Wolf Richter, the veteran investor behind the Wolf Street blog, got hit hard betting against the market during the blow-off rally of in 1999. But he says this market “is even crazier” than that legendary internet bubble, and he’s banking on the whole thing to topple over within a few months.

Still, he’s keeping a sense of humor about it his short of the SPDR S&P 500 ETF SPY, -0.57% .

“I’m sharing this trade for your future entertainment,” he told readers, “so you can hail me as the obliterating moron that infamously shorted the greatest rally floating weightlessly ever higher above the worst economic and corporate crisis imaginable.”

This isn’t the only short trade Richter’s made public in the past six months. He’s on a bit of a roll with the doom and gloom. Earlier this year, Richter nailed his bearish call when he pocketed a 26.5% gain by covering his SPY position and another 13.1% covering his QQQ QQQ, -0.01% short.

“I don’t expect those kinds of fireworks this time — but I didn’t expect them last time either,” he told MarketWatch. “I’m gunning for a regular run-of-the-mill sell-off.”

Richter acknowledged that, this time, the risk-reward is out of whack and he feels “crappy” about it, but he just can’t fathom how this rally can continue in the face of “the worst economy in my lifetime.”

“ ‘It’s a terrible, gut-wrenching scenario all around.’ ”

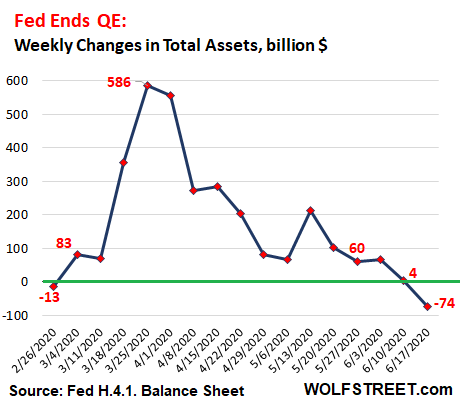

He pointed to the millions of people on state and federal unemployment insurance, the desperate situation of the airlines and other industries in the face of the coronavirus pandemic, and, of course, the drying-up flow of cash from the Federal Reserve.

All that, and we’re coming off the “greatest 50-day rally in history,” in which the S&P 500 SPX, -0.56% exploded for a 47% rebound from an intraday low on March 23.

What makes the situation even more “silly,” he said, is the surge in day traders who are taking outsized risks in “get-rich-quick schemes” that almost never end well. Richter pointed to action in shares of Hertz HTZ, -3.88% — a bankrupt stock that was bid up from 40 cents a share to over $6. He said that surge could go down “as the craziest moment of the crazy rally.”

The day-trading frenzy of 1999 didn’t even reach these levels, he said, adding that investors are now facing stocks prices that will no longer be propped up by the Federal Reserve.

“And now the market, immensely bloated and overweight after its greatest 50-day rally ever, has to stand on its own feet, during the worst economy in my lifetime, amid some of the worst corporate earnings approaching the light of the day, while over 30 million people lost their jobs,” Richer explained in his post. “It’s a terrible, gut-wrenching scenario all around.”

Read:‘There’s absolutely no reason to own U.S. equities right now,’ strategist says

For now, his short is doing just fine, with the Dow Jones Industrial Average DJIA, -0.80% and S&P 500 SPX, -0.56% , as of Sunday night, both heading for a weak open.

Add Comment