Netflix Inc. shares gave up early gains Wednesday, as investors digested its weaker-than-expected guidance for the second quarter and shrugged off mostly bullish notes from analysts.

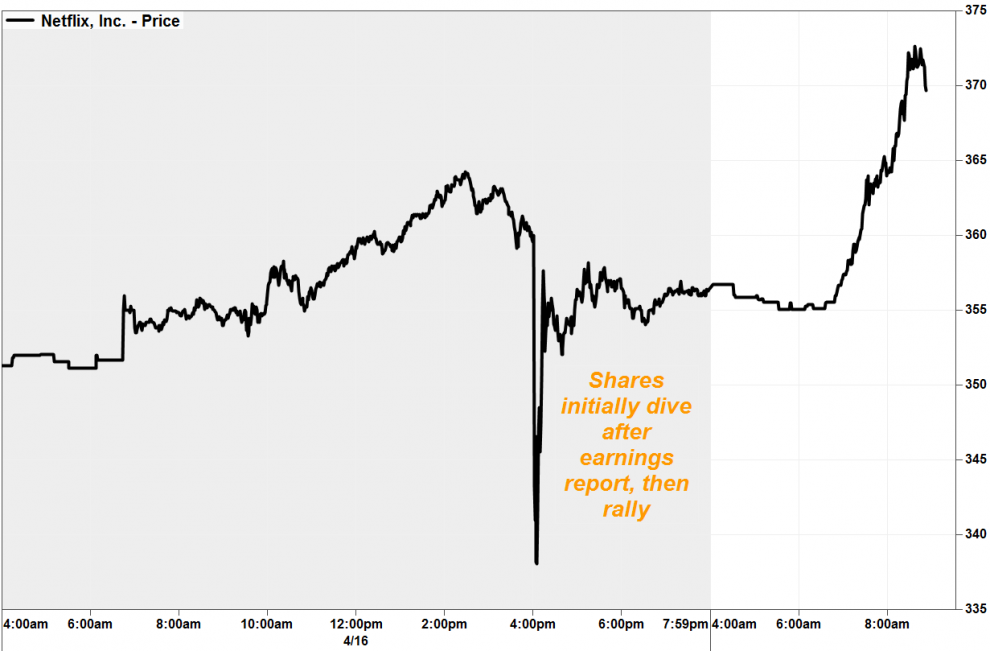

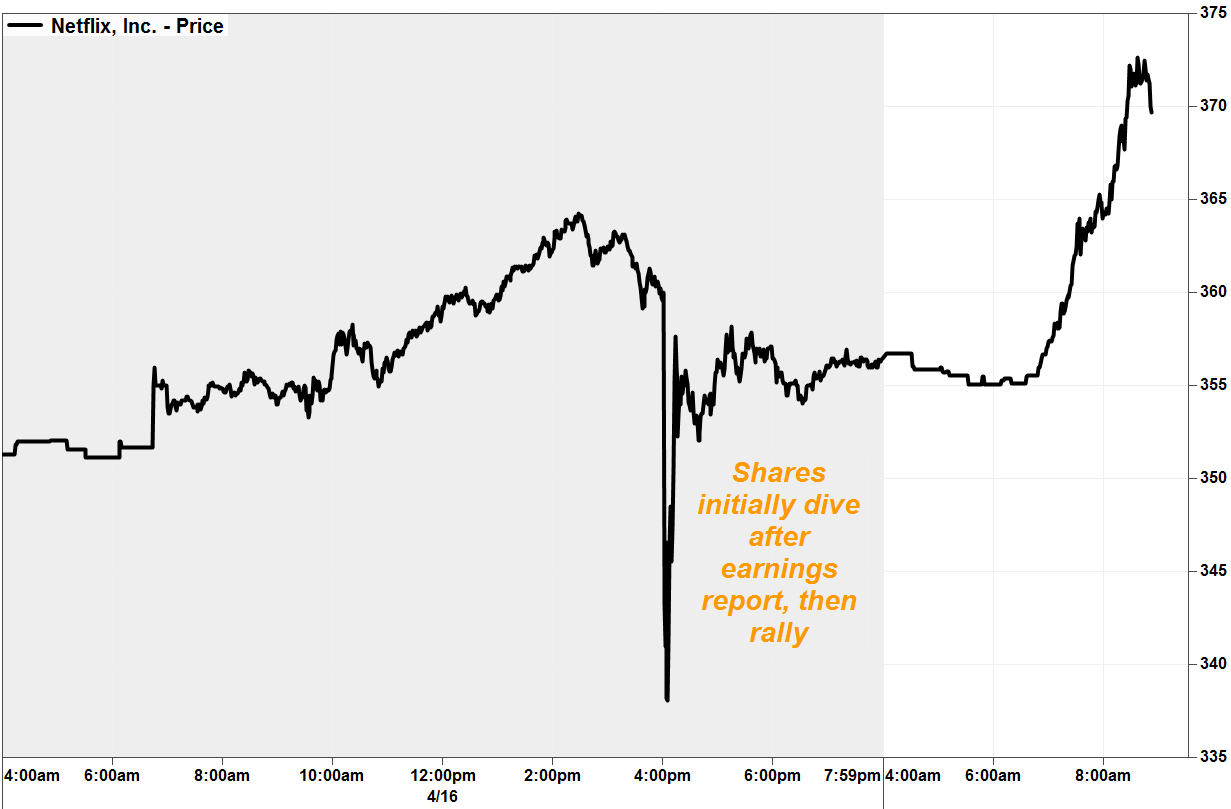

The stock NFLX, -1.17% took a dive in after-hours trade Tuesday, falling as much as 5.9%, after the company reported a record number of paying subscribers in the first quarter, but offered guidance for the second quarter that was below expectations.

Ahead of Wednesday’s open, the stock had reversed course to surge 3.3%. It was last down 1.2%.

JPMorgan analysts led by Doug Anmuth said while some were likely disappointed by the guidance, “we think there’s much more to like here than not.”

Analysts cited better-than-expected first-quarter paid net additions of 9.6 million and operating margins of 10.2% that beat the 8.9% consensus on lower-than-expected marketing costs, among other positives. Margins should move higher through 2019, even though some marketing spend has been shifted to later in the year, they wrote in a note to clients.

Netflix guided up its first-half paid net additions to 7% thanks to price increases and it said it expects to attract more new subscribers in 2019 than 2018, they wrote.

FactSet, MarketWatch

FactSet, MarketWatch

Read now: Netflix promises more information on what people are watching

See also: How the Disney-Netflix streaming war will create collateral damage

The second half will benefit from a strong slate of series and films, including the next series of “Stranger Things,” “Orange is the New Black,” “The Crown”and “Money Heist,” as well as Martin Scorcese’s “The Irishman,” said the note.

The news that more than 52 million subscribers watched “Triple Frontier,” a big-budget action film starring Ben Affleck, in its first four weeks is another positive.

“Importantly, we believe Netflix’s local content continues to travel well, incl. Kingdom, Netflix’s first large scale Korean original, which did well throughout Asia,” the analysts wrote.

JPMorgan is sticking with its outperform rating on the stock—the equivalent of buy— and raising its price target to $450 from $435.

At Stifel, analysts led by Scott Devitt reiterated their buy rating on the stock and raised their price target to $425 from $400. Investors should be comfortable with the second-quarter trajectory, they wrote in a note, after the company’s first-quarter beat and the news that it expects only short-term churn as a result of U.S. price increases and more planned for Brazil, Mexico and Germany.

“The company did bring 2019 free cash flow burn expectations down to -$3.5B, though the drivers (higher near-term cash taxes and real estate acquisitions, not content related) should not set the company back from FCF improvement in 2020 and FCF profitability in several years (we expect 2021),” said the note.

At SunTrust Robinson Humphrey, analysts led by Matthew Thornton also maintained their buy rating on the stock, although they said their model is under review. Netflix is gearing up for a strong third quarter and fourth quarter, they wrote, given the shift of some shows that were expected to be released in the second quarter.

SunTrust is unfazed by the pending competition from Disney Co. DIS, +1.42% and Apple Inc. AAPL, +1.95% both of which are releasing their own streaming services this year, which Netflix Chief Executive Reed Hastings said he does not expect to materially affect growth.

“Interestingly, regarding content, 10 of the top-10 and 21 of the top-25 series on the platform (in terms of viewership) are first-run Netflix originals/exclusives,” they wrote. “ Further, Disney + Fox + Warner + Universal T, -0.40% collectively account for a minority of NFLX content spend and of viewing hours on the platform and NFLX access to this some of this content likely has a longer than appreciated tail per licensing agreements.”

See also: Disney joins Netflix and Amazon as a streaming leader with new subscription service

Wedbush analysts led by Michael Pachter remained bearish on the company, however. Netflix is facing years of substantial cash burn and is about to lose a large part of its most popular content just after implementing a price increase, they wrote in a note.

Don’t miss: Netflix is burning money and lacks a good business model, this tech investor says

“Content migration and price hikes could cause a deceleration in subscriber growth, and consistently negative FCF makes [discounted cash flow] valuation impossible,” said the note, as analysts reiterated their underperform rating on Netflix stock, the equivalent of sell.

Pachter is expecting Disney, AT&T and Comcast CMCSA, +1.07% to pull all of their content from Netflix likely by the end of 2020.

“A combination of ongoing price increases, increasing competition for both subscribers and new content, and the loss of a substantial portion of Netflix’s existing content keep us firmly in the bear camp,” he wrote.

Webush increased its price target to $183 from $165, however, to reflect an updated sum-of-the-parts valuation. The price target is 49% below the stock’s current trading level, and is one of the lowest among analysts on FactSet.

Analyst Laura Martin at Needham said she is expecting the competition from Disney, in particular, to have an impact. She is expecting the company’s Nov. 12 launch of Disney +US to be aggressively marketed and promoted and notes it’s $70 a year, or $7 a month, pricing for 100% of its Marvel, Pixar, Princess and Lucas Film movies is competitive.

“We expect US subscribers to turn off Netflix to try Disney’s new SVOD service in 4Q19 (as many Netflix subscribers do now when Hulu, CBS All Access CBS, +0.94% or HBO Go have new content).,” Martin wrote in a note.

A proprietary survey of 325 U.S. consumers that Needham conducted last week found 70% of those surveyed saying they currently pay for Netflix as one of 3 streaming services that they subscribe to, but only 25% expected to be paying for that number within 3 years.

“By implication, consumers are not planning to add new SVOD services, but swap between them,” said the note. “The biggest valuation downside risk is for Netflix, in our opinion, which has 60 million US subs today, especially given its premium valuation multiple.”

Netflix’s structural cost and balance sheet disadvantages compared with its deep-pocketed rivals is another risk factor, she wrote. Disney, AT&T/Warner Bros., Apple and Amazon.com Inc. AMZN, +0.47% which already has a streaming service, all reach hundred of millions of consumers in their core businesses, which will greatly reduce their customer acquisition costs.

“For both Disney and WarnerBros, those libraries were paid for 30-50 years ago, which implies higher marginal ROI (return on investment) on current content investments,” said Martin. “Additionally, their content often benefits from emotional connection to the material created during childhood (e.g., Cinderella, Snow White, Lion King, etc).”

Needham rates the stock as hold and does not calculate a price target.

Netflix shares have gained 28% in the year to date, while the S&P 500 SPX, -0.13% has gained 16% and the Dow Jones Industrial Average DJIA, +0.04% has gained 13%.