Shares of Hertz Global Holdings Inc. surged Monday after JPMorgan recommended investors buy, citing strong industry tailwinds and a number of company-specific drivers that make the car rental company more attractive than its close peer, Avis Budget Budget Group Inc.

Analyst Ryan Brinkman at JPMorgan initiated Hertz at overweight and set a $30 stock price target, which implies about 16% upside from current levels.

The stock HTZ, +7.92% ran up 7.8% in afternoon trading. It has slipped 0.9% since it closed its first day trading on the Nasdaq exchange on Nov. 9 following its emergence from bankruptcy on June 30.

Brinkman gave a number of reasons for his bullish stance on Hertz:

- “A number of very strong industry and macro tailwinds,” including the “unprecedentedly strong” used vehicle pricing backdrop and supply/demand imbalance affecting rental cars, both with are products of the pandemic and its aftermath.

- The above tailwinds are expected to “subside only gradually” over the next 12-to-18 months, as there is no quick or easy solution to the global semiconductor shortage that is holding back light vehicle production.

- “A multitude of recently announced company specific initiatives,” including new partnerships with American Express Co. AXP, +3.40%, Tesla Inc. TSLA, -0.98%, Uber Technologies Inc. UBER, +6.33% and Carvana Co. CVNA, +1.06%. Those initiatives should help mitigate the eventual subsiding of macro tailwinds.

- “A fully refreshed post-bankruptcy capital structure,” which features less corporate debt and substantially more liquidity, which reduces risk.

- “What we see as relative value in comparison to shares of close peer Avis Budget,” which also benefits from the same macro factors as Hertz but trades at a “materially higher” valuation multiple.

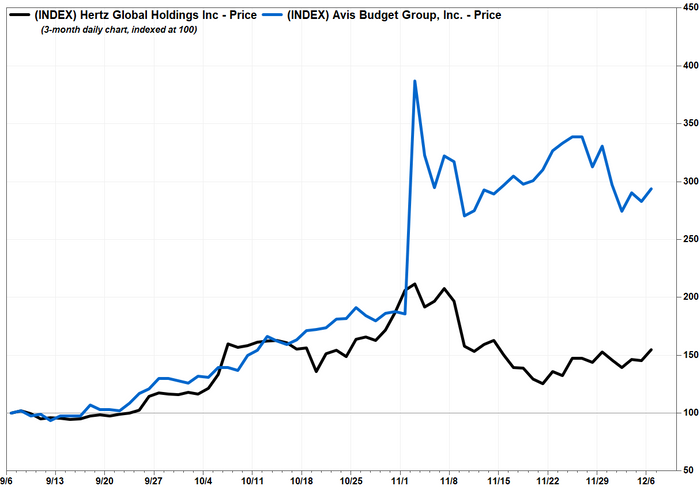

Hertz’s stock has soared 56.6% over the past three months, including the time when it traded over the counter. But Avis Budget shares CAR, +2.71% have nearly tripled over the same time, rocketing 194.4%, after they got the meme treatment in the wake of strong third-quarter results, which followed a big jump in bearish bets on the stock. For context, the S&P 500 index SPX, +1.24% has edged up 1.6% the past three months.

Brinkman rates Avis Budget at underweight with a price target of $225, which is 17% below current levels.

Brinkman wasn’t the only analyst with a bullish call on Hertz on Monday. Deutsche Bank’s Chris Woronka reinstated coverage, following a period of restriction, with a buy rating and $34 stock price target.

That target, which implies 31% upside from current levels, makes Woronka Wall Street’s most bullish analyst on Hertz of the seven analysts surveyed by FactSet who cover the company.

Woronka said his buy rating was a “relative valuation call, above all else,” as he rates Avis Budget at sell.

“In our view, the current valuation gap between the two companies is illogically wide,” Woronka wrote.

Woronka said that while Hertz recently announced a $2 billion stock repurchase program, which at the time it was announced represented about 18% of the company’s market capitalization, he believes it is “highly unlikely” that Avis Budget is currently buying back stock given how much prices have run up following third-quarter results.

“Our sense is that it will likely take some time for many investors to re-engage on the [Hertz] story, given that the stock was trading off of the major exchanges for nearly 18 months and the company was unable to be visible with the investment community,” Woronka wrote. “That said, the potential ability to broaden out the investor base in light of a larger market cap and forward-looking growth initiatives that can appeal to multiple investor groups, should be viewed as a positive catalyst.”