The sharp swoon in U.S. Treasury yields this month may not point to a looming economic slowdown after all.

Less than half of the bond-market’s rally in August can be explained by a deterioration in the economic growth outlook and expectations for further monetary easing from the Federal Reserve, according to Marko Kolanovic, J.P. Morgan’s global head of quantitative and derivatives strategy, in a Tuesday research note.

The rest of the bond market move was driven by non-economic factors that nonetheless have spurred demand for long-term government debt.

Market participants have complained that the speed of the bond market’s rally this month appeared overdone given the resilience of the U.S. economy. Recent data including strong retail sales and continued growth in jobs underscore the strength of U.S households that have weathered the worsening global economic growth trajectory.

See: Forget the yield curve, here’s who will prevent the U.S. from entering a recession

Given this backdrop, investors have been asking “how much of the move can be attributed to increased recession risk versus technical flows in an environment of poor liquidity,” said Kolanovic.

The 10-year Treasury note yield TMUBMUSD10Y, -3.58% has shed as much as 50 basis points this month, contributing to close to half of its year-to-date decline. The benchmark bond yield is down around a single percentage point since the start of 2019.

Falling long-term yields have pushed the 10-year yield below the 2-year note yield to invert the yield curve briefly last week. An inversion of the curve has preceded each of the last seven recessions.

Worries that the bond market was portending an economic downturn sparked the biggest one-day slump for the Dow Jones Industrial Average DJIA, -0.66% this year on Aug. 14.

Opinion: It’s not time to freak out about a recession — yet

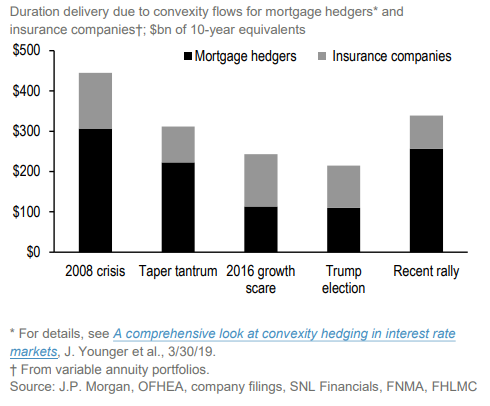

But Kolanovic says the value of long-term bond yields as an economic signal has been somewhat distorted by technical drivers such as so-called convexity hedging, a powerful driver of the bond-market’s rally this year.

Such technical flows were highlighted earlier in March after investors rushed to refinance home loans to take advantage of the slide in long-term mortgage rates, which were pegged to long-term Treasury yields. This resulted in a wave of prepayments from homeowners rolling over their loans at lower rates.

To hedge against the risk of diminished incomes from home loans, investors of mortgage-backed securities bought Treasurys with extended maturities, pushing yields lower in a vicious circle of bond buying.

JPMorgan estimates that inflows into long-term government bonds from convexity hedging this year amounted to around $400 billion.

Thin liquidity conditions over the summer have also helped super-charge the bond-market rally.

The lack of trading was exacerbated by the sudden retreat of high-frequency traders spooked by the spike in bond-market volatility this month. Analysts say high frequency traders have become increasingly important market makers for Treasurys over the last decade.

The one-month Merrill Lynch MOVE index, which tracks the implied volatility of the 10-year Treasury yield over 30 days, spiked to a reading of nearly 90 on Aug. 16, its highest levels since early 2016.

Read: Why the world’s biggest bond investor is dismissing the yield curve’s recession warning