectual property,” he wrote.

Read: Investors should ‘tread somewhat lightly’ on Nvidia shares, says Bernstein

On Nvidia, Bryson is upbeat about the company’s recent acquisition of Mellanox, which has a strong position in high-speed network interface cards (NICs), which Nvidia can now leverage.

“As we believe Mellanox only booked about $130 million in NIC Ethernet sales in CQ418 (due to the downturn in hyperscale spend), we believe at least 50% overall growth over the next few (2-3) years is probable with 100%+ growth possible for Mellanox in this market,” he wrote.

Opinion: Micron investors may be too hopeful that the end of the downturn is near

Bryson set a $184 price target on Nvidia shares and a $35 target on AMD shares. Nvidia’s stock has climbed 22% so far this year, while AMD shares have jumped 66%. The PHLX Semiconductor Index SOX, +1.54% is up 26% on the year, compared with a 17% rise for the S&P 500 SPX, +0.46%