Getty Images

Getty Images As the major U.S. stock-market indices continue languish in bear-market territory, investors are looking for signs of a market bottom and preparing a wish list of potential bargains in anticipation of a recovery.

One factor investors should consider are low liquidity stocks, according to a Monday research note by Goldman Sachs analysts, led by Ryan Hammond.

On Tuesday, the Dow Jones Industrial Average DJIA, +3.92%, the S&P 500 index SPX, +5.18% and the Nasdaq Composite index COMP, +5.72% were trading roughly 30% below their record highs notched in February, in what Goldman describes as “the quickest bear market on record.”

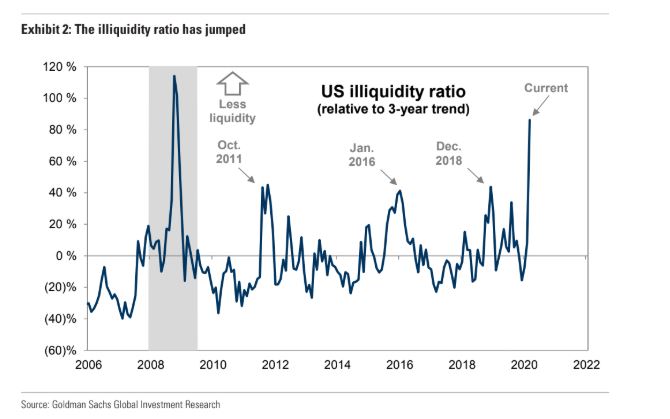

The price declines have led to higher bid-ask spreads and greater difficulty for investors in finding buyers or sellers of stocks at desired prices. “Liquidity has evaporated within U.S. equity markets, magnifying index-level moves during the ongoing bear market,” Hammond wrote. “The magnitude of the current liquidity shock, as measured by our ‘illiquidity ratio’, is now approaching the 2008 experience.”

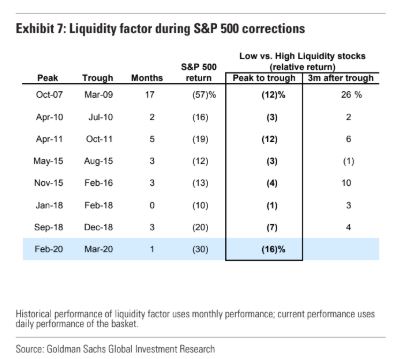

This lack of willing buyers and sellers in the market has caused lightly traded stocks to suffer greater declines in recent weeks than more actively traded shares, but this dynamic is also setting up low liquidity stocks for outsized gains, once the market finds a bottom and begins to recover. In other words, with investors paying higher prices for stocks with higher liquidity, there is a “illiquidity premium” that long-term investors can capture.

”For longer-term investors, accepting liquidity risk presents an opportunity,” Hammond wrote. “A strategy of buying illiquid stocks and selling liquid stocks has generated a 4% annualized return since 1976, with a 63% annual hit rate of outperformance. The factor has historically outperformed during correction rebounds.

The issue of course, is predicting when equity markets will hit their lowest levels of the current bear market, at which point low liquidity names will prove to be the best bargain. Given the current selloff is being driven by fears over the impact of the new coronavirus on corporate profits, Tom Hainlin, Global Investment Strategist at Ascent Private Capital Management told MarketWatch that has yet to see the necessary signs that would indicate an imminent recovery.

“We’re looking for some improvement in the coronavirus epidemic, some sort of signs of real containment or a potential treatment or cure” he said, adding that he expects more bad news on this front before governments get the situation under control.

Another sign that could trigger a sustained recovery would be aggressive fiscal stimulus from the federal government aimed at blunting, or even reversing, the economic impact of efforts to stem the spread of the disease.

Stocks with the highest illiquidity, according to Goldman’s analysis, include Ardagh Group S.A. ARD, +6.58% , Seaboard Corp. SEB, +8.41% , Gates industrial Corp. plc GTES, -8.27% , Liberty Media Corp. FWONA, -0.46% and American National Insurance Co. ANAT, +0.66% .

TFS Financial Corp. TFSL, +5.96% , United States Cellular Corp. USM, +11.68% Lions Gate Entertainment Corp. LGF.A, +5.72% , Centennial Resource Development, Inc. CDEV, -10.80% and ADT Inc. ADT, +4.22% round out the top ten most illiquid names, according to Goldman.