The equities market seems to be positioned for the old adage “sell in May and go away” to come to fruition.

That’s the finding of Nomura quantitative strategist Masanari Takada, who said a shakeout is coming as scheduled.

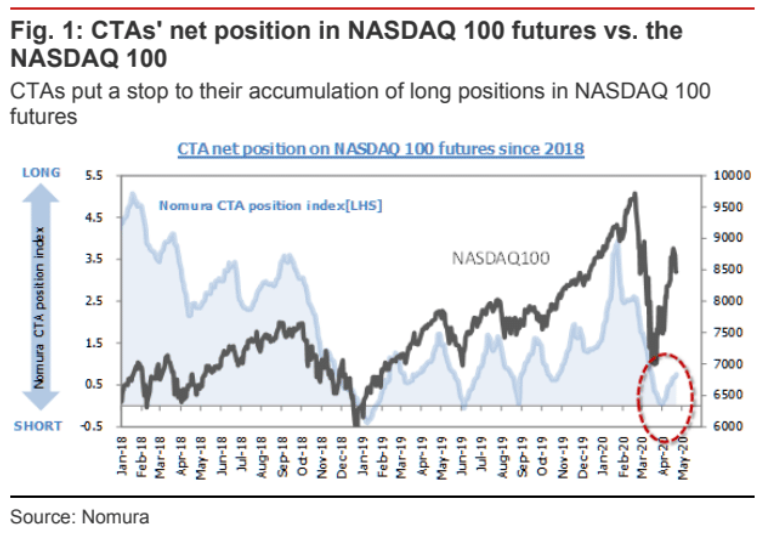

Most of what are called commodity trading advisors are trend followers, and Takada said they appear to have stopped accumulating Nasdaq 100 futures. If Nasdaq 100 can’t hold 8100, “we would expect the buying pressure generated by these CTAs on their own in the U.S. equity market to fizzle out on or around May 8. This would imply a need to brace for selling in tune with the ‘sell in May’ adage,” he said.

Nasdaq 100 futures NQ00, -0.48% on Thursday morning were trading around 8600.

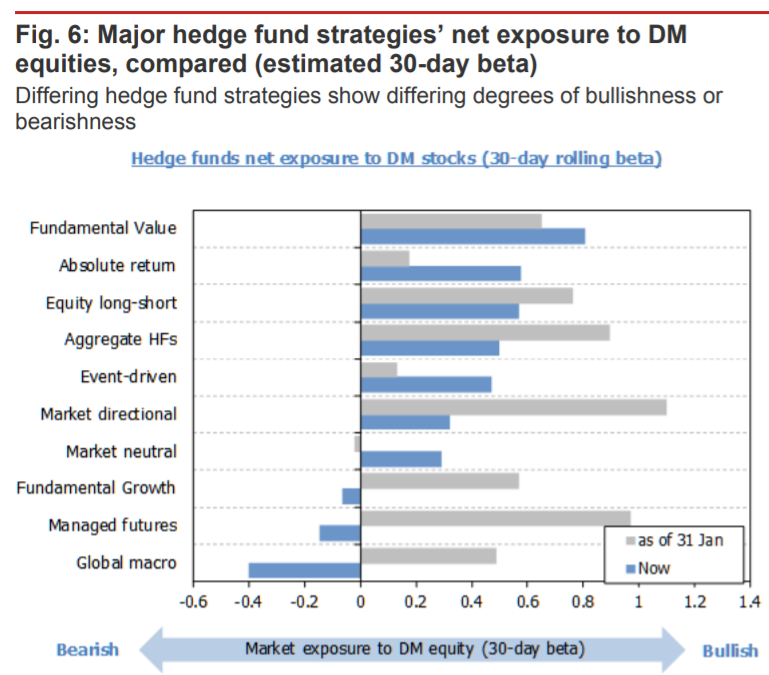

At the same time, macro hedge funds are still bearish on equities, he writes. “We suspect that global macro hedge funds will remain bearish until there is some reason to believe that [developed market] economies are on their way to finding a floor,” Takada said.

While it’s possible that global macro hedge funds might have to make an emergency rush for the exits from their short trades if optimism gets out ahead of a bottom, “our impression is that there is not much impetus among global macro hedge funds to rethink their current strategies just now.”

Data released Thursday showed record low readings of purchasing managers index for the services industry in the eurozone, the U.K. and Japan.

Takada also see signs of risk that stepped-up selling by momentum players could tip global crude futures prices CL.1, +2.00% into negative territory again.

See also: The stock market won’t get what it needs to keep the rally going, warns SocGen strategist

Add Comment