Oil could rally further, potentially pushing the global crude benchmark to $100 a barrel and prompting a global ‘surge’ in inflation and braking economic growth, according to economists at Oxford Economics.

The extended rise in prices would come as efforts by Saudi Arabia to make up for oil lost from Iran reduces the world’s spare crude output capacity, the economists, led by John Payne, said in a Wednesday note.

“In the short-run, it is likely the supply impact will be offset by higher production elsewhere, but the market is tightening and all it would take is one more shock to supply (e.g. Nigeria) and oil could reach $100 per barrel,” they said.

See: Strait of Hormuz: Oil ‘choke point’ in focus as U.S. ends Iran waivers

A move to $100 for Brent would correspond with a rise for U.S. benchmark West Texas Intermediate crude to $89 a barrel.

In Wednesday dealings, June Brent oil LCOM9, -0.01% traded at $74.71 a barrel, while June WTI oil CLM9, -0.74% was at $65.80 a barrel.

“Although Saudi Arabia will likely boost production to partially offset the impact of the U.S. ending waivers on Iranian imports, global spare capacity is being drained,” the economists said.

Read: The end of Iranian oil waivers and what it means for the OPEC-led output cut pact

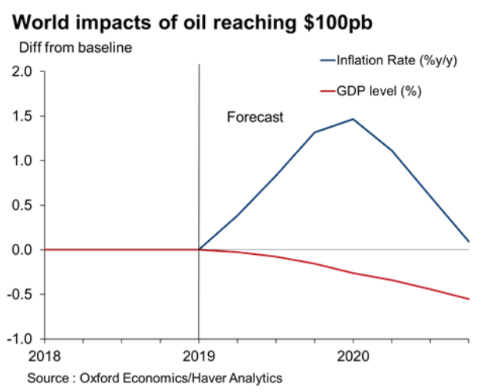

“Were [Brent] oil to increase to $100 [per barrel] by Q4 2019, simulations suggest the level of global GDP would fall 0.6% below baseline by end of 2020, and inflation would rise 1.5% above it by Q1 2020,” they said (see chart below).

Oxford Economics

Oxford Economics

Then inflation would average 4% year-over-year in 2020, the sharpest spike in prices since 2011, the economists said. Global GDP growth would also drop to 2.5% in 2020, they said.

A spike in oil prices would be “particularly damaging for already-fragile, oil importing emerging markets,” such as the Philippines, Argentina, Turkey and Indonesia,” but those that stand to benefit most would be oil exporters Russia, Saudi Arabia and U.A.E., the economists said.

In its baseline assumptions, however, Oxford Economics, sees Brent prices bottoming out at $63 this quarter, before slowly rising back to an average of $64 in 2019 and $66 in 2020, and 2019 GDP growth bottoming out at 2.6% in Q1 before recovering up to an average 2.9% through 2020.