Americans still look prepared to hop into cars for summer road trips, including the upcoming Fourth of July holiday, despite soaring gasoline prices and high inflation taking a toll as they fill up their tanks.

President Joe Biden called on Congress Wednesday to briefly suspend the federal taxes on gasoline and diesel, while encouraging U.S. oil refining companies to produce more supplies to alleviate the burden of high prices on consumers.

Read more: What a federal gas-tax suspension means for energy prices

However, analysts at JPMorgan said fuel prices won’t drop until supply-side issues, including an acute shortage of refining capacity, have been addressed, in a Wednesday client note.

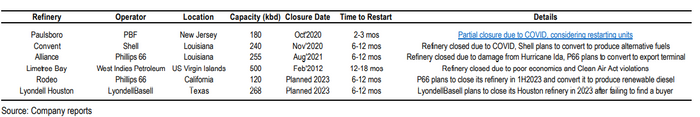

“The administration announced it could use ‘all reasonable and appropriate federal government tools’ to increase refining capacity, including the Defense Production Act to order refiners to bring some of their shuttered plants back online,” said JP Morgan’s Natasha Kaneva, Ted Hall and Prateek Kedia, in the bank’s global commodities research team. “The Biden administration could also consider ways to keep refineries that plan on closing in the near future to remain open, helping to avoid an even more severe shortage of capacity in 2023.”

In the recent past, it took an average of six to 12 months for shuttered refineries to restart (see chart), according to the commodities team. The national gas price average currently stands at $4.94 per gallon, compared with around $3.50 in February.

Reopening refiners will be a heavy lift with an average of six to 12 months to restart. SOURCE: J.P. MORGAN

Before the Biden administration imposed sanctions on Russian energy imports in an attempt to undermine the Kremlin’s ability to fund its war against Ukraine, the U.S. imported more than 300,000 barrels of vacuum gas oil (VGO) from Russia in the past two years, according to JP Morgan. VGO is an intermediate feedstock to escalate gasoline production from refineries. JPMorgan’s team suggested that the U.S. instead find alternatives, including trading with Venezuela, to boost capacity.

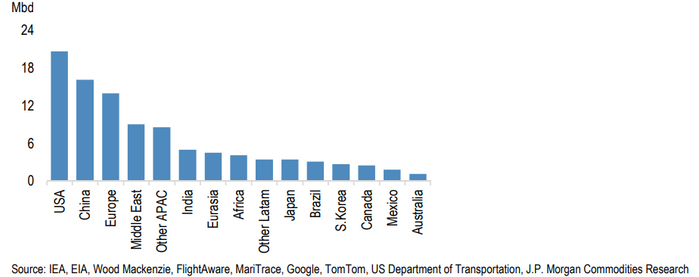

In addition, “persuading China to increase its quotas of transportation fuels exports could increase supply by about 500,000 barrels per day,” according to the report. China, the second-largest refiner world-wide, is on track to achieve a net-zero target by eliminating cargo exports of transportation fuels before 2025. The country’s emissions need to be reduced by 45% by 2030 and reach net-zero by 2050.

SOURCE: IEA, EIA, WOOD MACKENZIE, FLIGHTAWARE, MARITRACE, GOOGLE, TOMTOM, U.S. DEPARTMENT OF TRANSPORTATION, J.P. MORGAN COMMODITIES RESEARCH

While the Biden administration has backed policies and taken executive actions to lower gasoline prices, the JPMorgan team said those only provide “some temporary relief to U.S. consumers” and “will instead likely encourage Americans to drive more,” leading to a stronger demand growth and higher gas prices.