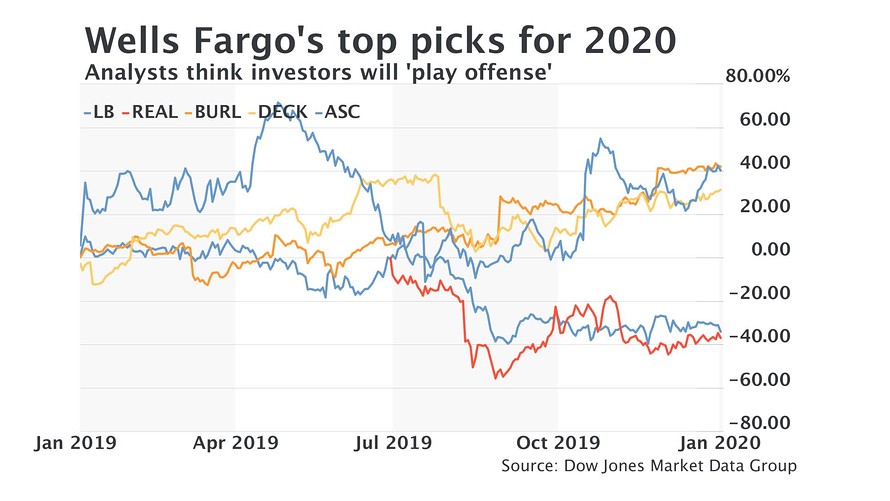

Among Wells Fargo’s top picks for 2020 are L Brands Inc., the parent company to Victoria’s Secret, which is struggling through a turnaround, and RealReal Inc., the luxury secondhand retailer that’s emerging from a controversy about the authenticity of its goods.

After a year in which investors sought safety in sectors like off-price and athletic gear, analysts think investors are ready to take more risk in 2020.

“[W]e see opportunity for investors to ‘play offense’ (especially in early 2020) by coming back to some of the beaten-down names that languished over the last 12 months,” analysts led by Ike Boruchow said.

As Victoria’s Secret struggled to regain favor in the past year, L Brands LB, +7.83% stock has tumbled nearly 34%. The company has taken steps to refocus on the lingerie brand, like shuttering Henri Bendel.

Wells Fargo notes that L Brands Chief Financial Officer Stuart Burgdoerfer highlighted the gap in results between Victoria’s Secret and the company’s beauty brand, Bath & Body Works, and the board’s willingness to consider “opportunities” to close that gap.

“[W]e believe that separating the Victoria’s Secret and Bath & Body Works businesses is more appealing than ever today, given that Bath & Body Works has remained one of the strongest concepts in the mall, while Victoria’s Secret comps have decelerated,” Wells Fargo said.

In the most recent quarter, Bath & Body Works same-store sales rose 9% while Victoria’s Secret’s fell 7%.

See: Victoria’s Secret Fashion Show canceled as talk of a spinoff or Bath & Body Works IPO arises again

Wells Fargo thinks “resale will be the next big ‘disruptor’ in the retail industry,” and The RealReal REAL, +3.19%, with its luxury focus, is poised to benefit.

“We estimate the luxury resale market to be roughly $7 billion today, and we believe that the only reason why the resale market isn’t already larger today is due to a lack of supply (almost $200 billion of inventory sitting in consumers’ closets but only 3% gets consigned annually),” Wells Fargo said. “We believe that The RealReal’s business model is key to unlocking greater supply in the marketplace.”

In response to reports that there are fakes sold on its site, The RealReal said it “authenticates every single item” that it sells.

Also: These luxury fashion gifts could come in handy for a rainy day

Other top picks for the year are off-price retailer Burlington Stores Inc. BURL, -0.20% , Ugg parent Deckers Outdoor Corp. DECK, +0.75% , and UK-based Asos PLC ASC, +2.80% .

Dow Jones Market Data Group

Dow Jones Market Data Group Wells Fargo also upgraded a number of retailers to overweight from equal weight including Calvin Klein parent G-III Apparel Group Ltd. GIII, -1.07% ($42 price target, up from $27); DSW parent Designer Brands Inc. DBI, +0.93% ($20 price target, raised from $16); and Michael Kors parent Capri Holdings Ltd. CPRI, -2.35% (price target moved to $47 from $35).

Michael Kors, faced with challenges including a slowdown in the wholesale channel, has struggled to turn around the business over the past couple of years.

“The Michael Kors brand has embraced the shift from physical to digital and improved productivity in the channel by closing unproductive doors, modernizing older locations in the fleet and reinvesting saving back into its improved e-commerce business,” Wells Fargo said.

Moreover, Capri’s Versace brand is “under appreciated,” analysts said. Capri, which was previously known as Michael Kors Holdings Ltd., announced the Versace acquisition in Sept. 2018.

“While we acknowledge the brand will be dilutive in the first two years and results have been mixed of late, we think it is more constructive to look at the long-term opportunity for the brand given the growth opportunities ahead,” Wells Fargo said.

Among the reasons for this optimism are Versace’s growing store footprint and continued e-commerce integration.

Don’t miss: 4 things to watch for in retail in 2020

Capri stock is up 3.1% over the past year.

Wells Fargo also downgraded three retailers. Off-price retailer Ross Stores Inc. ROST, +0.03% was moved to equal weight from overweight now that analysts don’t see any catalysts for outperformance. Wells Fargo maintained its $125 price target.

And both Signet Jewelers Ltd. SIG, +0.58% and Hanesbrands Inc. HBI, -1.10% were moved down to underweight from equal weight. Signet’s price target was lowered to $12 from $16. Wells Fargo thinks the company has lost market share after it faced hurdles like credit disruptions and allegations of diamond swapping at the Kay Jewelers brand.

Hanesbrands price target was also lowered to $12 from $16. While its Champion brand was once soaring due to the retro trend that give brands like Fila and Adidas AG ADS, +0.14% a boost, there been a more recent deceleration in growth. Moreover, its partnership with Target Corp. TGT, -1.04% is expiring on Jan. 21, which represents more than 15% of sales.

Signet stock sank 13% in Thursday trading after the downgrade. The stock has plummeted nearly 42% over the past year.

Hanesbrands stock is down almost 2% in Thursday trading, but has gained 16.4% over the last 12 months.

The SPDR S&P Retail ETF XRT, -0.77% is up 11.4% over the past year while the S&P 500 index SPX, -0.71% has rallied 33% for the period.