A bond market selloff is calling the tune across financial markets, including for foreign exchange. Equilibrium is unlikely to return until the yield on the benchmark 10-year U.S. Treasury note hits 2%, argued one well-known analyst on Friday.

“There will be no peace until U.S. 10s reach 2%,” said Kit Juckes, global macro strategist at Société Générale, in a note.

Need to Know: Here’s how far the Nasdaq could fall if bond yields reach 2%

A pair of U.S. government bond auctions, which had been a source of nervousness, went off without any major problems over the past week, with yields settling into a new and higher range, Juckes said. But with the S&P 500 index closing at a record on Thursday, the yield on the 10-year note TMUBMUSD10Y, 1.625% pushed back above 1.6%, weighing on stocks.

Rising yields have triggered rotation away from growth-oriented stocks, including large-cap, tech-related shares, into more cyclically sensitive and often value-oriented stocks and sectors. The tech-heavy Nasdaq Composite COMP, -1.02% slipped into correction territory, defined as pullback of 10% from a recent peak, as yields continued to climb, while the S&P 500 SPX, -0.16% and Dow Jones Industrial Average DJIA, +0.69% have traded at records. All three benchmarks are positive on the week, with the Nasdaq bouncing on days when the climb in yields relented.

The rising yields have resulted in renewed strength for the dollar, which Juckes said he wasn’t eager to fight at the moment. The ICE U.S. Dollar Index DXY, +0.28%, a measure of the currency against a basket of six major rivals, was up 0.3% Friday and has gained 0.9% so far in March.

“The pattern seems clear enough: The equity market is seeing a sector rotation but not a correction; the bond market is seeking a new equilibrium in the light of a vastly improved economic outlook in both the U.S. and elsewhere; some policy makers are pushing back against the bond moves, with little success,” Juckes wrote.

“As yields rise, the dollar rallies, but when yields settle at a new level, the dollar drops back. The pattern probably goes on until bonds find an equilibrium, unlikely before 10-year note yields have a 2-handle, judging by taper tantrums and past cycles,” he said.

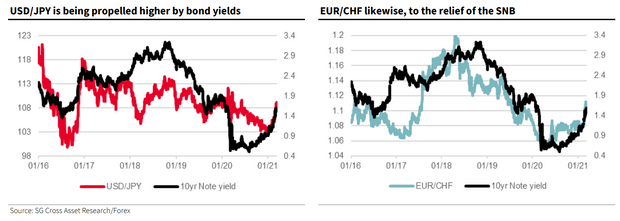

Meanwhile, the dollar/Japanese yen USDJPY, +0.51% and euro/Swiss franc EURCHF, +0.23% currency pairs are the most sensitive to higher Treasury yields (see chart above), Juckes said, noting that dollar/yen typically correlates more closely with real, or inflation-adjusted, US. yields than nominal rates, while euro/Swiss franc tends to track more closely with nominal yields.

Instead, this year has seen all four — real and nominal yields, dollar/yen and euro/Swissfranc — move higher largely in lockstep, he said.

“ While U.S. yields rise, EUR/CHF and USD/JPY are likely to go on trending higher, too, at least while the momentum is this strong. If we get to 2% 10-year note yields in the coming weeks, dumb extrapolation could take USD/JPY to 111, and EUR/CHF to 0.96,” he said. “Maybe too simplistic, but these moves are too strong to fight in the short-term.”