The rich appear to be losing faith in this bull market.

The 750 members of Tiger 21, a coalition of investors with some $75 billion in assets, increased their cash holdings by 20% in the first quarter, bringing the group’s total allocation to levels not seen since the start of 2013. The move also marks Tiger 21’s first cash-raising effort in three years.

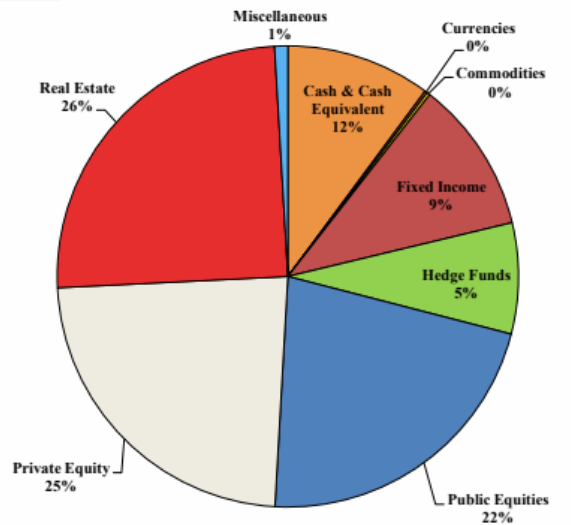

Here’s where Tiger 21’s allocation stands now:

The ongoing tariff tiff with China tops their long list of market concerns, along with an unsustainable budget deficit and the failure to make progress with North Korean relations. A bigger cash pile will also come in handy, they say, in the face of any other “black swan” events that could rattle stocks.

Tiger 21 President Michael Sonnenfeldt told MarketWatch that members are also worried about “continued government dysfunction, failing infrastructure, stock markets being ‘priced to perfection’ and rising economic inequality leading to greater polarization in America and elsewhere.”

The group is backing away from hedge funds, but just slightly, while real estate, still the asset of choice, has steadily fallen out of favor, dropping from a peak of 33% in the second quarter of 2017 to the current 26% level.

Even as Tiger 21 has one foot on “the brake because of concerns about the expansion becoming a little long in the tooth,” Sonnenfeldt points out the group still has “one foot on the gas because of a long-term optimism about the economy.”

Private equity remains preferred over public — 25% vs. 22% — reflecting the “edge” that the wealthy members feel they get when investing directly in small companies where they might have direct interest or outright ownership.

Cash wasn’t the best place to be for much of last week, though the Dow DJIA, -0.38% did close Friday’s session off nearly 100 points.

Want news about Asia delivered to your inbox? Subscribe to MarketWatch’s free Asia Daily newsletter. Sign up here.

Add Comment