With more people expected to stay home to track the U.S. 2020 presidential election and the summer Olympic Games in Tokyo, pizza delivery chains like Domino’s Pizza Inc. and Papa John’s International Inc. are top restaurant picks for analysts from BTIG.

“As we saw the last time around in 2016, we believe these events could present a significant distraction from restaurant visits, which has negative implications for most of casual dining given their dependence on in-restaurant sales,” wrote analysts led by Peter Saleh.

The summer Olympics in Tokyo will take place in late July.

“We expect the 13-to-16 hour time difference to drive an increase in late-night pizza delivery from national chains to accommodate viewing,” BTIG said.

Papa John’s PZZA, +0.68% is also in the midst of a turnaround that includes new leadership in Chief Executive Rob Lynch, and a new spokesperson, former NBA star Shaquille O’Neal.

In addition to expected menu innovations and marketing, BTIG thinks there’s room for growth through improved efficiencies, better margins, and more beneficial insurance costs for Papa John’s corporate stores.

Read: 4 things to watch for in retail in 2020

Papa John’s stock is rated buy with a $75 price target, up from $67.

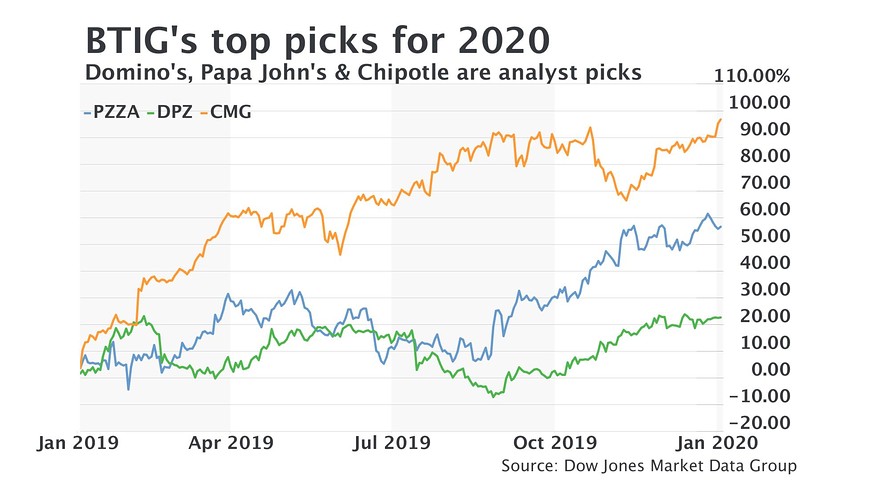

BTIG has rated Domino’s DPZ, +0.43% a “Top Pick” for years due to its skyrocketing stock movement and domestic system sales, which have increased 46% since 2015.

Total annual sales have risen from $2.79 billion in 2017 to $3.43 billion in 2018. Sales are forecast for $3.59 billion in 2019, according to FactSet.

Domino’s stock has gained 22.4% over the last year.

BTIG expects low-single-digit same-store sales growth for Domino’s domestically, with a boost from new menu items and new technology, the GPS tracking on deliveries.

“We believe such a product introduction could reignite order growth and be a catalyst for stronger comparable sales as the year progresses,” analysts said.

Domino’s is rated buy with a $325 price target.

BTIG also chose Chipotle Mexican Grill Inc. CMG, +0.81% as a “top pick” for a second year.

Dow Jones Market Data Group

Dow Jones Market Data Group “Menu innovation remains a considerable driver, building on the success of carne asada with Thursday’s introduction of a Supergreens salad mix, digital and loyalty continue to ramp significantly, and operating efficiencies remain to be found,” analysts said.

“We believe digital engagement is becoming as important to the Chipotle story today as food with integrity has been for the past fifteen years.”

Chipotle is rated buy with a $1,010 price target, up from $890.

See: Chipotle menu relaunch will help extend sales momentum into 2020

RBC Capital Markets is also bullish on Domino’s Pizza, rating the stock outperform with a $337 price target. Analysts think fast food will do well, particularly franchised names and others that have low exposure to tariff volatility, and food and labor costs.

RBC highlights McDonald’s Corp. MCD, -0.35% and Burger King parent Restaurant Brands International Inc. QSR, -0.40% for their global scale; Starbucks Corp. SBUX, -0.58% and Domino’s for their leading positions in their respective categories; and Olive Garden parent Darden Restaurants Inc. DRI, +0.11% for its segment leadership in casual dining.

Don’t miss: Olive Garden’s ‘Lasagna Mia’ misstep drives down same-store sales growth

RBC rates all those names outperform.

Analysts have also been bullish lately about Wingstop Inc. WING, +4.34% On Friday, the chicken chain was upgraded to outperform at Wedbush, and last month it was added to the Goldman Sachs “Conviction List.” Both research groups cite same-store sales drivers for their upbeat analysis. FactSet forecasts 10.2% same-store sales growth in the fourth quarter.

The Invesco Dynamic Leisure & Entertainment ETF PEJ, -0.70% has gained 14.6% over the past year while the S&P 500 index SPX, -0.71% is up 32.4% for the period.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>