Shares of Dow Inc. took a dive Friday toward a five-month low, after BofA Securities analyst Steve Byrne turned bearish, relative to other chemical companies, citing the belief that “the top is near” in polyethylene markets.

The downgrade comes about a week before the company is scheduled to report second-quarter results.

The stock DOW, -2.97% sank 2.8% in midday trading, enough to make it the worst performer among the Dow Jones Industrial Average’s DJIA, -0.28% components. The selloff put the stock on track for the lowest close since Feb. 26.

BofA’s Byrne downgraded Dow to underperform from neutral, saying further multiple expansion may be difficult in a backdrop of declining underlying margins.

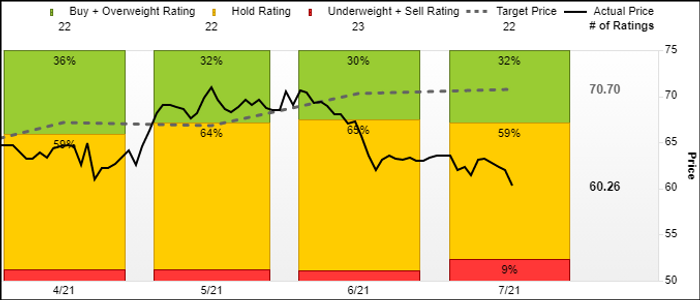

That puts Byrne in rare company, as only two of the 22 analysts surveyed by FactSet have the equivalent of sell ratings, while 13 are at hold and seven are at buy.

He also cut his price target for the stock to $68, which is about 13% above current levels, from $71. In comparison, Byrne’s target on buy-rated Olin Corp. OLN, -0.44% implies 35% upside.

“While current prices reflect upside to our new [price objective], we do believe that other shares will outperform Dow in a reflation environment, and see risks to other business, such as acrylics and siloxanes, where margin pressures are possible,” Byrne wrote in a note to clients.

Dow is scheduled to report earnings on July 22, before the market opens. The current FactSet consensus calls for a swing to earnings of $2.36 a share from a loss of 26 cents a year ago, while revenue is expected to jump 56.5% to $13.07 billion.

Byrne is not particularly positive on the stocks of other chemical companies ahead of second-quarter results.

“We see risk reward as fairly unfavorable approaching 2Q earnings,” Byrne wrote. “Expectations are high across the Street, while top line growth and commodity margins may be at peak levels.”

He also downgraded LyondellBasell Industries NV LYB, -4.59%, from neutral to buy, and double downgraded Westlake Chemical Partners LP WLKP, -0.30% to underperform from buy. Meanwhile, Byrne upgraded Olin to buy from neutral and Westlake Chemical Corp. WLK, -2.72% to neutral from underperform.

While Byrne expects Dow to underperform its peers, he believes the downside is potentially limited, given the upbeat outlook for the economy and as the dividend yield can be viewed as defensive.

At current prices, Dow’s annual dividend rate of $2.80 implies a dividend yield of 4.64%, compared with the yield for the SPDR Materials Select Sector exchange-traded fund XLB, -0.98% of 1.64% and the implied yield for the S&P 500 index SPX, -0.22% of 1.36%, according to FactSet.

Dow’s stock has gained 8.4% year to date, while the materials ETF has advanced 12.9% and the Dow industrials has climbed 14.1%.