The potentially imminent escalation of the U.S.-China trade fight — and the threat of further tit-for-tat measures — marks a significant risk to both countries and the world economy, analysts said.

The Trump administration plans to more than double tariffs on $200 billion of Chinese imports and extend levies to other goods from the country early Friday. Beijing promises to retaliate.

Trump Today: President touts ‘beautiful letter’ from Chinese leader Xi

“No one wins trade wars, not even the bystanders,” wrote Gregory Daco, chief U.S. economist at Oxford Economics, a research firm, in a Thursday note.

Oxford Economics

Oxford Economics

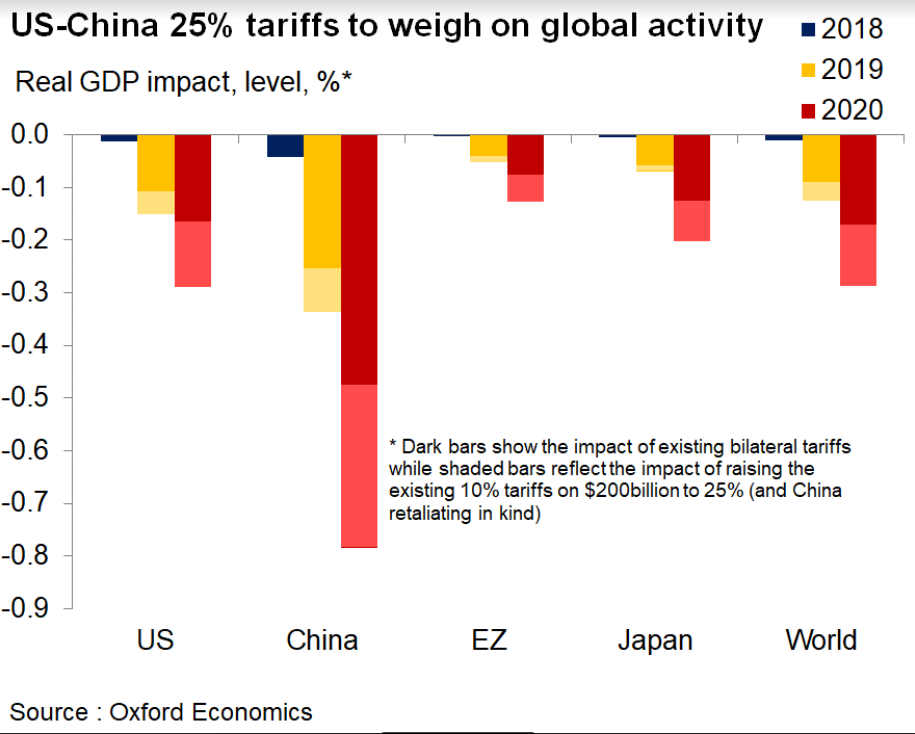

Daco updated his outlook for the U.S., Chinese and global economies, estimating that the move to hike tariffs to 25% from 10% on half of U.S. imports from China — with China raising 8% tariffs on $60 billion of U.S. imports to 25% — would reduce U.S. gross domestic product by 0.3% in 2020, while curbing China’s output by 0.8% (see chart above).

See: The group losing faith in a quick China trade resolution? The farmers drained by lost exports

The global reverberations would also be more significant, Daco wrote, with the eurozone and Japan seeing losses of around 0.1% to 0.2%, with Singapore suffering a 0.7% drag and global GDP being reduced by 0.3%, or $105 billion.

Read: Trump’s comments apparently emboldened China to take harder line on trade talks

Oxford Economics estimates that the existing tariffs put in place since early last year, hitting around $360 billion of bilateral trade, will impose a drag of 0.1% on real U.S. gross domestic product growth this year, worth about $22 billion, or $175 per household. Chinese GDP will be curbed by 0.3%, according to the firm’s model.

Read: Trump’s trade fight with China hasn’t affected most Americans so far — here’s what could change that

Global stocks pulled back this week as previous confidence that Washington and Beijing would soon complete a trade deal was shattered by U.S. threats to follow through with tariff hikes after charging Beijing had backtracked on pledges made in earlier negotiations. The S&P 500 SPX, -0.30% , which notched the latest in a string of all-time highs last week, is down 2.6% this week, while the Dow Jones Industrial Average DJIA, -0.54% has retreated around 2.6%. China’s CSI 300 stock index has dropped over 8%.

Then there’s the potential for even further escalation.

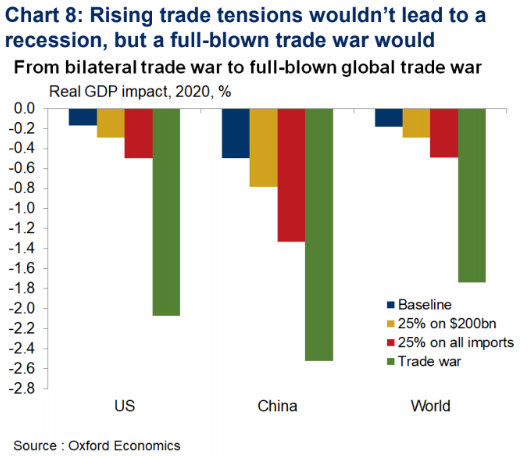

In a scenario where Washington puts tariffs of 25% on all imports from China, with Beijing retaliating in kind, U.S. GDP would take a hit of around 0.5%, he said, leaving the economy around $45 billion smaller by 2020 than in a world without tariffs. That would push real GDP growth — growth minus inflation — dangerously close to 1% by the end of 2020, he said.

China’s GDP growth would be reduced by around 1.3% in 2020, slowing to an unprecedented 5% annual pace, while world GDP would suffer a significant 0.5% loss (see chart below).

Oxford Economics

Oxford Economics

And then there’s the “extreme scenario” of full-blown, multilateral trade war. In this scenario, Oxford Economics modeled the impact of the U.S. putting 35% tariffs on all Chinese imports and 25% auto tariffs globally, plus 10% blanket tariffs on all other goods imported from the EU, Taiwan and Japan — with all countries retaliating in kind.

The firm calculated this would result in a 2.1% hit to U.S. GDP in 2020, pushing the economy into recession later this year. China’s economy would contract by 2.5%, while Europe and Japan would see average GDP losses of 1.5% and world GDP would be reduced by 1.7%.

The damage to private-sector confidence and the accompanying plunge in stock prices would likely see central banks forced into significant rate cuts and other measures, Daco said.

Want news about Asia delivered to your inbox? Subscribe to MarketWatch’s free Asia Daily newsletter. Sign up here.