In the tech bust we have seen in the last few months, with many tech companies which boomed during the pandemic losing steam, one less-appreciated factor in the share price declines is the role of stock-based compensation. Stock options and restricted shares are common in young tech companies where they are generously distributed to executives and key employees. These are in addition to salary commissions and bonuses.

They are designed to bind key figures to the company and, in theory, align their interests to those of the shareholders. It’s a great deal for the person receiving the stock-based compensation, since it has no risk – if the stock goes up, they can cash it in, and if the stock goes down, there is no loss per se. This is unlike the shareholder, who has to buy the stock in the open market and then face the full ups and downs. Stock compensation is a one-way street – the recipient benefits from appreciation of the stock but faces no loss from depreciation of the stock.

Also, when said executives or employees cash the stock options, they dilute the shareholders. Many tech companies then buy back the shares with cash to keep dilution under control. So in essence, the buyback of the stock is mainly to fund the stock options and restricted stock (collectively stock-based compensation) being granted to insiders.

In short, while stock-based compensation can be very effective in retaining the key people that can make a company successful, which is great for shareholders, we also need to be aware that there are dangers to us associated with this situation getting out of control, which can easily happen when growth slows and/or the stock price enters bear territory.

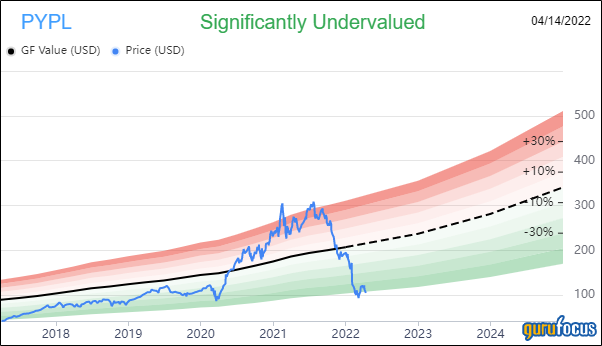

Now let’s look at the case of PayPal Holdings Inc. (NASDAQ:PYPL) as an example. The stock did extremely well during the pandemic, but since last year, it has experienced the corresponding pandemic bust. The stock has done a round trip back to its pre-pandemic level.

One problem a company like PayPal faces in its recovery is now the stock has fallen so far, the stock-based compensation it has given out in the last two years is now deeply underwater. But they still exist (and will do so for up to 10 years unless the insider quits or is fired) and companies have to keep on giving more and more stock compensation to incentivize and retain them. This causes increasingly future-weighted dilution potential and is an overhang on the stock price.

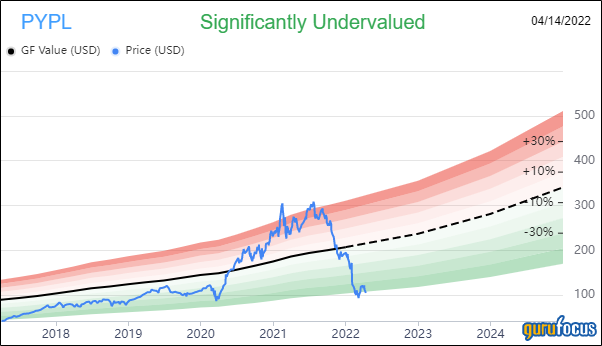

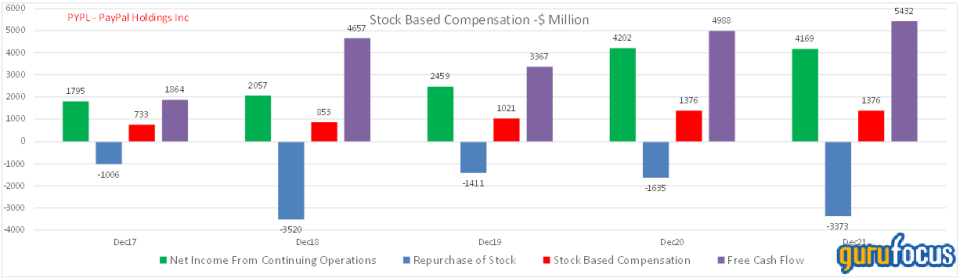

The following chart shows that stock-based compensation (the red bars) is a increasing proportion of net income (the green bars).

However, the stock-based compensation shown on the cash flow statement is understated. When the stock price boomed in the last two years, an increasing amount of stock options were cashed in by employees and insiders. To compensate for the dilution, the company repurchased (the blue bars) a large amount of stock ($3.73 billion in 2021 at very high stock prices).

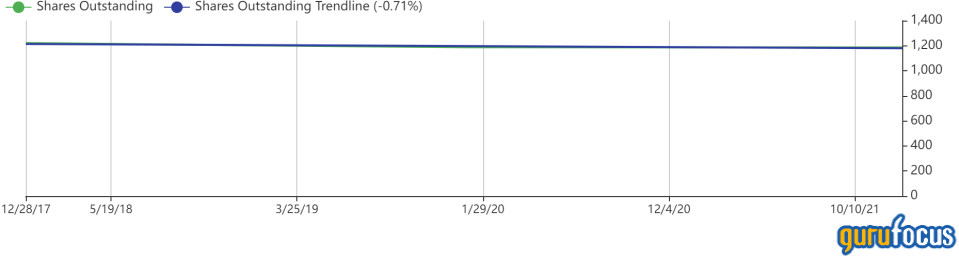

Meanwhile, the diluted share count is basically flat despite the billions being spent on stock buybacks.

I have observed that many tech companies are run by insiders, mainly for the benefits of insiders. I single out tech companies here because oftentimes, high growth or expectations of high growth make it easier for shareholders to fall into the trap of believing the executive team is shareholder-friendly just because stock prices go up, when that could be far from the truth. The Boards of Directors (who are lavishly compensated for a few days of work) are complicit in this situation as they are chosen and appointed by the executives and nepotism is very common. Its a big game of scratching each other’s backs and enriching themselves at the expense of the shareholders.

I am by no means picking on PayPal in particular – this is a common problem with lots of tech companies, and investors can often profit despite it. However, we need to be aware of these phenomena and take stock-based compensation into account before investing in these companies, as it can become a millstone around their neck. In the case of PayPal, despite the attractive valuation, I am leery of investing in the stock because stock-based compensation will weigh heavily on future results. I think the stock will struggle to regain traction as the company will have to grant increasing amount of stock to retain talent, and if the stock rises, they will need to buy back increasing amounts of stock to keep dilution in check.

This article first appeared on GuruFocus.