Shares of Tesla Inc. charged higher to a fourth-straight record close Monday, after even the most bearish analyst on Wall Street analyst lifted his price target following the electric vehicle maker’s blowout deliveries results.

Tesla rival Nio Inc.’s stock NIO, +22.70% also soared, in the wake of the China-based EV maker’s upbeat June sales report. Meanwhile, among other EV makers, shares of Workhorse Group Inc. WKHS, -15.78% pulled back after a record 11-day win streak and Nikola Corp. NKLA, -14.46% was headed for a fourth straight loss.

Tesla’s stock TSLA, +13.47% shot up a record $162.92, or 13.5%, to $1,371.58. The stock has soared 42.9% over the past five days, the last four of which were record closing prices.

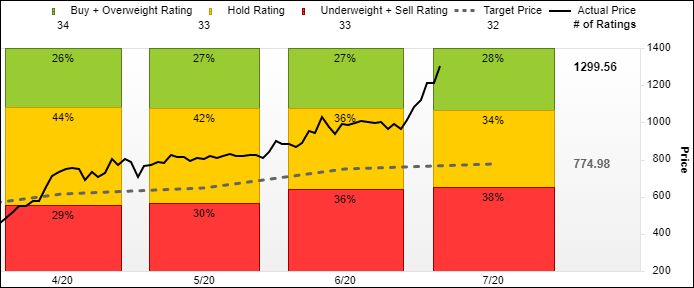

Analyst Ryan Brinkman at JPMorgan raised his stock price target by 7.3% to $295, but that was still 78.5% below current prices. Brinkman’s target remained the lowest of the 32 analysts surveyed by FactSet.

The price target increase follows Tesla’s report Thursday that it delivered 90,650 vehicles in the second quarter, well above expectations of 72,000.

Don’t miss: Tesla stock rockets higher as quarterly sales crush expectations.

See related: Some workers complain Tesla has threatened firings if they don’t return to work.

Brinkman said that the deliveries data led Chief Executive Elon Musk to imply Tesla’s second-quarter report, due out on or about July 22, could produce a surprise break-even result. But he cautioned investors that any “substantially better results” could include items that are “one-time or somewhat one-time in nature,” such as zero-emission regulatory credit sales or the release of deferred revenue associated with autonomous driving features.

Brinkman reiterated the underweight rating he’s had on Tesla for at least the last three years, citing “lofty valuation” coupled with “high investor expectations and high execution risk.”

“Our underweight rating considers notable investment positives, including a highly differentiated business model, appealing product portfolio, and leading-edge technology, which we believe are more than offset by above-average execution risk and valuation that seems to be pricing in a lot,” Brinkman wrote in a note to clients.

Of the 32 analysts surveyed by FactSet, 12 have the equivalent of sell ratings on Tesla, while 11 have the equivalent of hold and 9 have the equivalent of buy. The average price target is $774.98, or 43.5% below current prices.

Nio’s stock ran up 22.7% to $11.51, to also record a fifth straight gain. That was the stock’s second-highest close since going public on Sept. 12, 2018. The record close of $11.60 was reached on Sept. 13, 2018.

The stock has rocketed 66.8% during its current win streak.

Nio reported last week that June sales rose 179% from a year ago to 3,740 EVs. That consisted of 2,476 ES6 model EVs, which are Nio’s small SUVs, and 1,264 ES8 EVs. That took second-quarter sales to 10,331 vehicles, up 191% from a year ago.

Separately, DigiTimes reported Monday that Nio raised funds totaling $1.97 billion in the first half of 2020, and has acquired a factory in central China as it looks to expand its production capacity to 4,500 to 5,000 EVs a month from the current rate of 4,000.

Not all EV makers enjoyed gains Monday, as Workhorse’s stock tumbled 15.8% to $17.61, the first decline in 12 sessions. The stock had rocketed more than fivefold (up 406%) during its record 11-day win streak through Thursday, which was supported by the announcement last week of a $70 million securities purchase agreement from an institutional investor.

Nikola’s stock slumped 14.5% to $48.92 on Monday. It has shed 38.1% amid a four-day losing streak, and has tumbled 38.6% since the June 9 record close of $79.73.

JPMorgan’s Paul Coster had started coverage of the battery-electric and hydrogen-electric vehicle maker late last month with a neutral rating, saying the company was poised to disrupt the transportation industry.

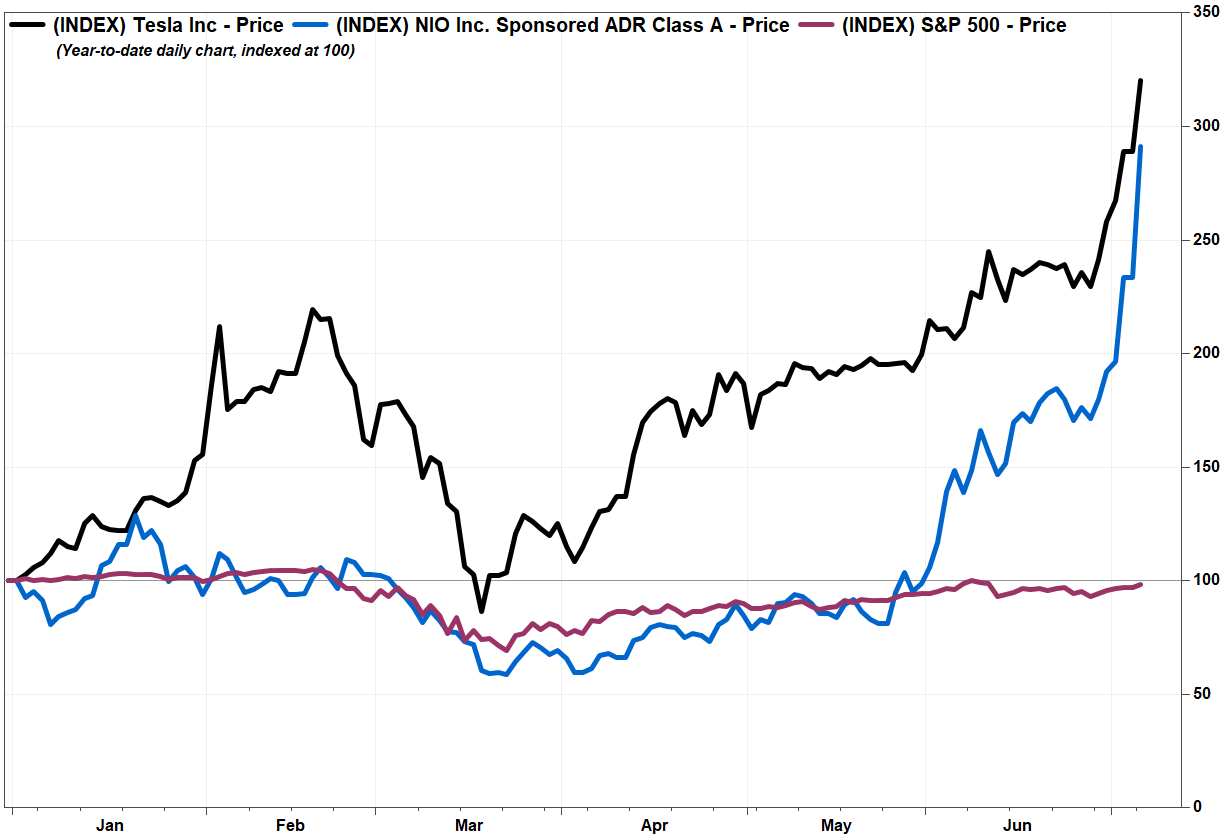

Despite the pullbacks, Workhorse’s stock was still up nearly sixfold (up 479.3%) year to date and Nikola shares were up nearly fivefold ( up 374.0%). Tesla’s stock has more than tripled (up 227.9%) this year and Nio’s stock has nearly tripled (up 186.3%), while the S&P 500 index SPX, +1.58% has slipped 1.6%.

Add Comment