Shares of Advanced Micro Devices Inc. rallied to uncharted territory Thursday, after Mizuho analyst Vijay Rakesh said he’s bullish on the semiconductor company again, citing expectations of server market-share gains.

Rakesh raised his rating to buy, after being at neutral since July 2019. He lifted his stock price target to $55, which is about 10% above current levels, from $38.

The chipmaker’s shares surged 4.4% in active morning trading, enough to pace all of the PHLX Semiconductor Index’s SOX, +0.61% gainers. AMD’s stock AMD, +3.93% reached an all-time intraday high of $49.96 earlier in the session, and was above the Jan. 2 record close of $49.10.

Trading volume swelled to 31.9 million shares, making the stock the most-actively traded on major U.S. exchanges.

Rakesh said the 2020 server market could be “stronger than muted consensus,” as prices could stabilize as most of the aggressive price cuts by AMD’s chief rival Intel Corp. INTC, +0.20% are now in the past. It was Intel’s price cuts and valuation concerns that had prompted Rakesh to downgrade AMD to neutral from buy in July.

Don’t miss: Opinion: AMD outshines Intel at CES 2020 as chip makers’ traditional roles remain reversed.

Also read: AMD stock finally breaks its dot-com-era record high.

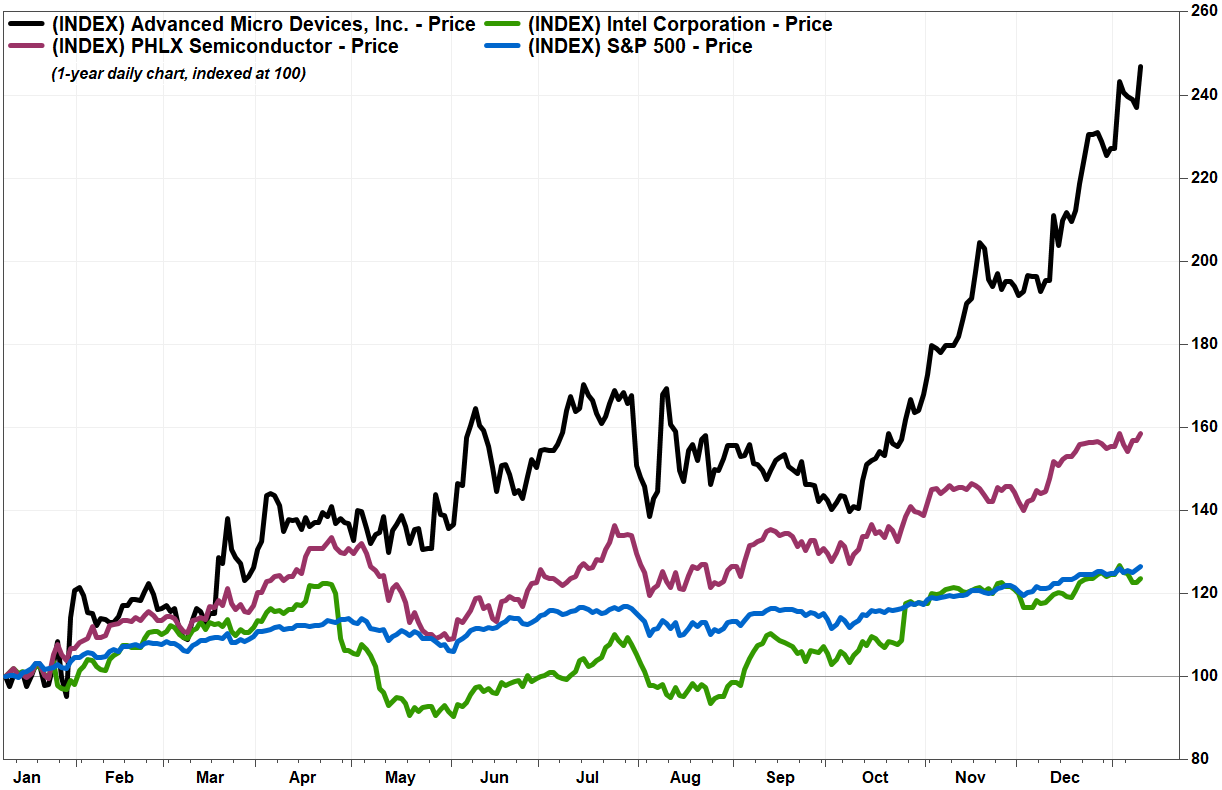

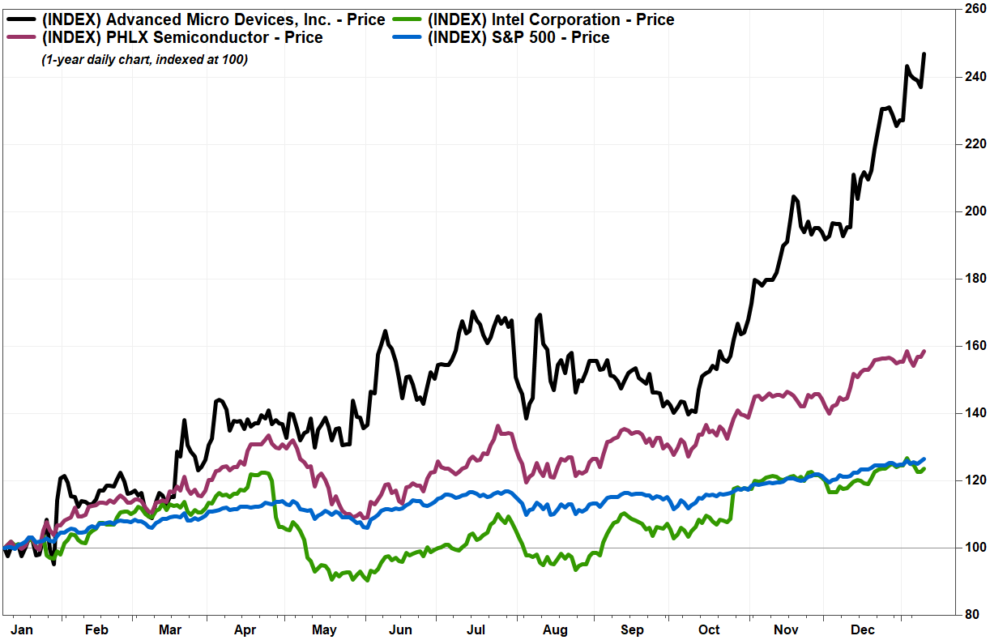

FactSet, MarketWatch

FactSet, MarketWatch Rakesh said his research suggests potential Intel delays in the 10 nanometer Ice Lake single-server market, which he estimates to be about 15% to 20% of the server market.

“The potential ramp delays in a key single socket segment of the market could allow AMD to win market share,” Rakesh wrote in a note to clients.

While AMD could face some headwinds in the graphics processing unit (GPU) market, given new cloud gaming services like Google Stadia, Rakesh said he believes AMD should keep seeing strength in PC gaming and growth in esports.

In addition to PC gaming, new console launches from Microsoft Corp. MSFT, +1.12% and Sony Corp. SNE, +1.30% 6758, +1.88%, estimated in the fourth quarter of 2020, “should position AMD for a good [second-half of 2020] pickup as both Xbox Series X and PlayStation 5 are…using AMD GPUs,” Rakesh wrote.

AMD’s stock has rocketed 147% over the past 12 months to make it the best performer among the S&P 500 index’s SPX, +0.58% components over that time. In comparison, Intel shares have gained 23%, the semiconductor index has rallied 59% and the S&P 500 has advanced 27%.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>

Add Comment