If there’s anything on the economic menu President Donald Trump desires nearly as much as lower interest rates, it’s probably a weaker U.S. dollar. The question for investors is how far will he go to get it.

Goldman Sachs on Thursday described outright currency-market intervention as a possibility, albeit a “low but rising risk.” Analyst Michael Cahill pointed to an increasing series of presidential tweets, comments and policy actions and proposals that have put U.S. currency policy back in the spotlight.

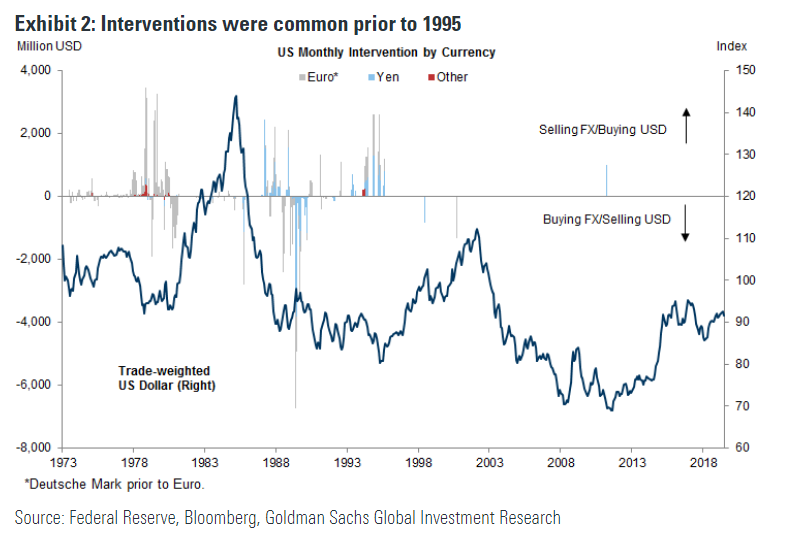

And while such a move would cut against policy norms that have been in place since around the mid-1990s (see chart below), “in a world where QE has become almost conventional, FX intervention is not a giant leap,” Cahill said in an email, referring to the quantitative easing, or QE, programs undertaken by major central banks in response to the global financial crisis.

Goldman Sachs

Goldman Sachs

In a note, Cahill said a move by the U.S. to sell dollars would be likely to spark a “sizable” market reaction, including a weaker U.S. currency, a stronger Japanese yen USDJPY, -0.02% and weaker foreign risk assets — such as stocks and corporate debt.

Trump in recent weeks has complained on Twitter and in interviews that other countries and the eurozone have weakened their currencies to the disadvantage of U.S. exporters. It’s often been combined with complaints about the Federal Reserve’s refusal so far to lower interest rates. Trump last month directly criticized European Central Bank President Mario Draghi on Twitter after he opened the door to additional monetary stimulus for the eurozone.

On Wednesday, Bloomberg reported Trump has asked staff to search for ways to weaken the dollar.

Trump has long complained about the strength of the U.S. dollar. Cahill recalled that Treasury Secretary Steven Mnuchin caused a stir in 2018 when he suggested a softening of the U.S. government’s longstanding strong-dollar stance — a position many observers have argued went out the window with Trump’s inauguration.

Archive: Trump is waving adios to the longstanding ‘strong dollar policy’

In addition, Democratic presidential contender Elizabeth Warren unveiled a plan to more closely manage the U.S. dollar in an effort to create jobs.

Comments by Trump and actions by policy makers around the world have stirred fears of a potential “race to the bottom” as countries act to weaken their currencies against each other. A prolonged bout of undesirably low inflation across several economies can provide the conditions that lead to a so-called currency war, wrote Jane Foley, senior FX strategist at Rabobank, last month.

Read: Why Trump’s tweets about the U.S. dollar might soon pack a lot more punch

Cahill noted a number of operational concerns that could complicate efforts to intervene. It’s not clear, he said, if the Fed would participate. If the Treasury were forced to go it alone it wold limit the scale of intervention, though it would still likely have a significant market-moving effect. Most likely, the Fed would indeed defer to the Treasury, he said, noting that Powell has talked about the department’s traditional role as steward of exchange-rate policy.

There are also practical concerns, however, including the unlikelihood the international community would coordinate in an effort to weaken the dollar. Also, intervention against currencies of traditional trading allies, such as the euro area, would likely be seen as an escalation of international trade tensions. Attempts to intervene against the Chinese yuan would also run into issues, including the country’s capital controls and a limited number of investible assets.

Meanwhile, efforts to jawbone, or verbally pressure the dollar, to the downside appear to be fairly effective, Cahill said. That’s one reason why the risk of outright intervention appears fairly limited he said.

Meanwhile, he noted the U.S. has so far avoided some more provocative currency actions, such as formally naming any trading partner a currency manipulator. Meanwhile, the Fed’s move toward rate cuts should also serve to weaken the dollar, he said.

The The ICE U.S. Dollar Index DXY, -0.05% , a measure of the U.S. currency against a basket of six major rivals, hit a nearly two-year high earlier this year but has since pulled back as rate-cut expectations mounted. The index is off 0.2% this week but remains up 0.9% for the year to date.