Recession fears continued to weigh on the stock market this week, as the S&P 500 cemented its worst first-half performance in more than 50 years, and a final reading on first-quarter GDP showed an even larger slowdown than previously believed.

As the Federal Reserve Bank of Atlanta updates its GDP Nowcast to indicate another quarter of contraction between April and the end of June, more Wall Street analysts are warning investors to start positioning their portfolios for a recession if they haven’t already.

Read: Is the U.S. already tipping into recession? Probably not, but worry signs multiply

In a note that captures this growing pessimism surrounding the U.S. economy, Guggenheim economist Matt Bush explains how the worsening economic slowdown is being reflected in the official data.

This week, the PCE consumption data showed that consumer spending has been essentially flat since January as rising prices have absorbed all of workers’ wage gains, and then some, as expenditures increased by only 0.2% in May, which was less than the 0.4% growth expected by Wall Street economists, according to FactSet.

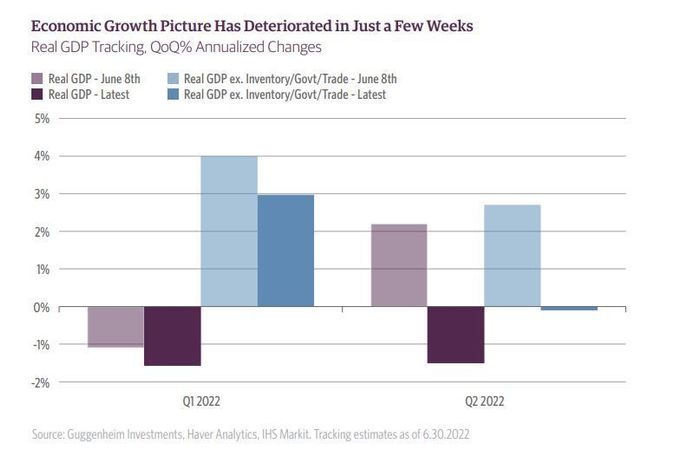

Bush wrote that this “considerable” slowdown in domestic demand has caused his gauge of second-quarter economic growth to drop from 2.7% a few weeks ago to negative 0.1% as the quarter ended.

“These developments raise the risk of two straight quarters of negative real GDP growth, which is conventionally regarded as the definition of recession,” Bush wrote.

The National Bureau of Economic Research, the official arbiter of U.S. business cycles uses different criteria. NBER defines a recession as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

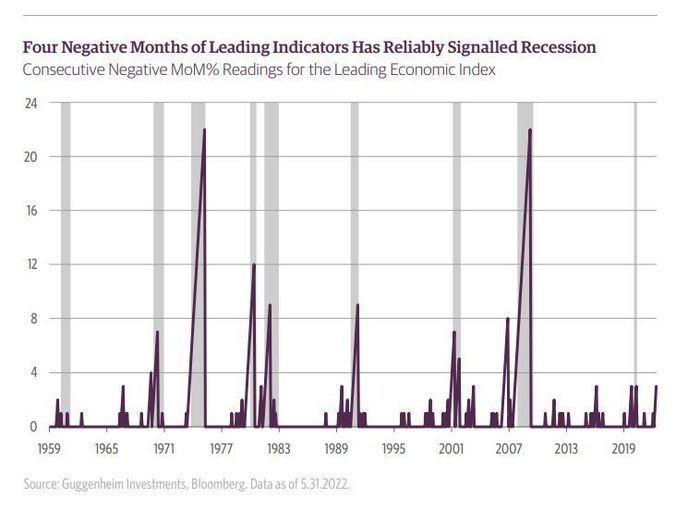

Bush also pointed to a deterioration in the leading-indicators index — an in-house model factoring in the drop in stock prices, a flatter yield curve, rising jobless claims, and declining expectations surrounding the strength of consumer spending, among other factors.

Guggenheim’s leading-indicators index has deteriorated for three straight months through May, and Bush believes it’s “highly likely” that June will end up being the fourth. Historically, this has almost always been a harbinger of recession, he said.

To be sure, this bearish outlook is nothing new from Guggenheim. Guggenheim Partners Global Chief Investment Officer Scott Minerd has repeatedly told the financial press — including during an interview with MarketWatch —that U.S. stocks could fall nearly 50% from their peak. He also says he expects real estate and fine art to outperform stocks over the coming years.

Stocks were slightly lower on Friday, with the Dow Jones Industrial Average DJIA, -0.21% off around 100 points, or 0.3%, and the S&P 500 SPX, -0.09% down 0.2%.

Add Comment