Wall Street has begun sifting through which corporate bonds might fit the Federal Reserve’s criteria for purchase under a series of new rescue programs announced Monday, which aim to alleviate stress triggered by the coronavirus.

Even before the pandemic swept onto U.S. shores, concerns have been mounting about the potential for lost jobs and defaults, if U.S. companies that spent the last decade loading up on record amounts of debt collapse.

Now the Fed, at least initially, plans to provide emergency aid to America’s corporations and, by extension, workers and the real economy.

Only the investment-grade portion of the record $9.2 trillion pile of outstanding U.S. corporate bond debt will be eligible for the new Fed facilities announced on Monday, which are separate from its “unlimited” bond-buying program unfurled to snap up Treasury and mortgage debt sold with government guarantees.

Read: Here’s a breakdown of the Fed’s expanded rescue programs to keep credit flowing during the pandemic

“We believe that the Fed has taken an important first step in – above all – attempting to stabilize the [U.S. dollar] investment grade market and provide liquidity once again to what has essentially been a broken market for the past week or two,” wrote Craig Nicol, U.S. credit strategist at Deutsche Bank, in a client note Tuesday.

While the bank didn’t respond to a request to see its “screen of the potential eligible securities,” Goldman Sachs analysts found that about $155 billion of last year’s total $878 billion of investment-grade U.S. corporate bond issuance could qualify for the Fed’s $100 billion primary bond buying facility.

However, the credit strategy team, led by Lotfi Karoui, said they viewed the Fed’s moves this week as “a first step reflecting the Treasury’s willingness to intervene in the corporate bond market,” with potentially more aid available if Congress signs off on additional funding, beyond the initial $300 billion announced.

Of note, the Fed said it would buy only up to 10% of any U.S. based company’s debt. Its bonds must be shorter dated to qualify and carry credit ratings of at least BBB-/Baa3 from one major rating agency.

Importantly, it also can’t be one of the companies in line to receive direct Federal financial aid under pending coronavirus aid legislation.

See: Here are the industries that could get coronavirus aid from the U.S. government

Optimism over Washington’s ability to enact such legislation was credited with pushing U.S. stocks higher on Tuesday, with the Dow Jones Industrial Average DJIA, +11.37% booking an 11.4% gain, although still down 27.5% on the year to date.

Read: McConnell, Pelosi, Schumer say deal on coronavirus stimulus is close

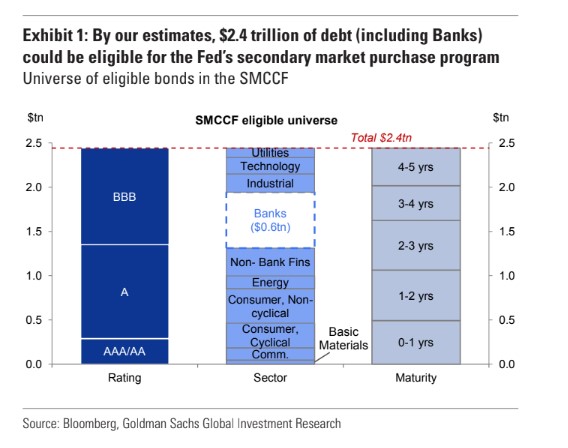

The Fed’s other, secondary $100 billion facility is aimed at sopping up existing corporate bonds within the same ratings constraints, but with maturities of up to five years, compared with buys of debt of up to four years for the primary facility.

Goldman analysts put this chart together to show a much larger $2.4 trillion of debt could be eligible for the secondary purchase program.

Meanwhile, details of the exchange-traded fund component of the secondary bond-buying facility remain vague, according to J.P. Morgan analysts, who said they think “the Fed will likely err on the side of being inclusive,” and that the program appears to target “stress in certain ETFs over the past few weeks,” in a client note.

Its parameters do allow the Fed to buy up to 20% of assets from individual bond ETFs, rather than only 10% of a company’s debt. Goldman’s analysts point out that three of the biggest such bond ETFs could qualify, namely the iShares iBoxx USD Investment Grade Corporate Bond ETF LQD, +2.05%, Vanguard Short-Term Corporate Bond ETF VCSH, +1.26% and Vanguard Intermediate-Term Corporate Bond ETF VCIT, +0.28%.

Each has more than $20 billion of assets under management, out of a total $118 billion that Goldman analysts see as likely being eligible for Fed purchases under that slate of the bond-buying initiative to help soothe corporate stress and potentially stanch a wave of defaults.

See: The Fed is going to buy ETFs. What does it mean?

The third $100 billion facility aims to more directly help consumers by keeping credit flowing on auto loans, credit cards, student debt and the like.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>