For yen traders, fluctuations in the currency have traditionally been correlated with equity markets and broad economic sentiment. As appetite for assets perceived as risky falls, investors flock to haven-related assets such as the Japanese yen.

However, all this might go out the door ahead of what’s known as Golden Week in Japan, the traditional weeklong holiday beginning April 29, as traders clamor for liquidity.

“Thin liquidity around the Easter holidays and the usual month-end flow, FX markets will have another liquidity event to deal with in late-April this year — the run up to a Golden Week holiday period in Japan,” wrote Adam Cole, chief currency strategist at RBC Capital Markets.

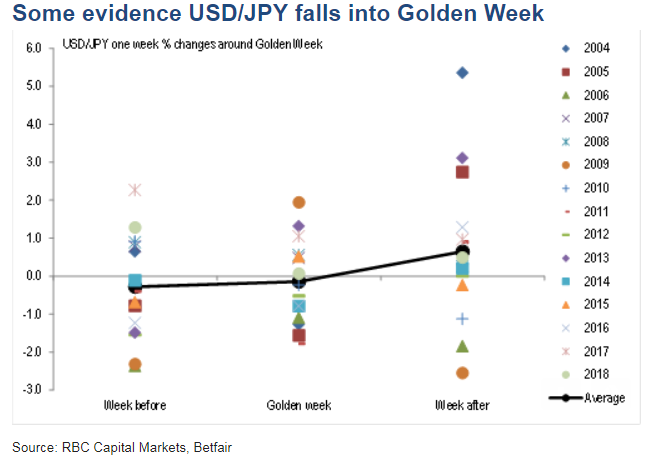

But, as liquidity dries up, history suggests there are opportunities for traders — especially in the period leading up to local festivities. “In the run up to Golden Week, there is some evidence that USD/JPY falls (average -0.3%, but much larger excluding the last two years), consistent with exporter offers being brought forward,” Cole said.

In fact, USD/JPY USDJPY, +0.31% has fallen nine of the last 15 weeks leading up to Golden Week, with five of them seeing declines greater than 1%, he noted in the chart below.

In a follow-up call, Cole said Japanese companies are predominantly buyers of yen, as they move to repatriate overseas profits. That can lead to an imbalance, which along with liquidity issues can make for sharp moves in the dollar/yen currency pair, ahead of the holiday period as companies pre-hedge potential flows.

Amplifying the potential surge in volatility is that 2019 will have twice as many national holidays, meaning local markets are closed for the entire 10-day period beginning the Saturday before Golden Week officially kicks off.

But for bond investors, the lead up to the holiday should provide little surprises. “I think it will be business as usual in the bond market,” said Robert Tipp, chief investment strategist at PGIM Fixed Income. “And unless we get some fundamental economic change during the period then it will reopen as is.”

On May 1, the Federal Reserve meets for its third policy meeting of the year. However, a change in monetary policy is seen as unlikely after the central bank halted its plans for rate hikes to move into wait-and-see mode.

According to CME data, fed-funds futures traders see a 98.5% probability the Fed remains on hold at that meeting.

Read: Why a senior IMF official fears the Fed may at some point need to hike rates even with low inflation

But for currency traders, it might be best to position for this trade once the festivities have passed. “Nonetheless, given that previous Golden Weeks have been shorter and normally discontinuous, is possible the impact could be larger this year and we would be wary of positioning for our core JPY-bearish view over the next couple of weeks,” said Cole.

Japanese derivative and equity markets are closed from April 27 through May 6, according to the Japanese Exchange Group.

Read: Why the U.S. dollar looks vulnerable to a selloff against the Japanese yen

Providing critical information for the U.S. trading day. Subscribe to MarketWatch’s free Need to Know newsletter. Sign up here.