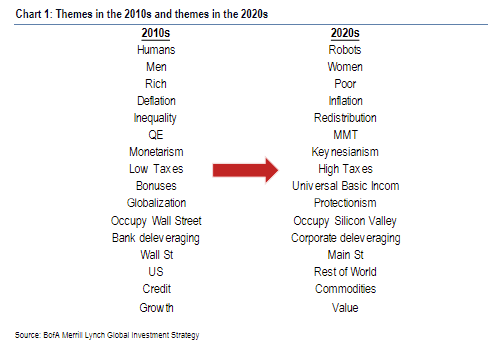

In the 2010s, it was low taxes, inequality and bonuses. Over the next decade, the script flips to high taxes, redistribution and universal basic income.

Those are just some of the shifting themes that Bank of America BAC, +1.69% , in a note led by top strategist Michael Hartnett, says investors will have to grapple with as the long-running bull market limps into 2020.

Here are the others:

“We are bullish on risk assets in 2019 as bearish investor sentiment and the irrationality of central banks and bond markets allow an ‘overshoot’ in credit and equity prices,” he wrote. “We are bearish on risk assets in 2020 as recession / policy impotence / bond bubble risks induce Big Top in credit and equities.”

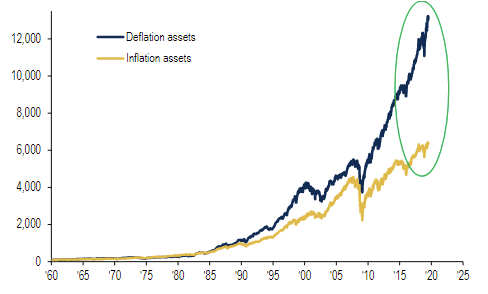

Hartnett explained that the most contrarian trade in the next 10 years is “long inflation,” and as you can see, that would be quite a reversal:

“The 2020s are likely to witness a more forceful attempt to create inflation,” he said. “Even the slightest sign of success will lead to dramatic rotation… away from the deflationary winners of the 2010s to the inflationary losers.”

Overall, Hartnett says the upcoming war on inequality will be bearish for stocks, leading to an overshoot in gold prices GC.1, -0.27% .

But, for the short term, there’s reason for bulls to be hopeful.

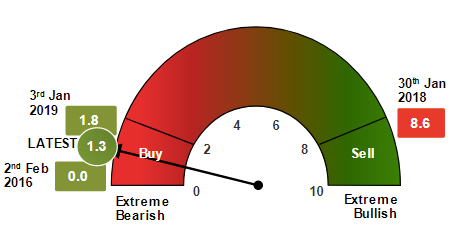

B. of A.’s Bull & Bear Indicator, which tracks 18 measurements on asset flow, sentiment, and price, is flashing a contrarian buy signal that hasn’t been seen since way back in January. The drop in the reading was driven in large part by asset flows out of equity and emerging market debt, Harnett said.

The indicator has a solid track record of predicting what’s next. Since 2000, global stocks rose a median 6.3% in the three months after such a buy signal was triggered, while 10-year Treasury yields increased 50 basis points.

The current signal implies that the S&P 500 index SPX, -0.07% is likely to retest the all-time above the 3,000 level. At least check, the broad market gauge was up 25 points at 2,931 during Wednesday’s rebound.