Shares of General Electric Co. ran up toward a near three-year high, after UBS analyst Markus Mittermaier said rising interest rates and the COVID-relief bill are reasons to get a little more bullish on the industrial conglomerate.

Mittermaier raised his price target to $15 from $14, while reiterating the buy rating he’s had on the stock since December 2019. The new target would make Mittermaier the second-most bullish on GE of the 21 analysts surveyed by FactSet, behind just Global Equities Research’s $21 target.

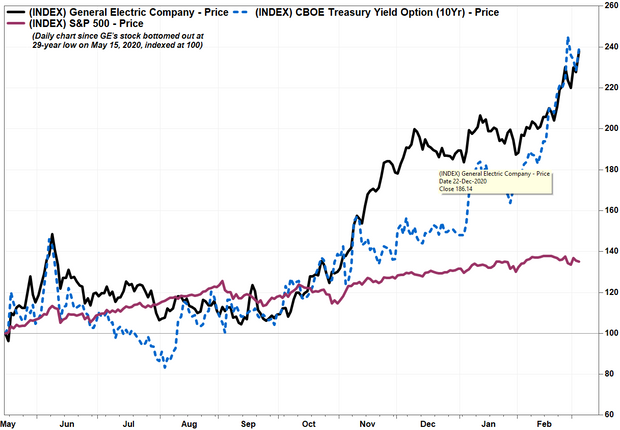

GE’s stock GE, +4.51% rose 4.1% in afternoon trading, putting them on track to close at the highest level since July 2018. It has gained 27.5% over the past three months, and 146.1% since May 15, 2020, when the stock closed at $5.49, the lowest price since December 1991.

Mittermaier’s increased bullishness isn’t because of an improved outlook for GE’s businesses. He believes there are three “material drivers” that could benefit GE by potentially reducing its unfunded pension liability.

First, he said the COVID-relief bill recently passed by the House of Representatives included extending amortization of pension shortfalls to 15 years from seven years, as well as stabilizing assumptions for interest rates.

“We believe the latter could mean that Erisa [Employee Retirement Income Security Act of 1974] funding requirements in the GE Pension Plan could be pushed further into the future, potentially significantly beyond the currently guided prefunding to 2023, [other things being equal],” Mittermaier wrote in a research note for clients.

Second, every 25 basis point (0.25 percentage points) increase in the discount raised used to value future payments reduces pension obligations by about $2.4 billion, Mittermaier said. His analysis shows that net-debt contribution from unfunded pension liabilities should come down by about $3 billion this year.

Although the Federal Reserve has indicated it will not raise its target for overnight interest rates any time soon, the yield on the 10-year Treasury note TMUBMUSD10Y, 1.469% was at 1.477% Wednesday, up from 0.917% at the end of 2020 and more than double the 0.622% yield six months ago. See Bond Report.

Third, Mittermaier said he believes GE will proactively lower its pension liabilities further, as they are “clearly an overhang” to the companies balance sheet, free cash flow and earnings per share (EPS). He noted that GE has already started to de-risk its pensions, by freezing defined-benefit plans and through lump-sum settlements.

Read more: GE freezing pensions for 20,000 employees.

Removing the pension overhang would be “good optics” and would boost investor sentiment, Mittermaier said. He estimates that a complete settlement of the defined pension liability would boost free cash flow by $300 million and add 12 cents to EPS in the first year.

“We believe de-risking of pension liabilities will reduce volatility, improve the overall sentiments, along with removing cash and earnings drag, which can provide further upside to the stock,” Mittermaier wrote.

GE’s stock has rallied 24.2% over the past 12 months, while the SPDR Industrial Select Sector exchange-traded fund XLI, +1.09% has climbed 26.8% and the S&P 500 index SPX, -0.39% has hiked up 28.3%.